- United States

- /

- Software

- /

- NasdaqCM:BTBT

Evaluating Bit Digital (BTBT) Valuation as Investor Attention Grows Ahead of CEO's Conference Appearance

Reviewed by Simply Wall St

If you’ve been watching Bit Digital (BTBT), you’ll know there’s a bit of a buzz building. The company’s upcoming appearance at the H.C. Wainwright 27th Annual Global Investment Conference is catching some eyes, with CEO Samir Tabar set to speak. These conferences can be more than just routines; they are important opportunities where a company like Bit Digital updates the financial community and lays out its roadmap, often giving fresh clues to both risks and growth prospects.

This increased focus hasn’t come out of nowhere. Over the past month, Bit Digital’s stock has seen a swing, but looking at the bigger picture shows the story isn’t all smooth. Shares are up around 3% over the past year, after some sharp jumps in the past 3 months and a minor slide recently. Long-term holders still remember the sizable gains made over three years, though recent momentum suggests a wait-and-see approach from investors as they weigh potential against volatility.

With the spotlight turning to this week’s high-profile presentation, is Bit Digital trading at a bargain, or is the recent excitement already reflected in its price?

Most Popular Narrative: 47.9% Undervalued

According to the most widely followed narrative, Bit Digital is trading well below its estimated fair value, with major upside seen if forecasts hold true. The stock is considered undervalued based on an assumption of rapid growth and future profitability.

The company’s structural pivot to become a dedicated Ethereum treasury and staking platform positions it to capitalize on the growing acceptance of Ethereum among institutional investors and asset managers. This is expected to drive future revenue growth through larger scale ETH holdings and increased staking yields.

Curious about what’s driving this bold valuation? There is a significant shift underway. The company’s strategy hinges on aggressive growth and a profit turnaround. Additionally, there are quantitative projections behind the scenes that might surprise you. Want to see what ambitious targets are needed to support that price? The full narrative unpacks all the financial assumptions shaping Bit Digital’s future value.

Result: Fair Value of $5.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, concentration in Ethereum and heavy reliance on partners could magnify downside if crypto markets stumble or if operational setbacks emerge.

Find out about the key risks to this Bit Digital narrative.Another View: Market Value Closer to Industry Peers

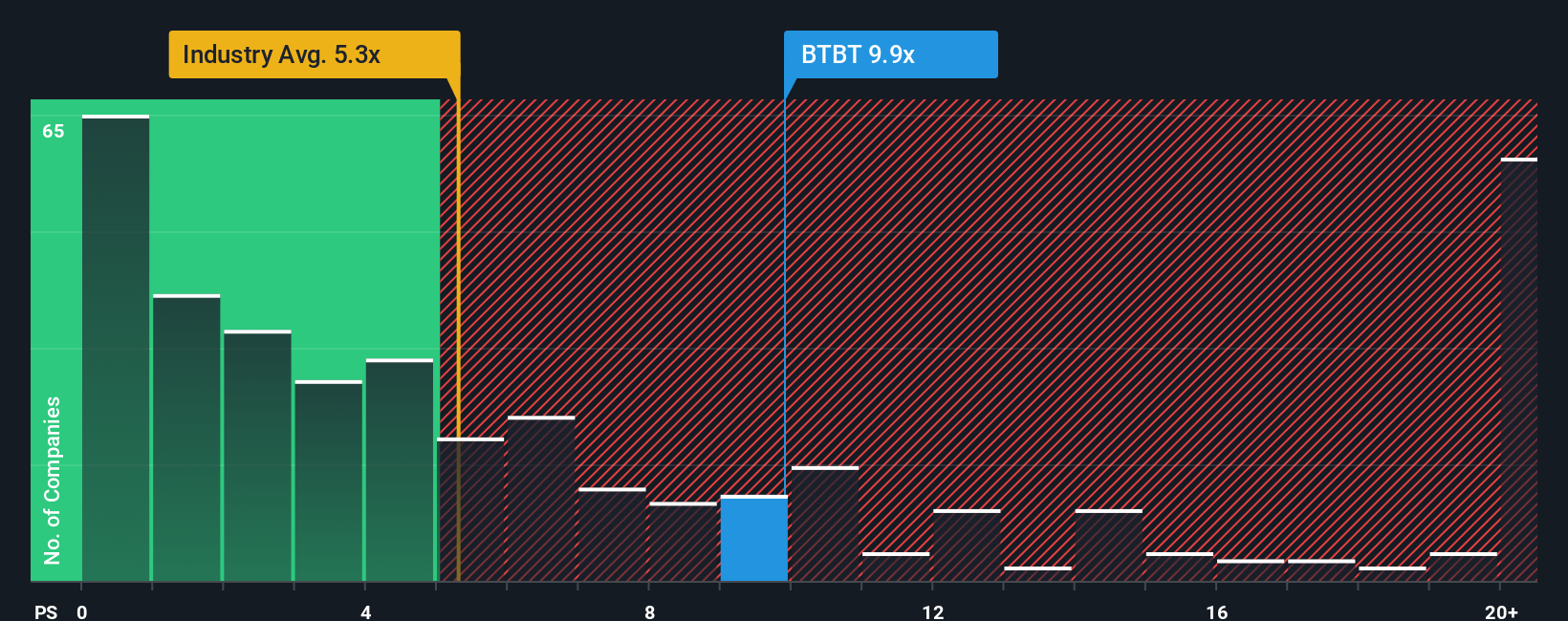

Looking at the company's price in relation to its sales, the picture is less clear-cut. Bit Digital trades at a much richer value compared to the broader US software industry, which raises questions about just how cheap it really is.

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Bit Digital to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Bit Digital Narrative

If the story outlined above doesn’t quite match your perspective or if you like digging into the numbers yourself, you can easily craft your own take in just a few minutes using our tools. Do it your way.

A great starting point for your Bit Digital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t just watch from the sidelines while others spot the next big winner. Step up your investment game and see where opportunity is going next. These handpicked screens surface companies making real waves, so you always have your finger on the pulse:

- Accelerate your search for high-yielding portfolios by pinpointing companies delivering strong cash returns. Tap into dividend stocks with yields > 3% for a steady income edge.

- Spot emerging tech stars at the intersection of science and investing by scanning breakthroughs in cutting-edge computing. Discover the future in quantum computing stocks.

- Unearth bargain opportunities with businesses trading below their potential, setting you up for big upside. Seize the moment in undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bit Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTBT

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives