- United States

- /

- Software

- /

- NasdaqGS:AUR

Aurora Innovation (AUR): Assessing Valuation After Director Share Sale and Bearish Analyst Commentary

Reviewed by Kshitija Bhandaru

Aurora Innovation (AUR) is in the spotlight after Director Brittany Bagley sold 50,000 shares, coinciding with a bearish outlook from analyst Kerrisdale. This development has prompted new questions about the company’s future trajectory.

See our latest analysis for Aurora Innovation.

Over the past year, Aurora Innovation’s 1-year total shareholder return is essentially flat, reflecting mixed sentiment even as the company lands new partnerships and advances its autonomous trucking platform. Recent volatility in the share price and insider activity suggest that investors are weighing growth potential against ongoing risks.

If leadership changes and shifting sentiment have you curious about the wider market, now is a smart time to broaden your perspective and discover fast growing stocks with high insider ownership

With analysts divided and insiders cashing out, could Aurora Innovation be presenting a rare value opportunity for patient investors? Or is the market already accounting for the company’s future growth prospects?

Price-to-Book of 5x: Is it justified?

Aurora Innovation trades at a price-to-book ratio of 5x, placing its valuation below the peer group average of 6.3x and above the broader US Software industry average of 4x. At the last close price of $5.39, this suggests the stock is moderately valued within its competitive set.

The price-to-book ratio compares a company's market value to its book value, offering investors insight into how much they are paying for each dollar of net assets. For technology companies, this metric can help reveal whether investor optimism about future growth is pushing valuations above the underlying assets.

While Aurora Innovation’s multiple is more attractive than similar peers, it is somewhat elevated compared to the overall industry. This may reflect its growth prospects and investor interest. The market appears to be weighing the company’s rapid forecasted revenue growth alongside ongoing losses, making the current valuation a sign of cautious optimism among investors.

Peer companies on average are valued higher, but the gap with the broader industry remains noticeable. This could mean that, unless growth accelerates or profitability improves, the current multiple remains vulnerable to shifts in sentiment.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 5x (ABOUT RIGHT)

However, Aurora Innovation still faces fierce competition and ongoing operating losses, which could quickly dampen the current sense of cautious optimism.

Find out about the key risks to this Aurora Innovation narrative.

Another View: Discounted Cash Flow Says Undervalued

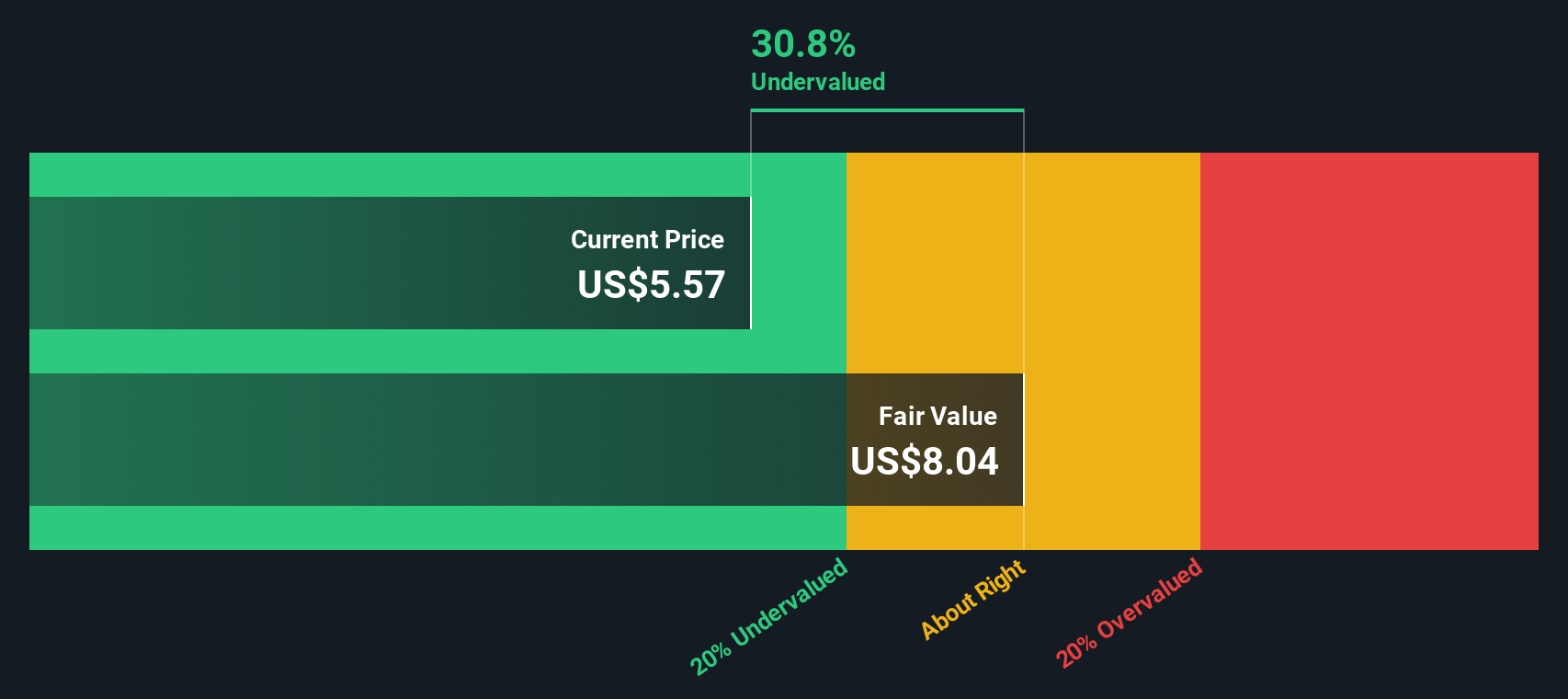

Looking from another angle, our DCF model suggests Aurora Innovation is actually trading about 32.8% below its estimated fair value of $8.03. This implies the market might be underestimating the company’s long-term cash flow prospects, despite current challenges. Could this be a case of overly cautious sentiment or a hidden opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aurora Innovation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aurora Innovation Narrative

If you have a different perspective or prefer hands-on analysis, you can quickly assemble your own outlook using our tools. All of this can be done in under three minutes Do it your way

A great starting point for your Aurora Innovation research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

The smartest investors never limit themselves to just one opportunity. If you want more exciting alternatives beyond Aurora Innovation, let Simply Wall Street help you take action.

- Unlock income potential by exploring these 19 dividend stocks with yields > 3% offering yields above 3% for consistent cash flow.

- Spot tomorrow’s tech winners by reviewing these 24 AI penny stocks making real progress in artificial intelligence.

- Start building wealth with these 886 undervalued stocks based on cash flows that could be priced lower than their future cash flow potential suggests.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUR

Aurora Innovation

Operates as a self-driving technology company in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives