- United States

- /

- Software

- /

- NasdaqGS:CCCS

CCC Intelligent Solutions (CCCS): Valuation in Focus After Executive Departure and Insider Stock Sales

Reviewed by Simply Wall St

Most Popular Narrative: 21.2% Undervalued

According to the most widely followed narrative, CCC Intelligent Solutions Holdings is trading below fair value, with a significant upside if growth projections are realized.

Acceleration in the digitization of insurance and automotive processes is driving multi-year, enterprise-wide adoption of CCC's AI-enabled solutions among top-tier insurers and repair shops. This is evidenced by multiple large customers moving from pilot phases to full production, positioning CCC for expanding recurring revenue and market penetration.

Curious how this growth story drives valuation? The most popular narrative hinges on a bold vision of recurring revenue taking off and expanding margins. What’s the secret ingredient that could boost this stock’s worth well above where it trades now? The full narrative packs in ambitious financial forecasts and an eye-catching profit outlook. Discover the numbers behind the analysts’ confidence.

Result: Fair Value of $12.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent declines in insurance claims or sluggish adoption of new AI modules could present challenges to CCC Intelligent Solutions Holdings’ growth outlook, even in light of impressive projections.

Find out about the key risks to this CCC Intelligent Solutions Holdings narrative.Another View: Multiples Suggest a Higher Price

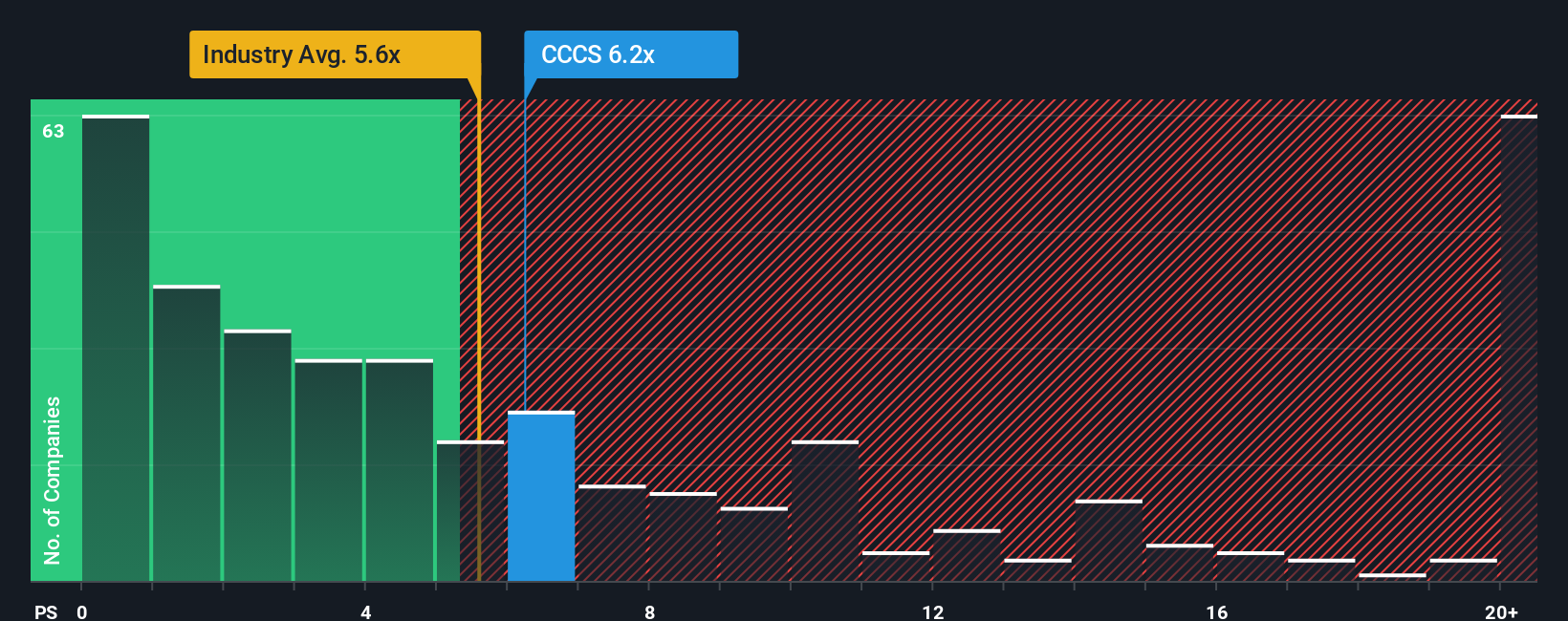

Looking at how the market values companies like CCC Intelligent Solutions Holdings compared to the broader industry, the numbers indicate a more expensive picture. This approach raises questions about whether growth is sufficient to justify the premium or if expectations are too high.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CCC Intelligent Solutions Holdings Narrative

If you have a different perspective or want to validate the story with hands-on analysis, you can assemble your own thesis in just a few minutes, Do it your way.

A great starting point for your CCC Intelligent Solutions Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Level up your search and go beyond the obvious. The Simply Wall Street Screener uncovers hidden leaders, overlooked value, and future trends you can act on now. Don’t let fresh opportunities pass you by.

- Upgrade your portfolio by targeting resilient companies with attractive yields using our selection of dividend stocks with yields > 3%.

- Jump ahead of market trends and catch the next wave in artificial intelligence innovation with these standout AI penny stocks.

- Access a handpicked lineup of market bargains trading below their true worth in our expertly curated list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCCS

CCC Intelligent Solutions Holdings

Operates as a software as a service (SaaS) company for the property and casualty insurance economy in the United States and China.

Slight risk and fair value.

Market Insights

Community Narratives