- United States

- /

- Software

- /

- NasdaqGS:AUR

Aurora Innovation (AUR) Sees 11% Stock Price Rise Over Past Week

Reviewed by Simply Wall St

Aurora Innovation (AUR) recently experienced significant index membership changes, transitioning between various Russell indices at the end of June 2025. This reshuffling may have influenced the company's stock price, which saw a 11% increase over the past week. The addition to value-focused benchmarks may have attracted value-oriented investors. The broader market remained largely flat during this period, suggesting that Aurora's reclassification events added weight to its positive movement. As the market anticipates an annual earnings growth of 15%, Aurora's strategic positioning in value indices might be advantageous in aligning with investor sentiment toward growth and stability.

Over the past three years, Aurora Innovation's shares have delivered a total return of 172.12%. This performance starkly contrasts the broader market's annual return of 11.4% over just the past year. Compared to the U.S. Software industry, which returned 19.2% in the last year, Aurora's recent strong movement is also notable. However, the company remains unprofitable, with losses continuing to escalate.

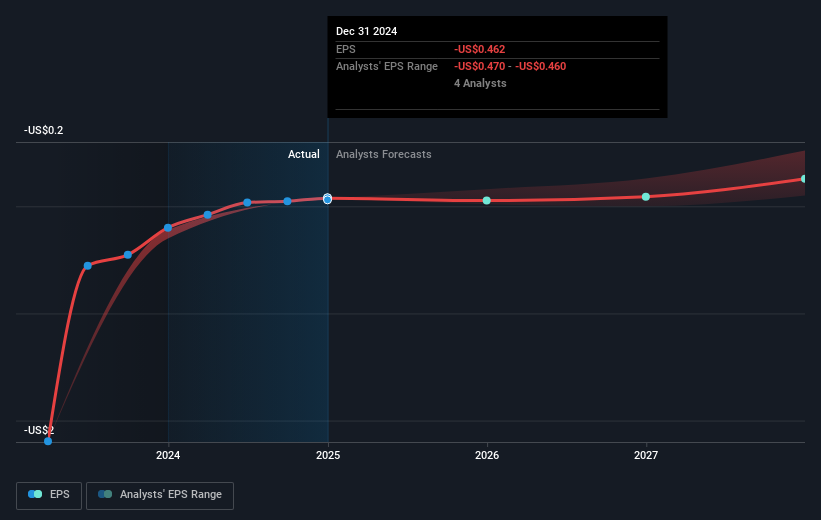

The recent reclassification in indices and the uptick in its share price could foster optimism about future revenue growth, anticipated to expand by 67.3% annually. Yet, the company's earnings forecasts remain negative, a factor investors should consider amid its 44.31% decline in Return on Equity. The current stock price at US$5.66 is significantly below the analyst consensus price target of US$10.51, reflecting a strong discount that may attract certain investors. However, given the ongoing unprofitability and forecast to remain so, investor sentiment might remain cautious.

Examine Aurora Innovation's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUR

Aurora Innovation

Operates as a self-driving technology company in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026