- United States

- /

- Biotech

- /

- NasdaqGS:AMGN

Top High Growth Tech Stocks To Watch August 2024

Reviewed by Simply Wall St

As global markets continue to recover from the early August sell-off, investors are buoyed by positive news on inflation and growth, leading to hopes of a "soft landing" for the economy. The technology-heavy Nasdaq Composite has particularly benefited, reflecting strong performance in high-growth tech stocks. In this favorable environment, identifying top-performing tech stocks involves looking at companies with robust revenue growth, innovative products or services, and strong market positioning.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Imeik Technology DevelopmentLtd | 26.19% | 24.78% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| eWeLLLtd | 25.55% | 25.92% | ★★★★★★ |

| G1 Therapeutics | 24.26% | 51.62% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Seojin SystemLtd | 34.20% | 58.67% | ★★★★★★ |

| Adveritas | 66.47% | 103.87% | ★★★★★★ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

| UTI | 103.56% | 122.67% | ★★★★★★ |

Click here to see the full list of 1276 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Amgen (NasdaqGS:AMGN)

Simply Wall St Growth Rating: ★★★★☆☆

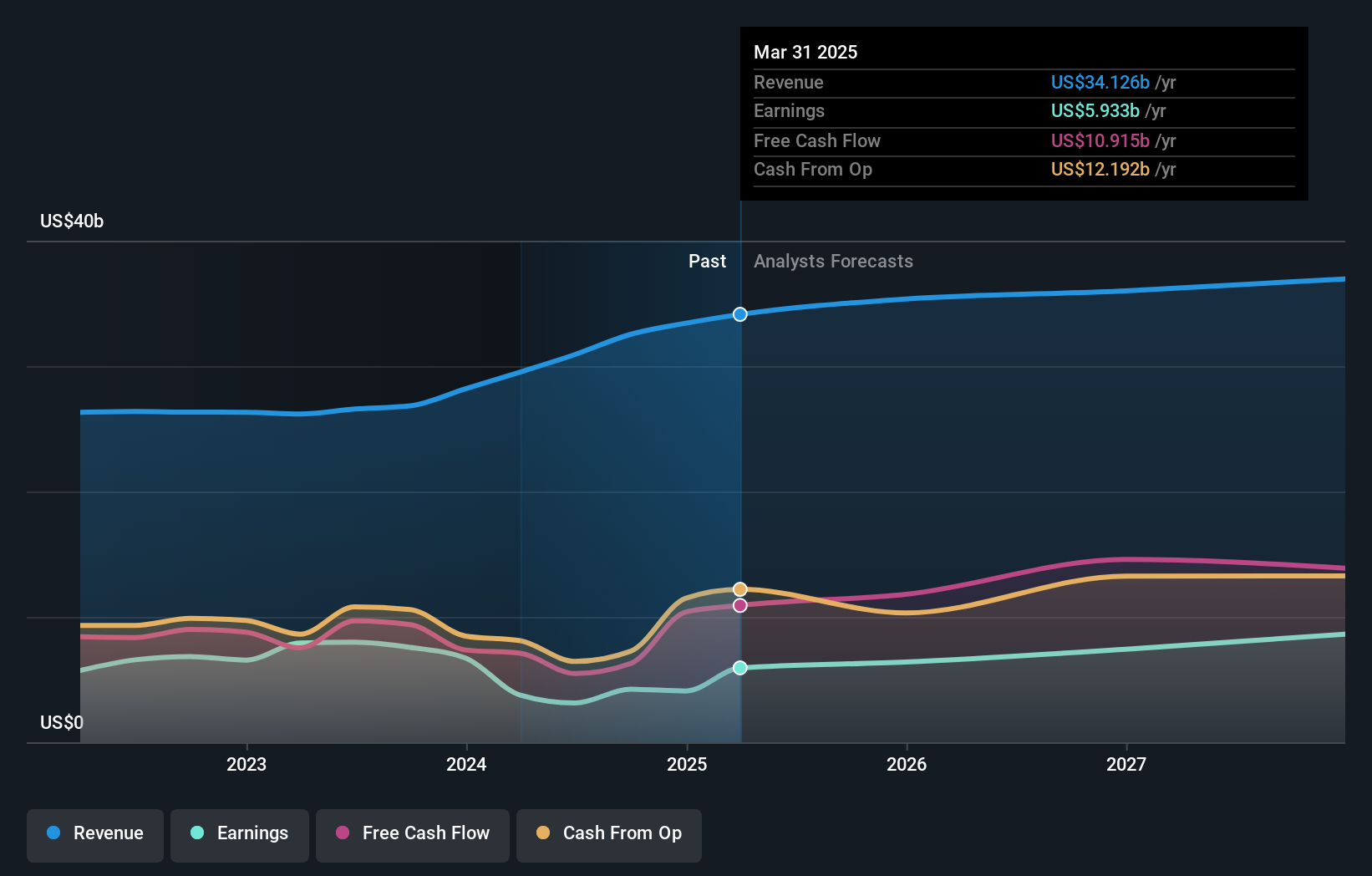

Overview: Amgen Inc. is a global biotechnology company that focuses on discovering, developing, manufacturing, and delivering human therapeutics, with a market cap of $172.72 billion.

Operations: Amgen generates revenue primarily from its human therapeutics segment, which brought in $30.93 billion. The company focuses on the biotechnology sector, emphasizing the discovery, development, and delivery of these therapeutic products globally.

Amgen's recent earnings guidance projects total revenues between $32.8 billion and $33.8 billion for 2024, reflecting a modest growth rate of 3% per year, which is slower than the broader US market's 8.8%. Despite a significant one-off gain of $1 billion impacting last year's results, the company's earnings are expected to grow at an impressive annual rate of 23.6%. The firm has also repurchased shares recently and declared a dividend of $2.25 per share for Q3 2024, demonstrating strong shareholder returns amidst its ongoing R&D investments in innovative therapies like BLINCYTO.

AppLovin (NasdaqGS:APP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation operates a software-based platform designed to enhance marketing and monetization for advertisers globally, with a market cap of $28.86 billion.

Operations: AppLovin generates revenue through two primary segments: Apps ($1.49 billion) and Software Platform ($2.47 billion). The company focuses on providing tools for advertisers to improve their marketing and monetization efforts both in the U.S. and internationally.

AppLovin's earnings are anticipated to grow at 22.9% annually, outpacing the US market's 15.1%. For Q3 2024, the company projects revenue between $1.115 billion and $1.135 billion, reflecting robust growth from last year's $750 million in Q2 sales to over $1 billion this year. Their R&D expenses have been significant, with a focus on innovative ad tech solutions driving future growth prospects despite recent index drops.

- Navigate through the intricacies of AppLovin with our comprehensive health report here.

Gain insights into AppLovin's past trends and performance with our Past report.

Cadence Design Systems (NasdaqGS:CDNS)

Simply Wall St Growth Rating: ★★★★☆☆

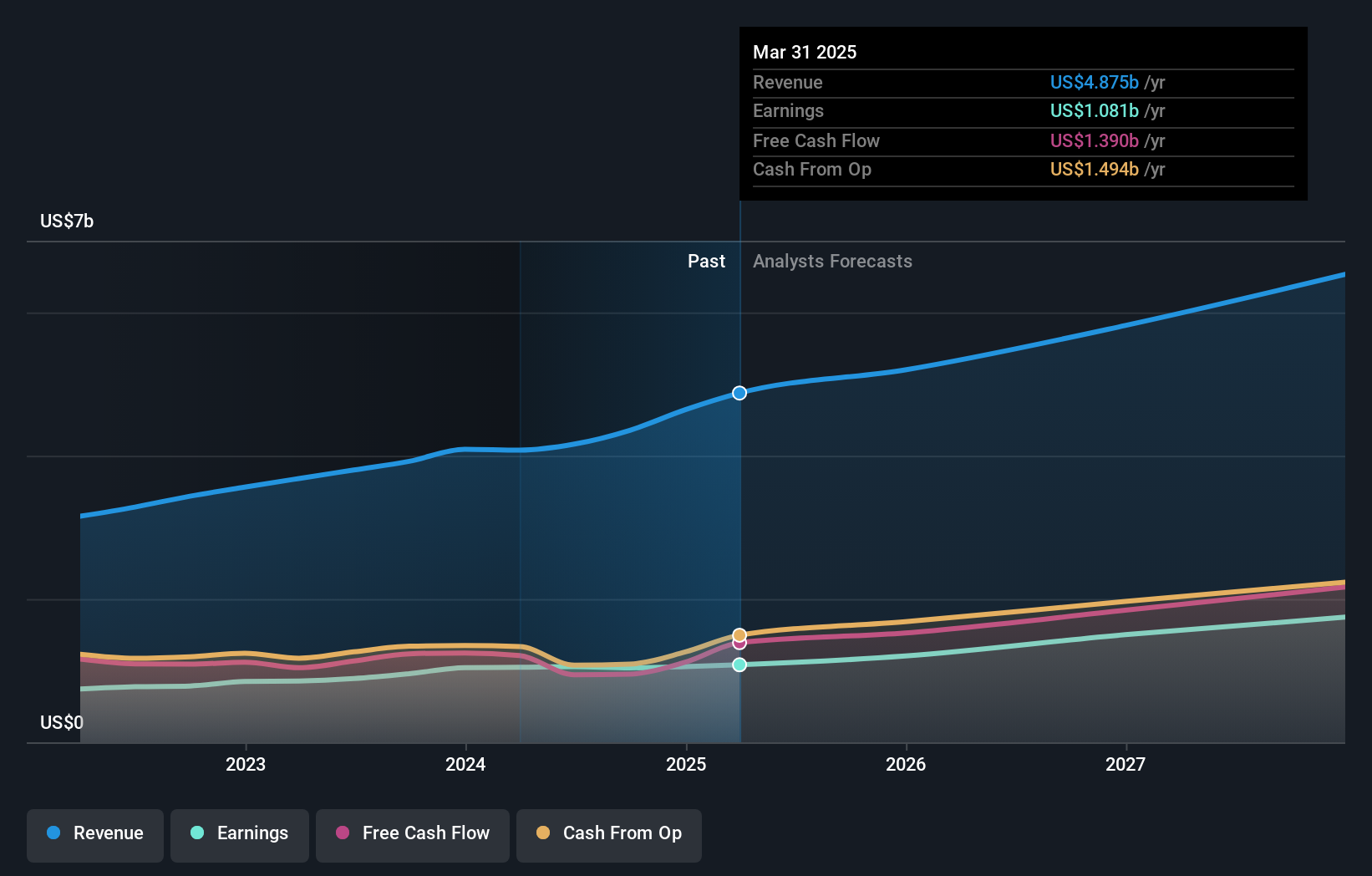

Overview: Cadence Design Systems, Inc. offers software, hardware, services, and reusable integrated circuit (IC) design blocks globally and has a market cap of $76.94 billion.

Operations: Cadence Design Systems, Inc. generates revenue primarily from its CAD/CAM software segment, which accounted for $4.16 billion. The company's business model focuses on providing comprehensive design solutions for integrated circuits and electronic devices worldwide.

Cadence Design Systems has demonstrated robust growth, with revenue increasing to $1.06 billion in Q2 2024 from $976.58 million a year ago and net income rising to $229.52 million from $221.12 million. Their R&D expenses, crucial for maintaining innovation, were substantial at 13% of revenue, reflecting their commitment to advancing design automation tools and IP solutions. The company repurchased 423,453 shares for $125.17 million between April and June 2024, indicating confidence in their future prospects while enhancing shareholder value through strategic buybacks.

- Click to explore a detailed breakdown of our findings in Cadence Design Systems' health report.

Understand Cadence Design Systems' track record by examining our Past report.

Next Steps

- Embark on your investment journey to our 1276 High Growth Tech and AI Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMGN

Amgen

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives