- United States

- /

- Software

- /

- NasdaqGS:CCCS

How Investors May Respond To CCCS Q2 Revenue Growth Paired With Persistent Earnings Pressure and New Guidance

Reviewed by Simply Wall St

- On July 31, 2025, CCC Intelligent Solutions Holdings reported its second quarter results, showing year-over-year sales growth to US$260.45 million, but a decrease in net income to US$12.96 million, and also provided updated revenue guidance for the third quarter and full year 2025.

- An interesting insight is that while sales rose, a shift to a net loss over the six-month period highlights ongoing cost or margin pressures despite revenue momentum.

- We’ll examine how the updated revenue guidance and ongoing earnings pressure impact the future growth narrative for CCC Intelligent Solutions Holdings.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

CCC Intelligent Solutions Holdings Investment Narrative Recap

To own CCC Intelligent Solutions Holdings, you need to believe that continued adoption of its innovation platform and new AI capabilities will deliver sustained growth, even as near-term profitability faces pressure. The recent results, rising sales but declining net income, reinforce that the biggest short-term catalyst remains expanding client commitments and product launches, while the primary risk centers on persistent earnings pressure from rising costs and margin compression. At this stage, the impact of this quarter’s sales growth is not material enough to change either story.

Among the recent announcements, the introduction of updated full-year revenue guidance stands out. The company now expects 2025 revenue between US$1.046 billion and US$1.056 billion, which maintains the previous range and reflects consistent expectations despite pronounced earnings volatility, adding context to how management sees the balance between key growth drivers and operational costs.

By contrast, investors should be aware that despite revenue expansion, the persistent margin and earnings pressure leaves CCC’s short-term outlook vulnerable if cost trends do not improve...

Read the full narrative on CCC Intelligent Solutions Holdings (it's free!)

CCC Intelligent Solutions Holdings is forecast to reach $1.3 billion in revenue and $203.4 million in earnings by 2028. This relies on a projected annual revenue growth rate of 9.8% and a substantial earnings increase of $194.2 million from the current earnings of $9.2 million.

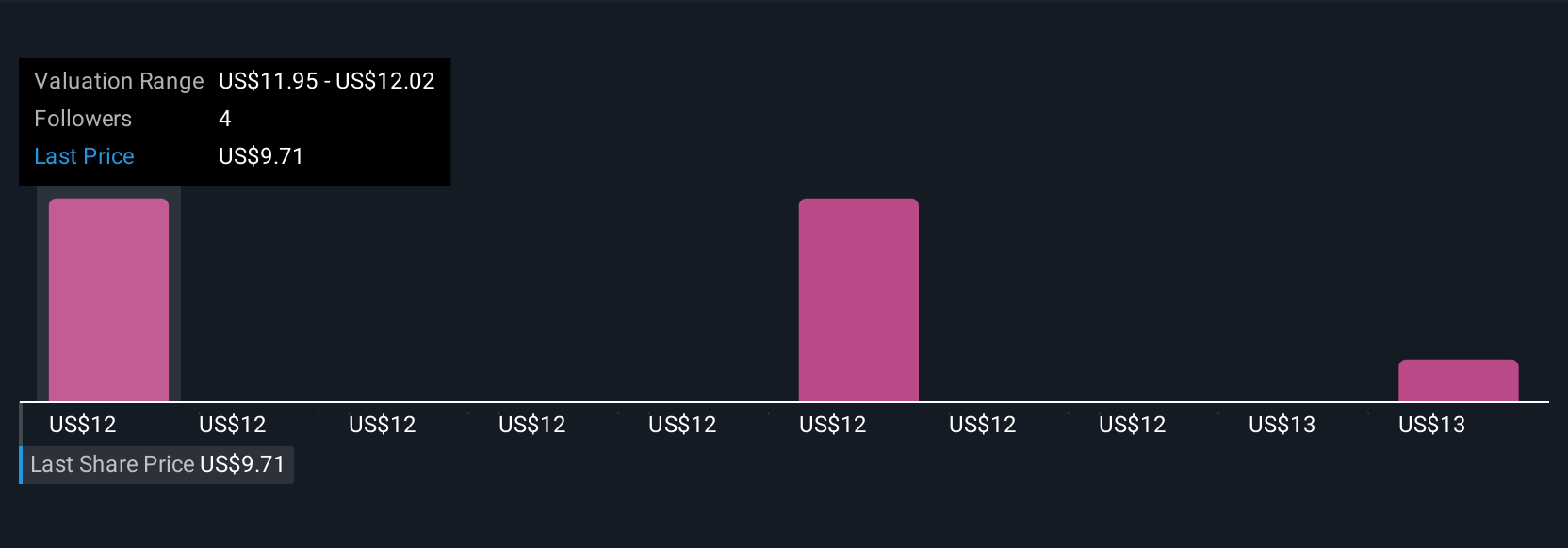

Uncover how CCC Intelligent Solutions Holdings' forecasts yield a $12.05 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members place CCC's current fair value between US$12.05 and US$13.08. While recent revenue guidance is steady, the spotlight on earnings pressure suggests a wide range of outcomes, be sure to review a variety of these perspectives.

Explore 3 other fair value estimates on CCC Intelligent Solutions Holdings - why the stock might be worth as much as 34% more than the current price!

Build Your Own CCC Intelligent Solutions Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CCC Intelligent Solutions Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free CCC Intelligent Solutions Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CCC Intelligent Solutions Holdings' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCCS

CCC Intelligent Solutions Holdings

Operates as a software as a service (SaaS) company for the property and casualty insurance economy in the United States and China.

Slight and fair value.

Market Insights

Community Narratives