- United States

- /

- Software

- /

- NasdaqCM:BTBT

Bit Digital (BTBT) Valuation in Focus After $135 Million Convertible Note Spurs Crypto Expansion and Investor Debate

Reviewed by Kshitija Bhandaru

Bit Digital (BTBT) has just closed a $135 million convertible note offering, expanding from its original plan and signaling a firm commitment to ramping up its Ethereum holdings. Investors are watching closely as this latest financing sparks debate about the impact on both company strategy and stock performance.

See our latest analysis for Bit Digital.

Bit Digital’s announcement of its upsized convertible note offering sent shares tumbling 8% after the news, as investors weighed the near-term dilution against longer-term digital asset ambitions. Despite bouts of volatility, the company has built solid revenue momentum in the past year, and total shareholder return over three years stands at nearly 197%. This highlights renewed curiosity about its growth narrative even as short-term sentiment remains in flux.

If you're wondering where else the next breakout might come from, now’s a perfect chance to discover fast growing stocks with high insider ownership

With the stock trading well below its analyst price targets and a bold capital allocation plan in play, the question now is whether Bit Digital is a bargain waiting to be recognized or if markets are already pricing in every ounce of future growth.

Most Popular Narrative: 38.6% Undervalued

Bit Digital’s most widely followed fair value estimate lands at $5.70 per share, a full $2.20 above the last closing price. This sets expectations for a turnaround, hinging on conviction in future growth and profitability.

Monetizing the WhiteFiber stake provides nondilutive capital and allows agile ETH expansion. This positions the company as a premium, yield-generating platform for Ethereum investors.

Want to see what’s driving this ambitious price target? The narrative is powered by a bold mix of accelerated earnings, rapidly rising revenue, and an awaited swing to profit. Curious how much growth, and how valuable those profits, analysts are betting on? The details behind these projections might surprise you.

Result: Fair Value of $5.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the pivot to Ethereum introduces concentration risks, and shareholder dilution could rise if more capital is needed; both of these factors may temper optimism.

Find out about the key risks to this Bit Digital narrative.

Another View: Is the Discount Even Bigger?

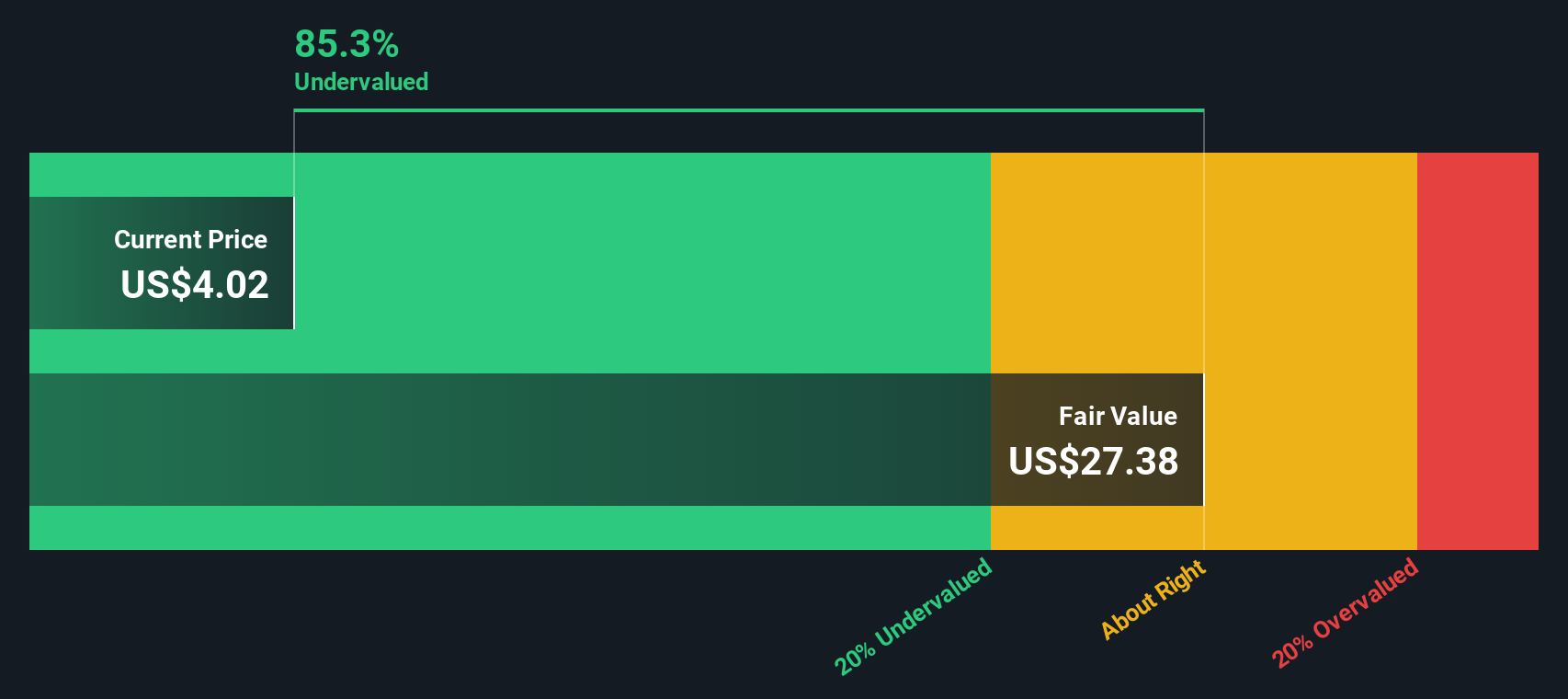

Taking a step back from earnings and analyst targets, our SWS DCF model suggests Bit Digital could be trading as much as 87% below its intrinsic value. This deep discount raises the question: are the risks clouding investor judgment, or is this a rare opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bit Digital Narrative

Got a different perspective or want to dig into the numbers on your own? It takes just a few minutes to craft your own take. Do it your way.

A great starting point for your Bit Digital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit yourself to just one opportunity when there are so many standout stocks catching investors’ attention. Make the most of today’s market by checking out these handpicked ideas before the next wave of growth passes you by:

- Access potential bargains by reviewing these 896 undervalued stocks based on cash flows backed by strong fundamentals and under-the-radar momentum.

- Target reliable income streams and stability by scanning these 19 dividend stocks with yields > 3% offering yields above 3% and proven financial health.

- Ride the innovation wave with these 24 AI penny stocks. See which companies are set to lead the next chapter in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bit Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTBT

Bit Digital

Engages in the institutional grade ethereum treasury and staking business.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives