- United States

- /

- Software

- /

- NasdaqGS:BL

Introducing BlackLine (NASDAQ:BL), The Stock That Zoomed 119% In The Last Three Years

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But if you buy shares in a really great company, you can more than double your money. For example, the BlackLine, Inc. (NASDAQ:BL) share price has soared 119% in the last three years. How nice for those who held the stock! On top of that, the share price is up 33% in about a quarter.

Check out our latest analysis for BlackLine

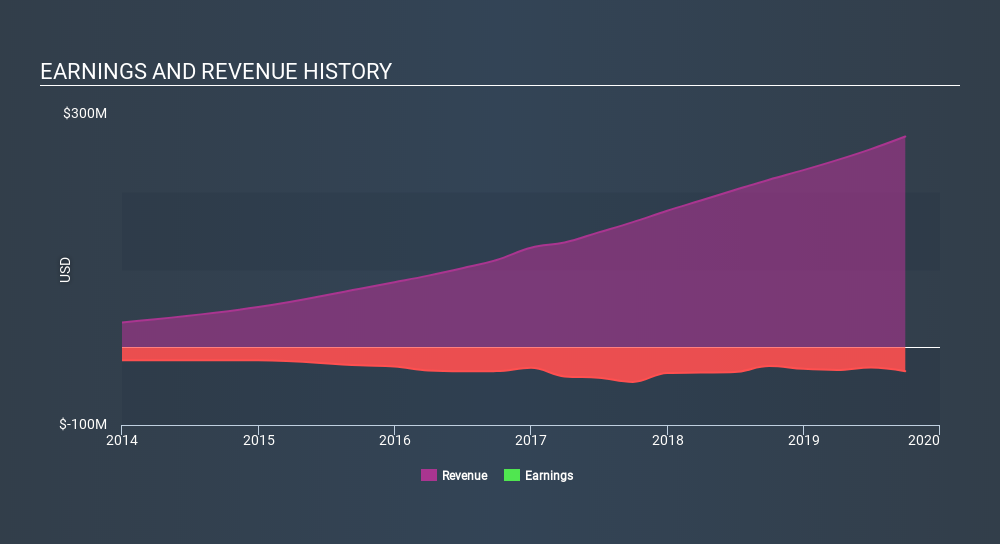

Given that BlackLine didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years BlackLine has grown its revenue at 28% annually. That's much better than most loss-making companies. Meanwhile, the share price performance has been pretty solid at 30% compound over three years. This suggests the market has recognized the progress the business has made, at least to a significant degree. Nonetheless, we'd say BlackLine is still worth investigating - successful businesses can often keep growing for long periods.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

BlackLine is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think BlackLine will earn in the future (free analyst consensus estimates)

A Different Perspective

Pleasingly, BlackLine's total shareholder return last year was 32%. So this year's TSR was actually better than the three-year TSR (annualized) of 30%. Given the track record of solid returns over varying time frames, it might be worth putting BlackLine on your watchlist. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for BlackLine that you should be aware of.

Of course BlackLine may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:BL

BlackLine

Provides cloud-based solutions to automate and streamline accounting and finance operations in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives