- United States

- /

- Software

- /

- NasdaqGS:BL

Does Engaged Capital's Board Critique Signal Deeper Governance Questions for BlackLine (BL) Investors?

Reviewed by Sasha Jovanovic

- On November 24, 2025, Engaged Capital, LLC announced that it had sent a letter to BlackLine Inc. demanding to inspect the company’s records concerning the Board’s handling of multiple acquisition offers, including an actionable US$66 per share bid from SAP SE and the activities of the Board’s Strategic Committee.

- This activist intervention shines a spotlight on BlackLine’s board oversight, transparency, and responsiveness to shareholder interests, raising questions about governance and the handling of potential buyout scenarios.

- We’ll review how Engaged Capital’s transparency demands and critique of BlackLine’s board could shape the company’s investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

BlackLine Investment Narrative Recap

To believe in BlackLine as a shareholder today, you’d need confidence in the company’s long-term ability to capitalize on the digital transformation of finance, particularly as it seeks larger, enterprise-scale deals and deepens integration with leading ERP platforms. The recent activist demand from Engaged Capital for board transparency around acquisition bids may influence near-term sentiment, but it doesn’t materially alter the most critical short-term catalyst, the company’s ability to close larger deals and sustain revenue growth amid tough economic conditions. The biggest risk remains slow deal closures and revenue volatility caused by customer budget constraints and macroeconomic uncertainty.

Among BlackLine’s recent announcements, the latest quarterly earnings released in early November stand out as most relevant to this discussion. While revenue grew year-over-year, net income and margins declined, reflecting some of the same concerns raised by Engaged Capital regarding underperformance and challenges securing larger deals. This earns attention as it links continued operational hurdles to the board scrutiny and activism now shaping the conversation around potential buyout scenarios and governance.

However, investors should also be aware that despite clear opportunities, heightened competition from integrated ERP vendors like SAP or Oracle poses...

Read the full narrative on BlackLine (it's free!)

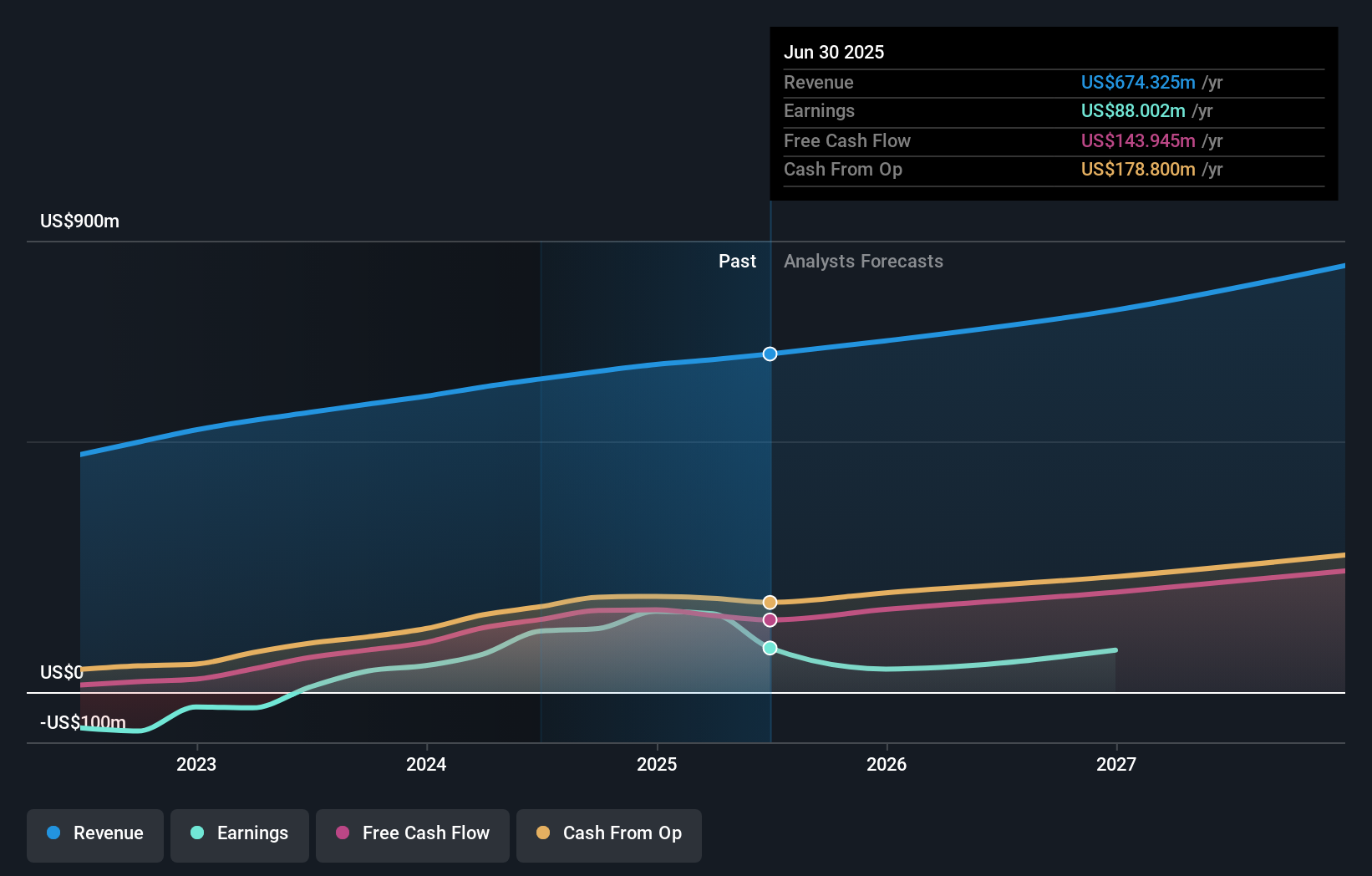

BlackLine's narrative projects $920.5 million revenue and $68.3 million earnings by 2028. This requires 10.9% yearly revenue growth and a $19.7 million decrease in earnings from $88.0 million today.

Uncover how BlackLine's forecasts yield a $61.83 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Fair value estimates from four members of the Simply Wall St Community stretch from US$38.46 up to US$98.77 per share. While expectations differ, slow deal cycles and macro-driven revenue risk put the company’s growth ambitions to the test. Consider how your own viewpoint stacks up and see what other investors are factoring in.

Explore 4 other fair value estimates on BlackLine - why the stock might be worth as much as 80% more than the current price!

Build Your Own BlackLine Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BlackLine research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BlackLine research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BlackLine's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackLine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BL

BlackLine

Provides cloud-based solutions to automate and streamline accounting and finance operations in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.