The board of CDK Global, Inc. (NASDAQ:CDK) has announced that it will pay a dividend on the 30th of March, with investors receiving US$0.15 per share. This makes the dividend yield 1.4%, which will augment investor returns quite nicely.

View our latest analysis for CDK Global

CDK Global's Earnings Easily Cover the Distributions

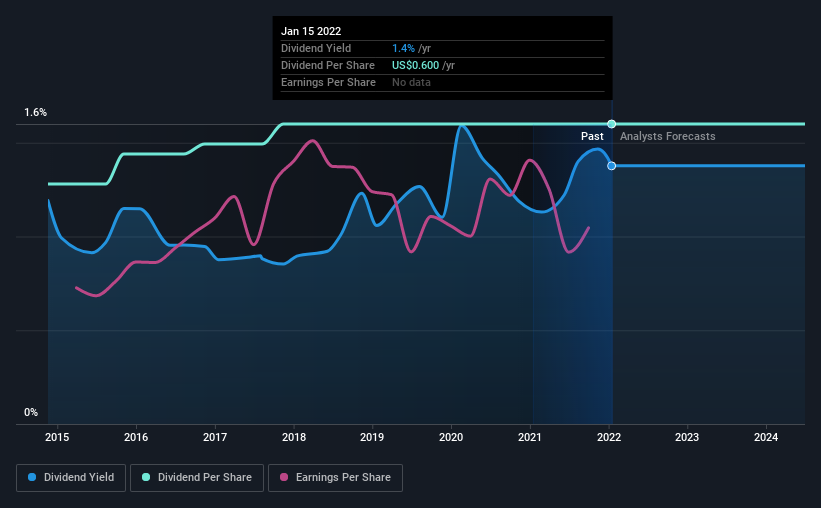

A big dividend yield for a few years doesn't mean much if it can't be sustained. But before making this announcement, CDK Global's earnings quite easily covered the dividend. However, with more than 75% of free cash flow being paid out to shareholders, future growth could potentially be constrained.

Looking forward, earnings per share is forecast to rise by 30.2% over the next year. If the dividend continues on this path, the payout ratio could be 28% by next year, which we think can be pretty sustainable going forward.

CDK Global Is Still Building Its Track Record

The dividend's track record has been pretty solid, but with only 7 years of history we want to see a few more years of history before making any solid conclusions. Since 2015, the first annual payment was US$0.48, compared to the most recent full-year payment of US$0.60. This means that it has been growing its distributions at 3.2% per annum over that time. It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Dividend Growth May Be Hard To Achieve

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Unfortunately, CDK Global's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year. Earnings growth is slow, but on the plus side, the dividend payout ratio is low and dividends could grow faster than earnings, if the company decides to increase its payout ratio.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The low payout ratio is a redeeming feature, but generally we are not too happy with the payments CDK Global has been making. We don't think CDK Global is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 2 warning signs for CDK Global (1 shouldn't be ignored!) that you should be aware of before investing. We have also put together a list of global stocks with a solid dividend.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CDK

CDK Global

CDK Global, Inc., together with its subsidiaries, provides integrated data and technology solutions to the automotive, heavy truck, recreation, and heavy equipment industries in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.