- United States

- /

- Software

- /

- NasdaqGS:CFLT

Assessing Confluent (CFLT) Valuation After A Strong Three Month Share Price Run

Reviewed by Simply Wall St

Confluent (CFLT) has been drawing investor attention after a recent stretch of positive returns, including gains over the past month and past 3 months, prompting fresh questions about how its current valuation stacks up.

See our latest analysis for Confluent.

The recent 30-day share price return of 30.29% and 90-day share price return of 35.20% suggest momentum has been building. The 1-year total shareholder return of 4.69% and 3-year total shareholder return of 46.86% provide a longer-term reference point against today’s US$30.15 share price.

If Confluent’s recent move has caught your eye, it could be a moment to see what else is happening across high growth tech and AI names through high growth tech and AI stocks.

With Confluent trading around US$30.15, which is a small discount to the recent analyst price target and an intrinsic value estimate that sits above today’s level, you have to ask: is there still a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 2% Undervalued

With Confluent’s fair value estimate at about US$30.77 versus the US$30.15 last close, the most followed narrative sees only a small valuation gap.

The view of Confluent as a de facto standard for data streaming, coupled with the complexity of building similar infrastructure in house, underpins the thesis that the company can sustain above peer growth and progress toward 1 billion dollars in recurring revenue.

Curious what supports that premium setup? The narrative leans on firm revenue compounding, better margins and a rich earnings multiple years out. Want the full blueprint?

Result: Fair Value of $30.77 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still the risk that slower Confluent Cloud consumption, or customers shifting to self managed or open source options, could cap growth expectations and pressure margins.

Find out about the key risks to this Confluent narrative.

Another View: Sales Multiple Sends A Different Signal

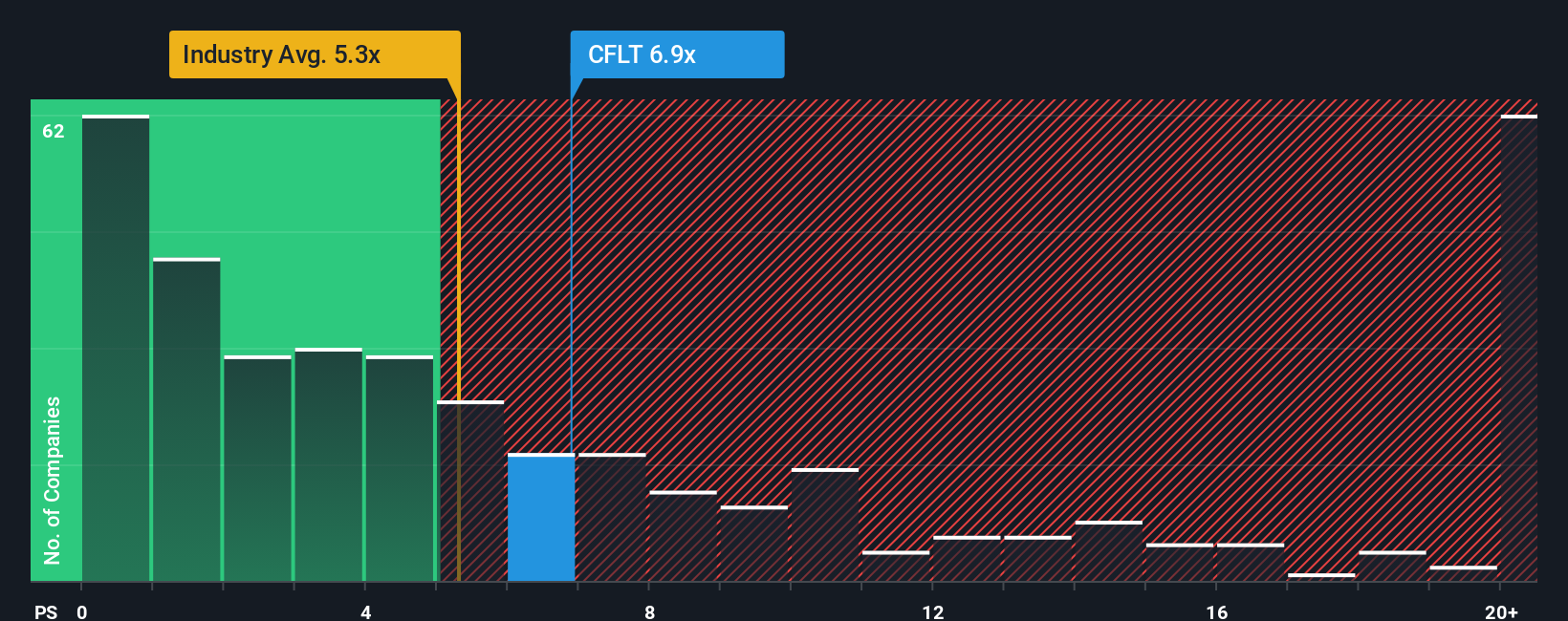

Our first narrative circles around a fair value near US$30.77, only slightly above the US$30.15 share price. Looking at the P/S ratio tells a tougher story. Confluent trades on 9.6x sales versus a fair ratio of 7.6x and a US Software industry average of 4.7x.

So while the crowd narrative leans toward “about right,” the sales multiple points to richer pricing, even compared with peers at 9.7x. For you, that raises a clear question: is this a quality premium you are comfortable paying, or a valuation risk you would rather avoid?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Confluent Narrative

If you see the numbers differently or want to stress test your own view, you can pull the data together and build a narrative in just a few minutes: Do it your way.

A great starting point for your Confluent research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Confluent is just one name on your radar, this is a useful moment to broaden your watchlist and pressure test your thinking against other angles.

- Spot potential value opportunities early by checking out these 880 undervalued stocks based on cash flows that line up with your expectations on price versus fundamentals.

- Hunt for growth stories tied to artificial intelligence through these 25 AI penny stocks and see which names stand out on your metrics.

- Add a different return profile to your watchlist by considering income ideas such as these 14 dividend stocks with yields > 3% that may suit a yield focused approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CFLT

Confluent

Operates a data streaming platform in the United States and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion