- United States

- /

- Software

- /

- NasdaqGS:CCC

Assessing CCC Intelligent Solutions Holdings (CCCS) Valuation as Growth Outlook Slows and Investors Eye Price-to-Sales Risks

Reviewed by Kshitija Bhandaru

CCC Intelligent Solutions Holdings (CCCS) is catching attention after recent analysis pointed out a gap between its past revenue growth and a less optimistic forecast for next year, compared to the wider industry.

See our latest analysis for CCC Intelligent Solutions Holdings.

Despite CCC Intelligent Solutions Holdings delivering solid revenue gains, the last twelve months have been tough on shareholders. The share price return stands at -20% year-to-date, and the 1-year total shareholder return is down nearly 14%, which signals that investor momentum has faded after a period of more robust three-year gains.

If you’re curious about other technology innovators with fresh momentum, it’s a great moment to search for what’s next using our See the full list for free.

With shares trading at a notable discount to analyst targets but future growth expectations trailing the industry, investors may wonder if CCC Intelligent Solutions Holdings is now undervalued or if current prices already reflect slower progress ahead.

Most Popular Narrative: 23.5% Undervalued

With CCC Intelligent Solutions Holdings closing at $9.28, the narrative consensus places fair value notably higher, hinting at a meaningful disconnect catching investor eyes. Let’s spotlight what’s fueling this outlook.

Acceleration in the digitization of insurance and automotive processes is driving multi-year, enterprise-wide adoption of CCC's AI-enabled solutions among top-tier insurers and repair shops, as evidenced by multiple large customers moving from pilot phases to full production. This positions CCC for expanding recurring revenue and market penetration.

Curious what powerful assumptions back this bullish valuation? The engine is a bet on stickier customers, recurring revenues, and bold profit margin expansion thanks to rapid AI-driven growth. See what’s under the hood and how they calculate that upside for CCC Intelligent Solutions Holdings.

Result: Fair Value of $12.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, industry claim volumes are declining, and delays in rolling out new solutions may dampen the company's anticipated revenue growth and earnings momentum.

Find out about the key risks to this CCC Intelligent Solutions Holdings narrative.

Another View: What Do Multiples Say?

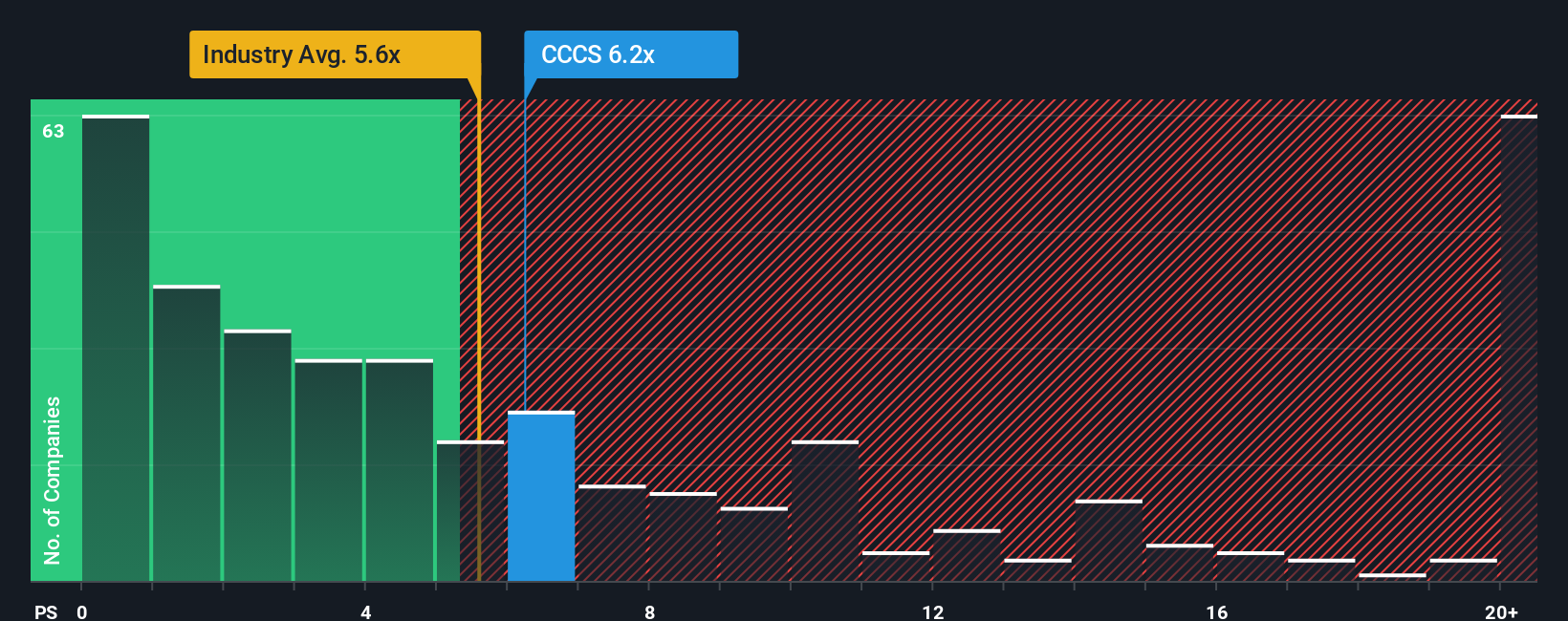

Taking a different approach from analyst forecasts, the market's key valuation ratio for CCC Intelligent Solutions Holdings stands at 6.1x sales. This is not only above the US Software industry average of 5.3x, but also exceeds the fair ratio of 5.3x. This suggests the stock is currently priced higher than its business fundamentals might warrant. Does this premium mean investors see something others are missing, or does it signal a need for greater caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CCC Intelligent Solutions Holdings Narrative

If you want a hands-on perspective, dig into the numbers yourself and shape your own CCC Intelligent Solutions Holdings story in just a few minutes, then Do it your way.

A great starting point for your CCC Intelligent Solutions Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let valuable opportunities slip by. Expand your watchlist and find the next big mover in your portfolio using these hand-picked ideas below.

- Unlock steady income and track record by reviewing these 19 dividend stocks with yields > 3% that consistently reward shareholders with attractive yields above 3%.

- Capitalize on the future of healthcare by seeking out innovation leaders with these 32 healthcare AI stocks offering cutting-edge advancements in medical technology and AI-driven patient care.

- Seize growth at compelling prices by sorting through these 894 undervalued stocks based on cash flows where strong cash flows point to potential bargains overlooked by the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCC

CCC Intelligent Solutions Holdings

Operates as a software as a service (SaaS) company for the property and casualty insurance economy in the United States and China.

Very undervalued with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.