- United States

- /

- Software

- /

- NasdaqGS:BL

BlackLine (BL) Is Up 6.3% After Market Rally Fueled by Trade and Rate Cut Optimism – What's Changed

Reviewed by Sasha Jovanovic

- BlackLine, along with other technology companies, experienced a meaningful boost in share performance after recent positive news on corporate earnings, easing U.S.-China trade tensions, and increasing investor optimism regarding future interest rate cuts.

- This broad market rally reflects how macroeconomic shifts can elevate companies without company-specific catalysts, signaling the market’s responsiveness to external sentiment drivers.

- We'll examine how optimism surrounding potential interest rate cuts impacts BlackLine's investment narrative and perceived growth prospects.

Find companies with promising cash flow potential yet trading below their fair value.

BlackLine Investment Narrative Recap

To be a BlackLine shareholder, you need to see long-term value in finance automation and believe that demand for cloud-based solutions will keep growing, despite slower adoption in some markets. While recent market optimism from macroeconomic news briefly lifted the stock, the main catalyst, expansion into larger enterprise deals, remains reliant on closing bigger contracts in a challenging economic environment, and none of the recent news is likely to materially change the risks tied to weaker billings growth or slower AI adoption in finance.

One announcement standing out lately is BlackLine’s September launch of AI-enabled intercompany accounting tools, which supports the catalyst of increasing deal size and addressing more complex customer needs. This directly targets enterprises looking for advanced automation, but it also highlights how much the company’s success rests on getting new products adopted quickly to hit its growth targets.

On the other hand, investors should be aware that, despite improving products and positive sentiment, BlackLine continues to face headwinds when it comes to closing large deals and overcoming...

Read the full narrative on BlackLine (it's free!)

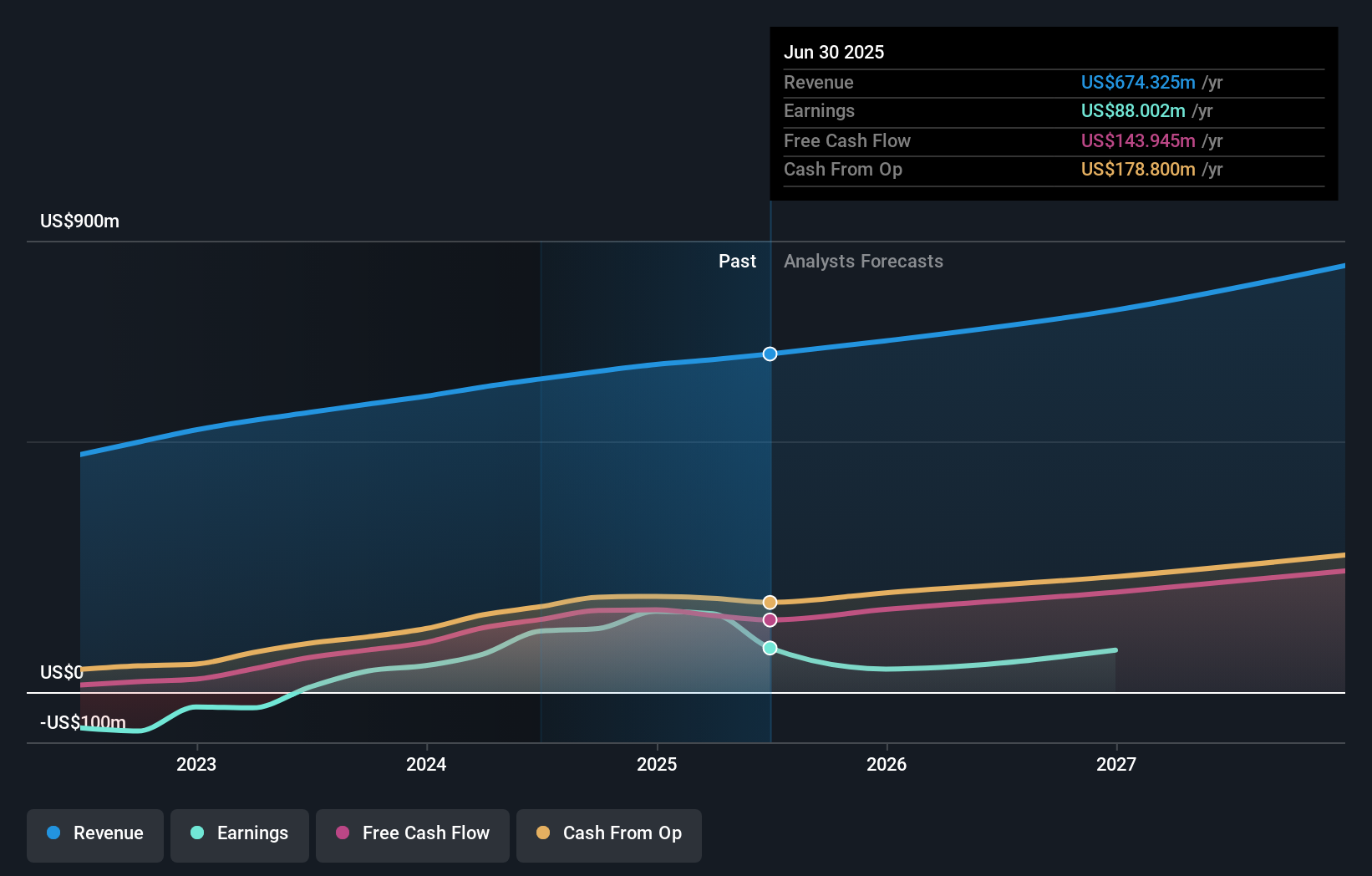

BlackLine's narrative projects $920.5 million in revenue and $68.3 million in earnings by 2028. This requires 10.9% yearly revenue growth but a decrease of $19.7 million in earnings from the current $88.0 million.

Uncover how BlackLine's forecasts yield a $61.83 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community estimate BlackLine’s fair value from US$38.46 to US$106.34 per share. As you compare these viewpoints, consider that slower billings growth in the current economic climate could temper optimism and shape future expectations for the company’s growth and resilience.

Explore 4 other fair value estimates on BlackLine - why the stock might be worth 26% less than the current price!

Build Your Own BlackLine Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BlackLine research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free BlackLine research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BlackLine's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackLine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BL

BlackLine

Provides cloud-based solutions to automate and streamline accounting and finance operations in the United States and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives