- United States

- /

- Software

- /

- NasdaqGS:CFLT

Confluent (CFLT): Revenue Growth Forecast at 14.1% Sets High Bar for Profitability Ahead of Earnings

Reviewed by Simply Wall St

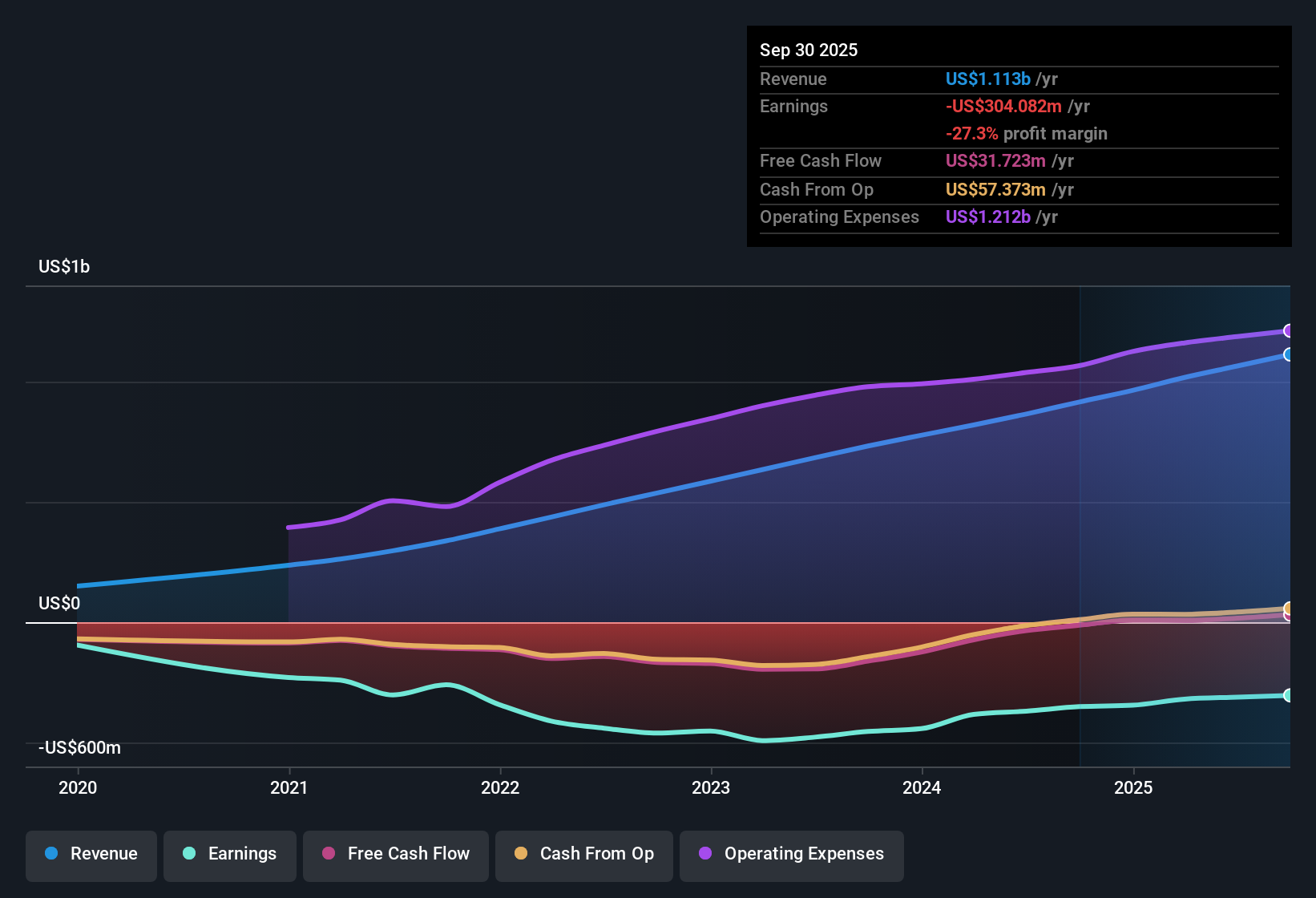

Confluent (CFLT) is forecasting revenue growth of 14.1% per year, outpacing the broader US market’s 10.1% annual growth expectation. Despite strong top-line momentum, the company remains unprofitable and has reported annual losses worsening at a rate of 2.6% over the past five years. While Confluent’s Price-to-Sales ratio of 7.5x is lower than its peers' 10.4x average and the stock currently trades at $23.75, well below an estimated fair value of $32.66, investors are left weighing ongoing revenue upside against the persistence of losses and recent share price volatility.

See our full analysis for Confluent.The next section takes a closer look at how these results line up with the market’s narrative and where those expectations might be put to the test.

See what the community is saying about Confluent

Margin Expansion Hinges on Cloud Uptake

- Confluent’s gross margin improvement is closely tied to recurring cloud revenues from new offerings like WarpStream and Flink, both showing exponential annual recurring revenue growth but still contributing a small share of overall results to date.

- Analysts' consensus view highlights that expanded cloud and ecosystem partnerships are intended to enhance recurring revenues and margins, supporting future earnings potential.

- This momentum is backed by a projected 10x increase in production AI use cases, which is expected to accelerate platform growth and subscription expansion.

- However, competitive pressures from cloud service providers and customer migration to open-source or self-managed solutions may pressure Confluent's margins and challenge the durability of its premium positioning.

Losses Persist Despite Robust Growth

- While revenue is expected to grow 14.1% per year, losses have actually increased at 2.6% per year over the past five years, with analysts forecasting continued unprofitability through at least the next three years.

- Analysts' consensus view draws attention to this tension: the platform is mission-critical for digital transformation, fueling strong topline momentum and high customer retention.

- Yet, the lack of progress toward profitability—if current profit margins of -29.3% do not converge toward industry averages—raises doubt that longer-term operating leverage will materialize quickly.

- Against a backdrop of rapid real-time data growth, the durability of Confluent's losses stands out in contrast to its outsized revenue trends and growing customer pipeline.

Valuation Discount Signals Cautious Optimism

- Trading at a Price-to-Sales ratio of 7.5x, Confluent is more attractively valued than its peer average of 10.4x, but remains at a premium to the broader US software industry’s 5.5x. Its $23.75 share price sits notably below both the DCF fair value of $32.66 and consensus price target of $27.87.

- According to the analysts' consensus view, this valuation gap leaves room for upside if revenue growth and future profitability meet expectations.

- However, for shares to re-rate closer to fair value, investors would need to believe earnings will reach $220.6 million by 2028 and Confluent can command a multiple that exceeds current industry norms.

- Disagreement among analysts, with the most bearish estimate at just $20.00, underscores ongoing skepticism about whether high sales growth alone is enough to justify a rebound.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Confluent on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the numbers with a different lens? Share your insight and shape the conversation with your own narrative in just a few minutes. Do it your way

A great starting point for your Confluent research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Confluent’s persistent losses and lack of progress toward profitability make it difficult to rely on consistent financial results or sustained earnings momentum.

If steady performance matters to you, use our stable growth stocks screener (2116 results) to quickly find companies that deliver reliable revenue and earnings growth through all kinds of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CFLT

Confluent

Operates a data streaming platform in the United States and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion