- United States

- /

- Software

- /

- NasdaqGS:CDNS

Cadence Design Systems (NASDAQ:CDNS) stock performs better than its underlying earnings growth over last five years

Long term investing can be life changing when you buy and hold the truly great businesses. While the best companies are hard to find, but they can generate massive returns over long periods. To wit, the Cadence Design Systems, Inc. (NASDAQ:CDNS) share price has soared 335% over five years. And this is just one example of the epic gains achieved by some long term investors. And in the last week the share price has popped 4.8%.

Since it's been a strong week for Cadence Design Systems shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Cadence Design Systems

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

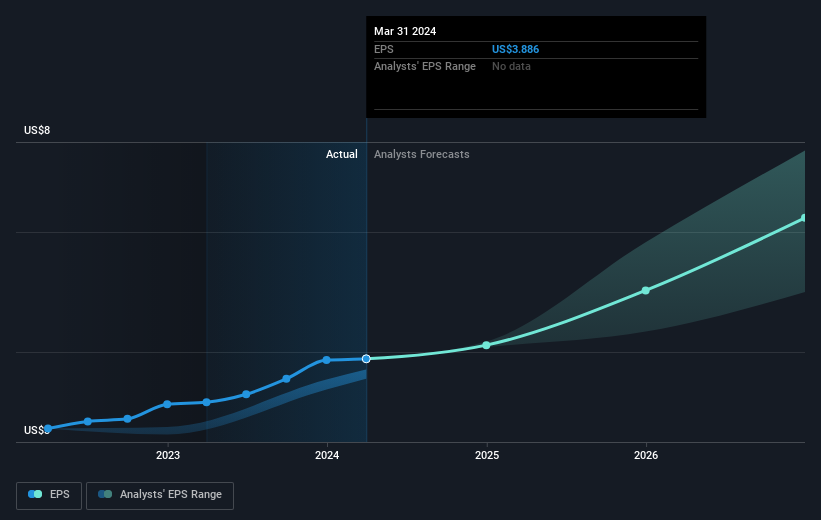

Over half a decade, Cadence Design Systems managed to grow its earnings per share at 22% a year. This EPS growth is lower than the 34% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 78.78.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Cadence Design Systems has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

It's nice to see that Cadence Design Systems shareholders have received a total shareholder return of 26% over the last year. However, that falls short of the 34% TSR per annum it has made for shareholders, each year, over five years. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course Cadence Design Systems may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CDNS

Cadence Design Systems

Provides software, hardware, and other services worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives