- United States

- /

- Software

- /

- NasdaqCM:BTDR

Why Bitdeer Technologies Group (BTDR) Is Down 8.6% After Chip Delays, Plant Fire and Legal Scrutiny

Reviewed by Sasha Jovanovic

- Earlier this month, Bitdeer Technologies Group reported delays in the development of its second-generation SEAL04 chip and disclosed equipment losses caused by a fire at its Massillon, Ohio plant, as legal scrutiny also intensified.

- These operational and developmental setbacks have prompted legal investigations and external skepticism, highlighting the challenges the company faces despite recent operational gains and expansion initiatives.

- We’ll examine how project delays, especially the SEAL04 chip setback, reshape Bitdeer’s investment narrative and operational outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Bitdeer Technologies Group Investment Narrative Recap

To be a shareholder in Bitdeer Technologies Group, you need confidence in the company's ability to execute on proprietary ASIC chip development and to become a vertically integrated Bitcoin mining and AI compute provider. The recent SEAL04 chip delays and Ohio plant fire directly impact execution risks, but the main short-term catalyst, ramping up self-mining capacity with first-generation chips, remains intact, while the elevated risk is further operational setbacks or protracted development timelines.

Among the latest developments, Bitdeer's recently announced follow-on equity offering of US$148.62 million signals efforts to secure additional capital after operational challenges and project delays. This move, while necessary for funding expansion and R&D, comes when market skepticism is heightened and may increase dilution risks in the immediate-term context of ongoing chip development and recovery from equipment loss events.

In contrast, investors should be aware that the funding environment may become even more challenging if operational execution continues to fall short...

Read the full narrative on Bitdeer Technologies Group (it's free!)

Bitdeer Technologies Group's outlook envisions $1.8 billion in revenue and $343.9 million in earnings by 2028. Achieving this would require 71.6% annual revenue growth and a $664.2 million earnings increase from the current earnings of -$320.3 million.

Uncover how Bitdeer Technologies Group's forecasts yield a $34.79 fair value, a 243% upside to its current price.

Exploring Other Perspectives

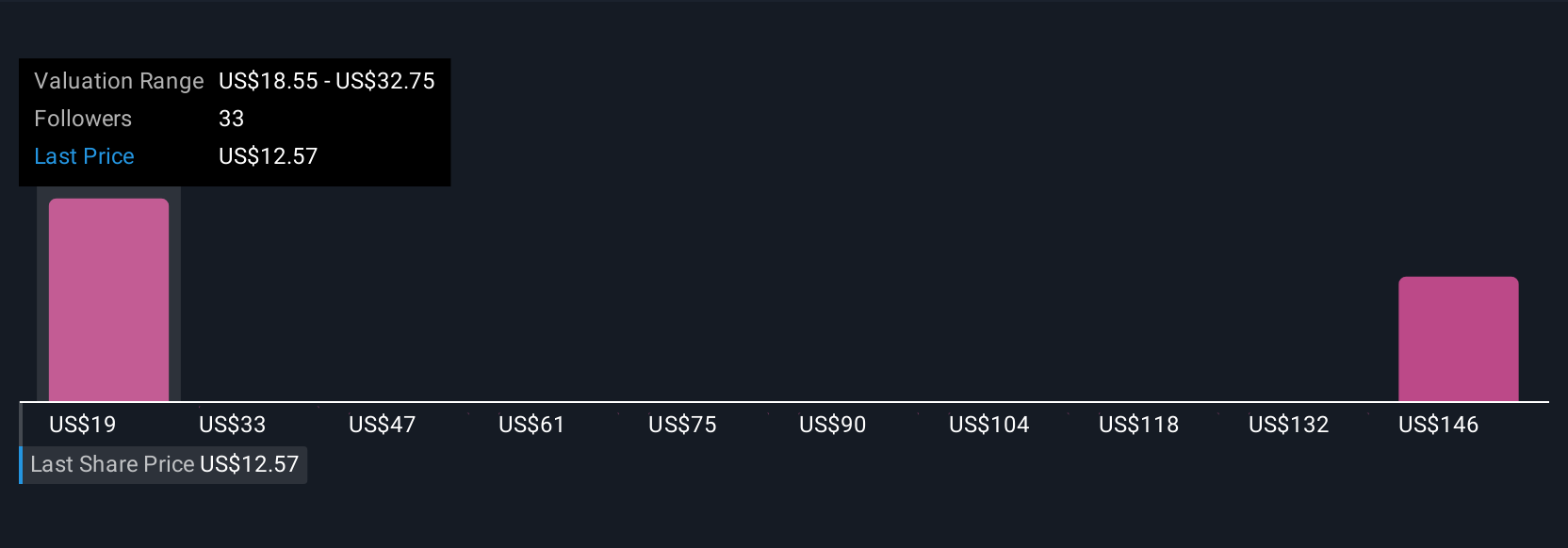

Seven Simply Wall St Community valuations of Bitdeer range from US$18.55 to US$377.16 per share. Amid these wide opinions, the company’s reliance on successful proprietary ASIC development remains central to unlocking future value and attracting performance-focused shareholders.

Explore 7 other fair value estimates on Bitdeer Technologies Group - why the stock might be a potential multi-bagger!

Build Your Own Bitdeer Technologies Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitdeer Technologies Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bitdeer Technologies Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitdeer Technologies Group's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and high-performance computing (HPC) in Singapore, the United States, Bhutan, and Norway.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Very Bullish

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Very Bullish

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026