- United States

- /

- Software

- /

- NasdaqGS:BRZE

Does Braze Offer Opportunity After a 33% Drop and Shopify Partnership in 2025?

Reviewed by Bailey Pemberton

If you have been eyeing Braze stock and wondering if now is the moment to buy, hold, or simply watch from the sidelines, you are not alone. The past year has been a bit of a roller coaster for Braze. Its share price has fallen by 33.3% year-to-date and is down nearly 8% over the last month alone. Over a three-year stretch, Braze is off about 12.9%, but some of those losses have been more recent, hinting at a shift in sentiment or perceived risk.

Part of that shift seems connected to the changing landscape in tech, as broader software stocks have come under pressure from rising interest rates and investors rethinking growth-at-all-costs models. At the same time, companies that show they can capture meaningful customer engagement have started to claw back interest, and Braze is well known for its customer engagement platform and sits right in that crosscurrent.

Here is what might catch your eye if you are a value-conscious investor: Braze scores a 3 out of 6 by undervaluation checks, meaning it appears underpriced in half the ways analysts traditionally evaluate companies like this. That is hardly a flashing green light, but also far from a warning siren, suggesting there just might be opportunity if you know where to look.

Now, let us break down the methods used to assess Braze’s valuation one by one. Later, we will get into a perspective that puts these numbers into an even sharper, real-world context.

Why Braze is lagging behind its peers

Approach 1: Braze Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's fundamental value by forecasting its future cash flows and discounting them back to today's dollars. This approach is widely used because it focuses on real, projected money that the business will generate, not just current earnings or book value.

For Braze, the analysis begins with its latest trailing twelve months Free Cash Flow, which stands at $19.92 million. According to analyst projections, Braze’s free cash flow is expected to grow rapidly, reaching $104.15 million by 2028. While detailed analyst estimates typically stop at five years, further forecasts are extrapolated based on industry trends and the company's growth profile, continuing up to the next decade. Over these ten years, expected annual free cash flows rise steadily, painting a picture of continued expansion.

After discounting all these future cash flows back to the present, the DCF model calculates an estimated intrinsic value for Braze stock of $24.91 per share. However, when compared to the company’s current share price, this suggests that the stock is actually trading about 16.2% above its fair value. This indicates it appears somewhat overvalued based on these projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Braze may be overvalued by 16.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Braze Price vs Sales

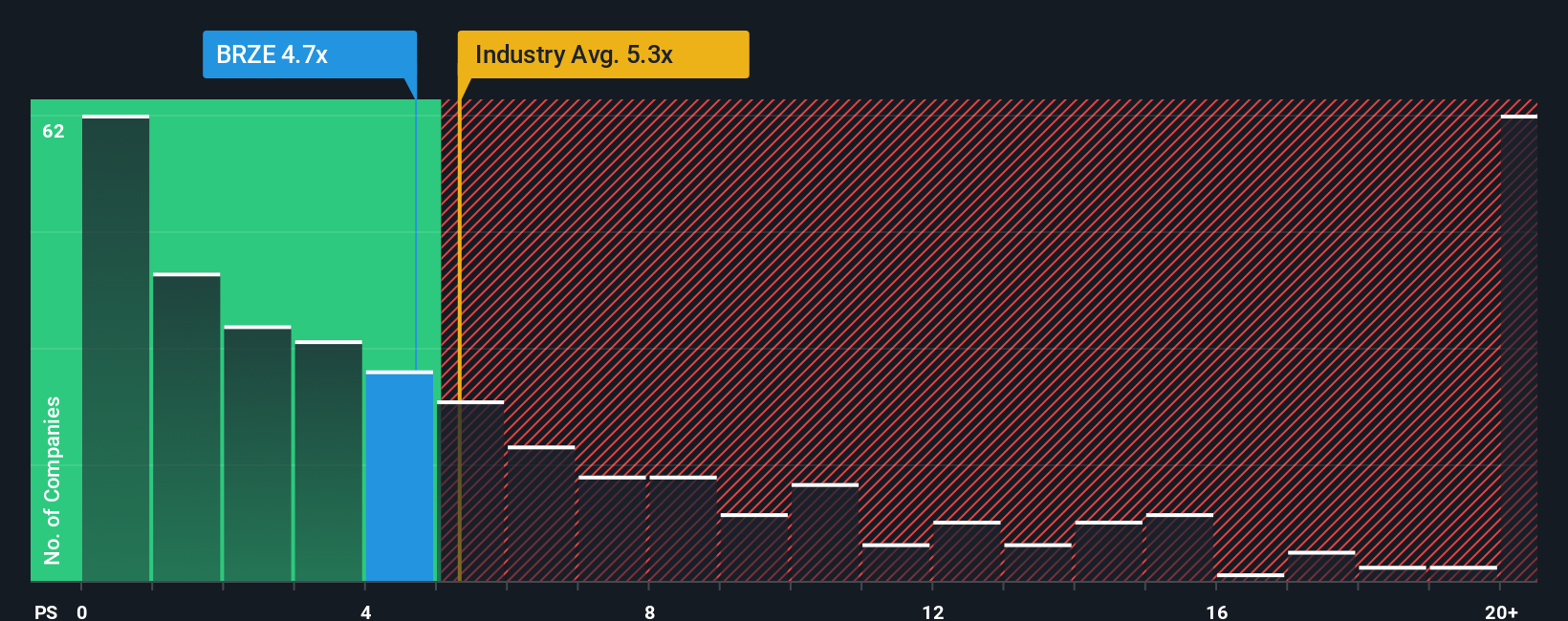

When evaluating technology companies that are not yet profitable but are growing quickly, the Price-to-Sales (PS) ratio is frequently the primary valuation gauge. This metric gives insights into how much investors are willing to pay for each dollar of company revenue, which is especially meaningful for businesses still investing heavily for future gains rather than turning out consistent profits.

Growth prospects and perceived business risks both heavily influence what counts as a “normal” PS ratio. High-growth software firms tend to trade at higher multiples, reflecting optimism about their ability to increase sales rapidly. In contrast, heightened risks or industry pressures can justify a lower ratio.

Currently, Braze trades at a 4.92x PS ratio. For context, this sits below both the industry average for software companies at 5.28x and the average among its direct peers at 6.48x. This suggests the stock may be valued more conservatively than the broader group.

Simply Wall St’s proprietary Fair Ratio for Braze, which factors in the company’s unique mix of growth rates, risk, profit margin, industry placement, and market capitalization, clocks in at 5.34x. Unlike a blanket industry or peer comparison, this Fair Ratio offers a sharper and more personalized perspective on valuation, tuned to Braze specifically.

With Braze’s current multiple just slightly below its Fair Ratio and the difference less than 0.10, the evidence points to the stock being fairly valued by this measure.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Braze Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your unique story about a company, linking your perspective on its future revenue, earnings, and margins to a specific fair value and investment forecast. Instead of relying only on traditional metrics, Narratives connect the bigger business picture: what Braze does, where you think it is going, and what could shift its fortunes, directly to a financial forecast and explicit fair value estimate.

Narratives are simple and accessible on Simply Wall St’s Community page, trusted by millions of investors. This lets anyone create, explore, or follow real investor perspectives. They help you decide when to buy or sell, because each Narrative shows its calculated fair value next to the current share price. As company news or earnings events hit the market, Narratives update automatically with the latest data, making sure your thesis always adapts with new information.

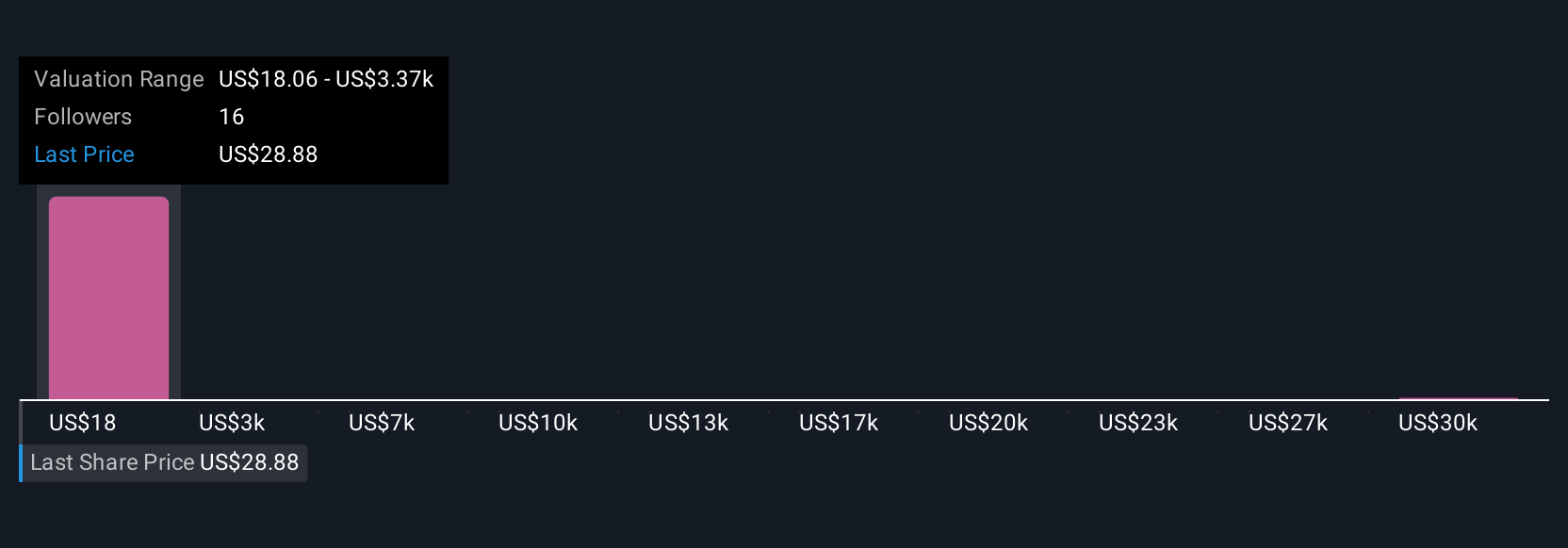

For example, if you believe Braze's AI-driven expansion and Shopify integration will accelerate growth beyond consensus, your Narrative might set a higher fair value. A more cautious investor could emphasize integration risks and assign a lower one, with current community perspectives on Braze ranging from a price target of $68.00 at the top end to $35.00 at the low. Narratives bring these viewpoints to life, letting you invest with both the numbers and the story in mind.

Do you think there's more to the story for Braze? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Braze might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRZE

Braze

Operates a customer engagement platform that provides interactions between consumers and brands worldwide.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)