- United States

- /

- Software

- /

- NasdaqGS:CDNS

Cadence Design Systems (NasdaqGS:CDNS) Unveils Industry-First LPDDR6/5X Memory IP for AI and HPC

Reviewed by Simply Wall St

Cadence Design Systems (NasdaqGS:CDNS) recently introduced the industry's first LPDDR6/5X memory IP system, a move that aligns with its focus on next-generation AI and HPC markets. Over the last quarter, Cadence's share price rose 22%, a movement potentially influenced by these advancements. Concurrently, the broader market remained flat, with the S&P 500 and Nasdaq experiencing slight gains. While the introduction of Cadence's cutting-edge solutions might add weight to its share price increase, overall trends in the tech sector, including partnerships with key players like Samsung and NVIDIA's AI-driven growth, further bolster this positive trajectory.

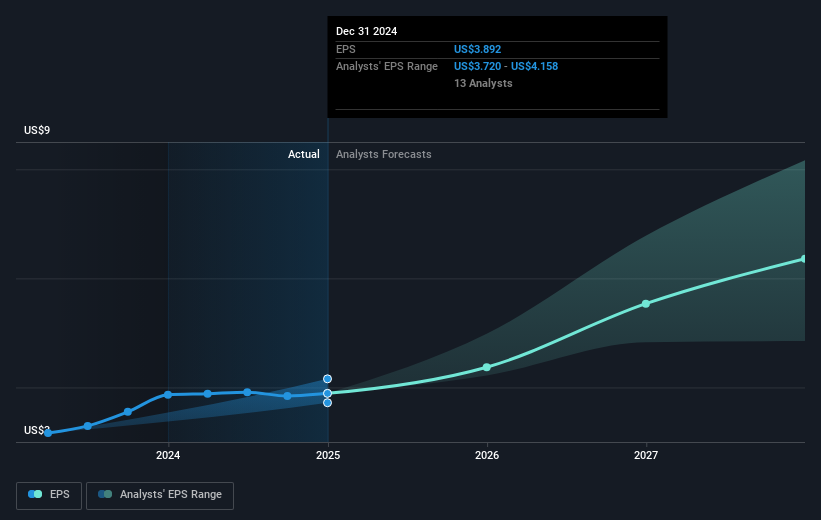

The recent introduction of Cadence Design Systems' LPDDR6/5X memory IP system suggests alignment with emerging AI and HPC markets, potentially enhancing future revenue and earnings prospects. Over the past five years, Cadence's total return, including share price appreciation and dividends, reached a substantial 226.45%. This long-term gain highlights the company's capacity for sustained growth, particularly amid evolving tech-sector dynamics. In contrast, over the last year, Cadence's share price performance lagged behind the broader US market and the US Software industry, indicating some recent challenges or adjustments within its operational context.

Looking forward, Cadence's advances in memory IP systems and strategic partnerships with sector leaders like NVIDIA and Samsung may play crucial roles in supporting the anticipated revenue increase from US$4.87 billion today to US$6.7 billion in 2028, as projected by analysts. Similarly, earnings forecasts, predicted to rise from US$1.08 billion to US$1.7 billion by 2028, could be positively impacted by these developments. Despite this potential, Cadence's current share price of US$305.78 is below the consensus analyst price target of US$321.16, representing a slight discount of 0.66%, suggesting room for price appreciation if these forecasts materialize. Investors should consider these dynamics, weighing potential opportunities against market performance and sector trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CDNS

Cadence Design Systems

Provides software, hardware, and other services worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives