Key Takeaways

- Strategic client commitments and key acquisitions position CCC for growth, innovation, and efficiency gains, enhancing revenue opportunities and operating margins.

- Adoption of emerging solutions and strong contract renewals bolster revenue growth, strengthen core business, and enhance operational efficiencies amid rising complexities.

- Economic sensitivity and shifting consumer behaviors are reducing insurance claim volumes, pressuring CCC's revenue and potential growth amidst macroeconomic and operational challenges.

Catalysts

About CCC Intelligent Solutions Holdings- Operates as a software as a service (SaaS) company for the property and casualty insurance economy in the United States and China.

- CCC's clients are increasingly committing to using CCC as their core long-term innovation platform, which should drive continued growth for established solutions and provide opportunities for expansion into next-generation capabilities. This strategic positioning is likely to impact revenue growth positively.

- CCC's acquisition of EvolutionIQ and the rapid integration of its AI-powered medical synthesis technology, particularly through the planned launch of Medhub for auto casualty, will enhance CCC's Casualty suite, creating new revenue opportunities and potentially improving operating margins through efficiency gains in claim management.

- The ongoing adoption of emerging solutions such as Diagnostics, Build Sheets, and Estimate-STP, which form a growing portion of CCC’s revenue, demonstrates significant demand and potential for cross-sell and upsell, supporting robust revenue growth and enhancing net dollar retention metrics.

- The strategic renewals and expansions of major contracts, such as with Caliber Collision and the new partnership with an OEM in the EV space, indicate strength in CCC's core business relationships, ensuring a steady revenue base and potentially enhancing earnings through increased service penetration.

- CCC's digital transformation support and AI-based solutions are positioned to aid clients in navigating rising complexities, including regulatory changes, vehicle complexity, and medical cost inflation, which is expected to enhance operational efficiencies and contribute positively to net margins over the long term.

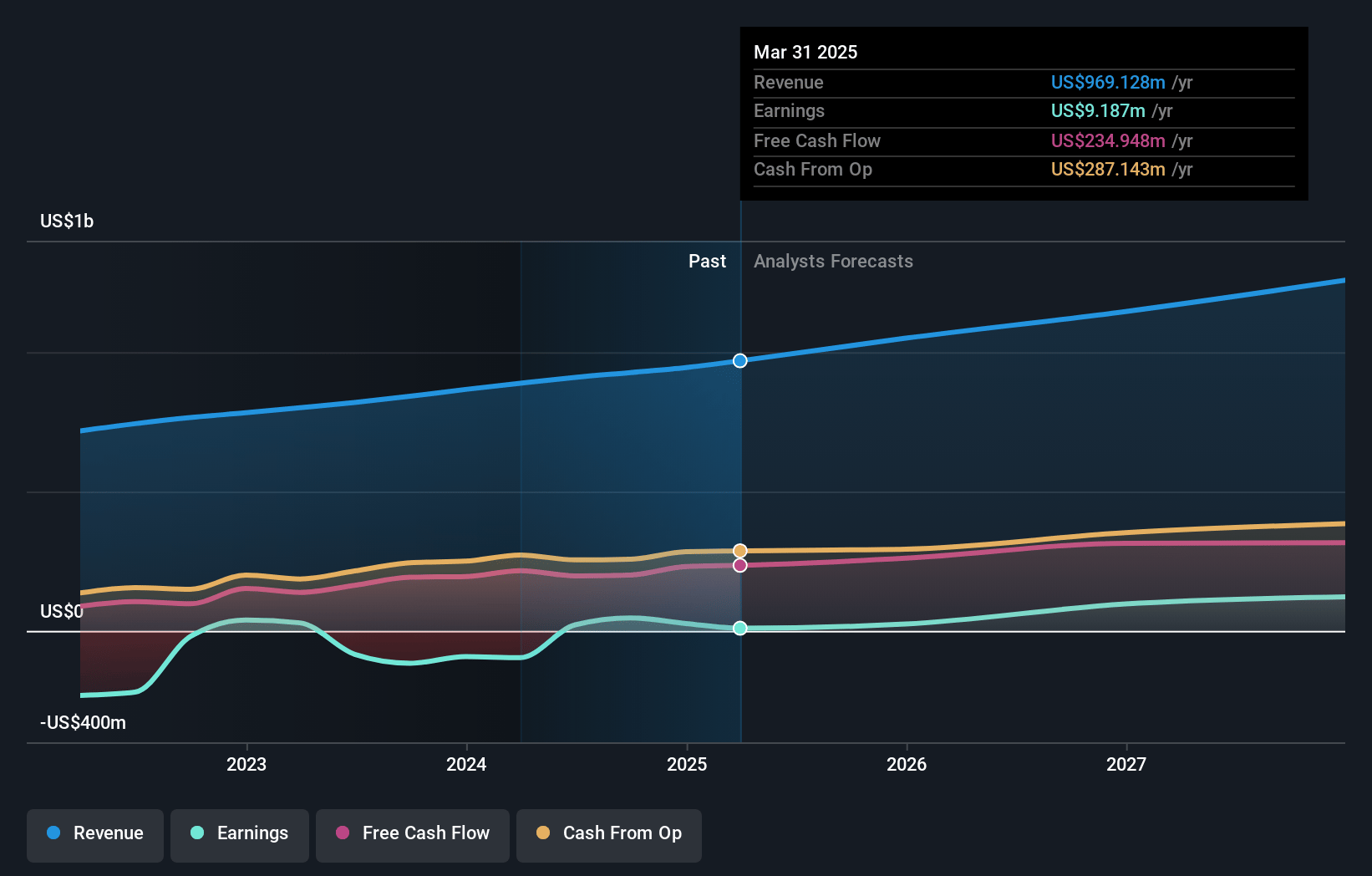

CCC Intelligent Solutions Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CCC Intelligent Solutions Holdings's revenue will grow by 9.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.9% today to 14.1% in 3 years time.

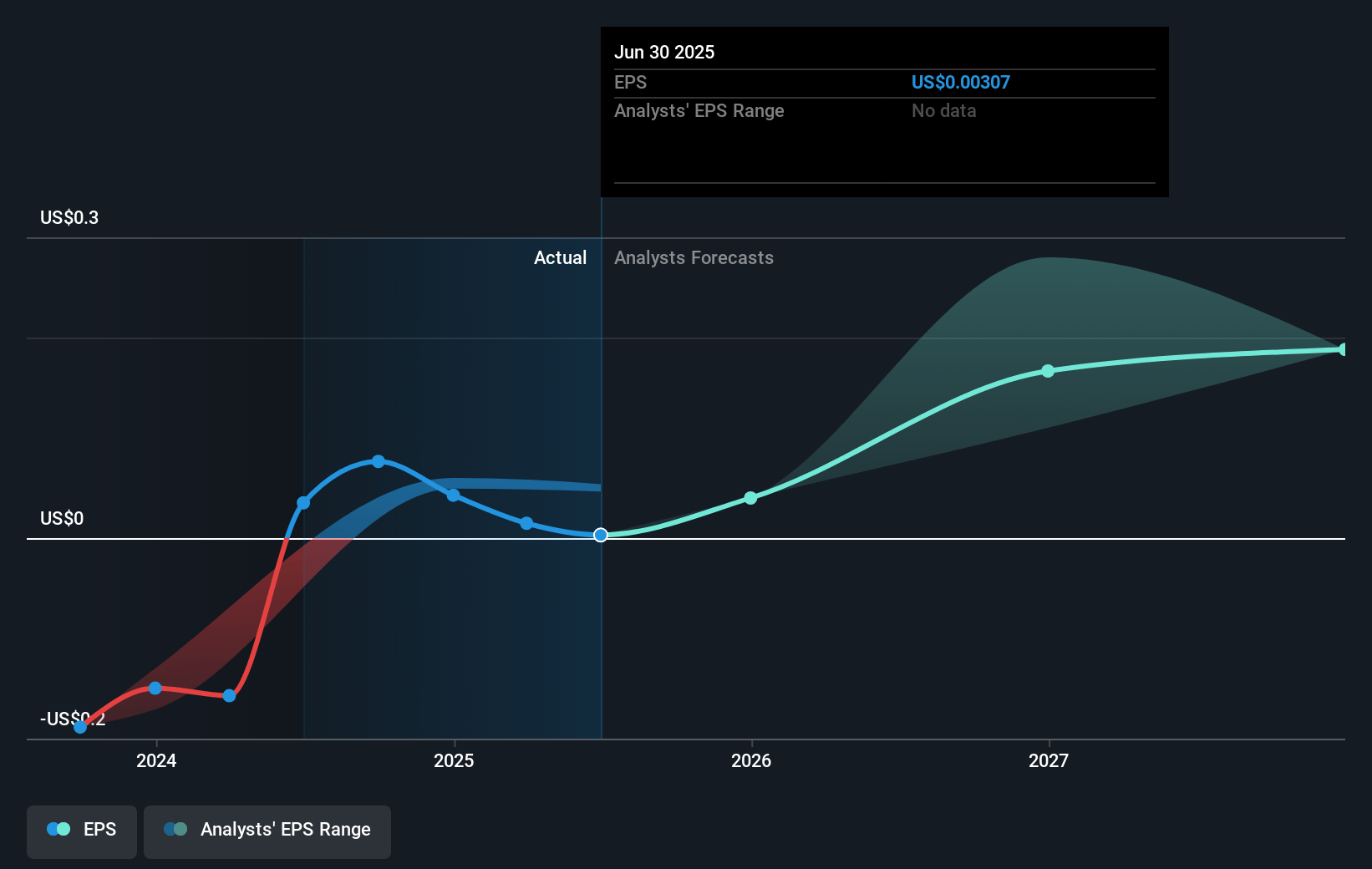

- Analysts expect earnings to reach $180.6 million (and earnings per share of $0.18) by about July 2028, up from $9.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 65.4x on those 2028 earnings, down from 705.9x today. This future PE is greater than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to grow by 5.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.35%, as per the Simply Wall St company report.

CCC Intelligent Solutions Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising consumer sensitivity to economic conditions and increased auto insurance premiums have led to a decline in filed auto physical damage claims, which can add pressure to CCC's revenue streams tied to volume, as approximately 20% of their revenue is volume-dependent.

- The uncertainty in the macroeconomic environment may elongate sales and implementation cycles for CCC's solutions, potentially slowing down revenue growth from new business in the short term.

- Adjusted gross profit margins have slightly declined due to increased depreciation expenses from capitalized projects, which could impact net margins going forward if not counterbalanced by revenue growth.

- Stock-based compensation is projected to peak at 24% of revenue for the year, partly due to acquisition considerations, which may suppress net earnings and shareholder value if not managed effectively.

- The impact of changing customer behaviors, such as increased consumer self-pay for repairs instead of filing insurance claims, could lead to a continued reduction in claim volumes, impacting CCC’s earnings that are dependent on insurance claim processing.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.934 for CCC Intelligent Solutions Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $180.6 million, and it would be trading on a PE ratio of 65.4x, assuming you use a discount rate of 8.3%.

- Given the current share price of $9.84, the analyst price target of $11.93 is 17.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.