- United States

- /

- Software

- /

- NYSE:NOW

High Growth Tech Stocks in the US To Watch This May 2025

Reviewed by Simply Wall St

The United States market has shown a positive trend, rising 1.3% over the last week and climbing 8.2% in the past year, with earnings forecasted to grow by 14% annually. In this favorable environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and potential to capitalize on emerging trends within the technology sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 27.47% | 39.60% | ★★★★★★ |

| Ardelyx | 20.57% | 59.97% | ★★★★★★ |

| Clene | 61.80% | 67.01% | ★★★★★★ |

| Travere Therapeutics | 28.83% | 64.80% | ★★★★★★ |

| TG Therapeutics | 25.99% | 38.42% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.67% | 61.11% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Lumentum Holdings | 21.54% | 110.32% | ★★★★★★ |

| Alkami Technology | 22.46% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

Click here to see the full list of 232 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bentley Systems (NasdaqGS:BSY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bentley Systems, Incorporated offers infrastructure engineering software solutions across various regions including the Americas, Europe, the Middle East, Africa, and the Asia-Pacific with a market cap of approximately $14.59 billion.

Operations: The company generates revenue primarily from its computer software and related services, amounting to $1.39 billion.

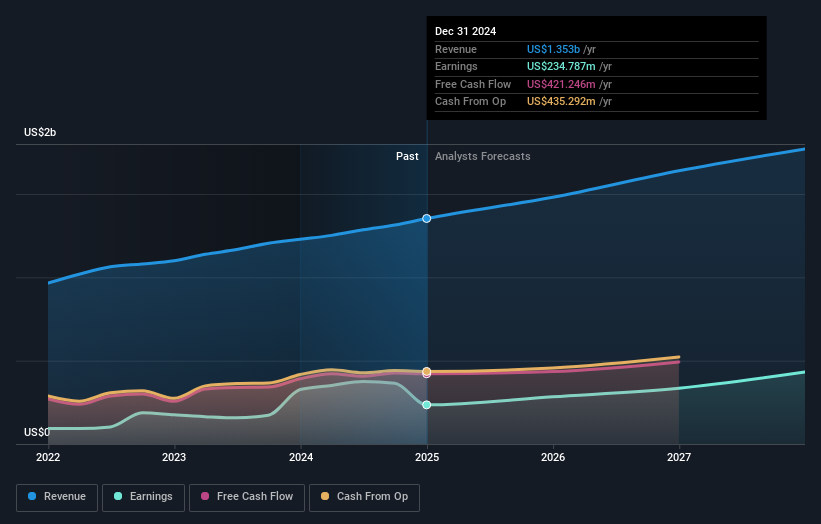

Bentley Systems, a software firm entrenched in the infrastructure engineering sector, has demonstrated resilience with its recent financial outcomes. In the first quarter of 2025, revenue surged to $370.54 million from $337.76 million year-over-year, coupled with a notable increase in net income to $91.37 million from $70.31 million. This performance is underpinned by strategic share repurchases totaling $92.57 million since 2022 and an incremental dividend rise announced for Q1 2025, signaling confidence in sustained fiscal health and shareholder value enhancement. Despite challenges like a high debt level and lower profit margins compared to last year—18.5% versus 28.1%—the company's forward-looking revenue projections between $1,461 million and $1,490 million reflect optimism about its growth trajectory relative to the broader U.S market.

- Get an in-depth perspective on Bentley Systems' performance by reading our health report here.

Examine Bentley Systems' past performance report to understand how it has performed in the past.

Tenable Holdings (NasdaqGS:TENB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tenable Holdings, Inc. offers cyber exposure management solutions across various regions including the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan with a market capitalization of approximately $3.82 billion.

Operations: Tenable Holdings generates revenue primarily from its Security Software & Services segment, which accounted for $923.20 million. The company operates in multiple regions, providing solutions that address cyber exposure management needs globally.

Tenable Holdings, despite a challenging financial landscape marked by a net loss of $22.94 million in Q1 2025, continues to invest strategically in growth areas such as cybersecurity and cloud security. The appointment of Eric Doerr as Chief Product Officer underscores the company's commitment to innovation, particularly with the upcoming expansion of its Tenable One platform. This move, coupled with a robust share repurchase program where 1.6 million shares were bought back for $60 million in early 2025, signals a proactive stance towards enhancing shareholder value and stabilizing its market position amidst forecasts of becoming profitable within three years—an outlook buoyed by an expected annual earnings growth rate of 58%.

- Navigate through the intricacies of Tenable Holdings with our comprehensive health report here.

Evaluate Tenable Holdings' historical performance by accessing our past performance report.

ServiceNow (NYSE:NOW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ServiceNow, Inc. offers cloud-based solutions for digital workflows across various regions globally and has a market capitalization of $203.52 billion.

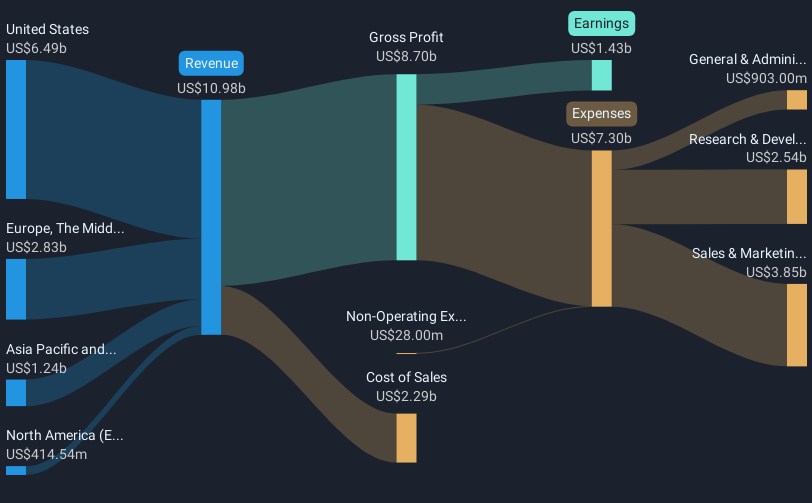

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $11.47 billion. It operates across multiple regions, including North America, Europe, the Middle East and Africa, and Asia Pacific.

ServiceNow, a prominent player in the tech landscape, continues to leverage its robust R&D investments to stay ahead of technological advancements and market demands. In 2025, ServiceNow reported significant R&D expenses amounting to $1.2 billion, reflecting its commitment to innovation, particularly in AI and workflow automation solutions. This strategic focus not only enhances product offerings but also solidifies its competitive position by rapidly adapting to changing customer needs and integrating cutting-edge technologies across various sectors including ITSM and HR workflows. The company's recent partnerships and product launches underscore its ability to transform enterprise operations efficiently, making it a key enabler of digital transformation strategies for businesses globally.

- Unlock comprehensive insights into our analysis of ServiceNow stock in this health report.

Gain insights into ServiceNow's historical performance by reviewing our past performance report.

Where To Now?

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 229 more companies for you to explore.Click here to unveil our expertly curated list of 232 US High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives