- United States

- /

- Software

- /

- NasdaqGM:APPN

Appian (APPN): Evaluating the Current Valuation and Potential for Future Upside

Reviewed by Kshitija Bhandaru

See our latest analysis for Appian.

After a tough year for Appian, recent share price action hints at some stabilization, though momentum has yet to turn decisively. Despite occasional surges, its 1-year total shareholder return is still down nearly 10%. This underscores the challenges of sustaining a turnaround while the broader software sector continues to evolve.

If you’re weighing your next move, now is an opportune moment to broaden your perspective and discover fast growing stocks with high insider ownership

With Appian’s shares still lagging behind their highs and valuation metrics in focus, the key question looms: is the current price reflective of true value, or might there be overlooked upside for prospective investors?

Most Popular Narrative: 9.3% Undervalued

Appian’s consensus fair value target is slightly above the current trading price, suggesting investors are considering moderate upside potential versus sector headwinds.

Broad enterprise demand for application modernization and workflow automation is accelerating. AI is seen as a catalyst that significantly lowers modernization costs and complexity, positioning Appian's platform for increased adoption, larger deal sizes, and improved revenue growth over the coming years.

Curious what market forces are behind this edge? The most followed narrative centers on enterprise transformation, future profit expansion, and an ambitious top-line outlook. What’s the missing piece making these numbers align? Find out in the full narrative.

Result: Fair Value of $33.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including the threat of generative AI commoditizing low-code automation, as well as persistent challenges with customer expansion that could temper Appian’s growth outlook.

Find out about the key risks to this Appian narrative.

Another View: Discounted Cash Flow Raises Doubts

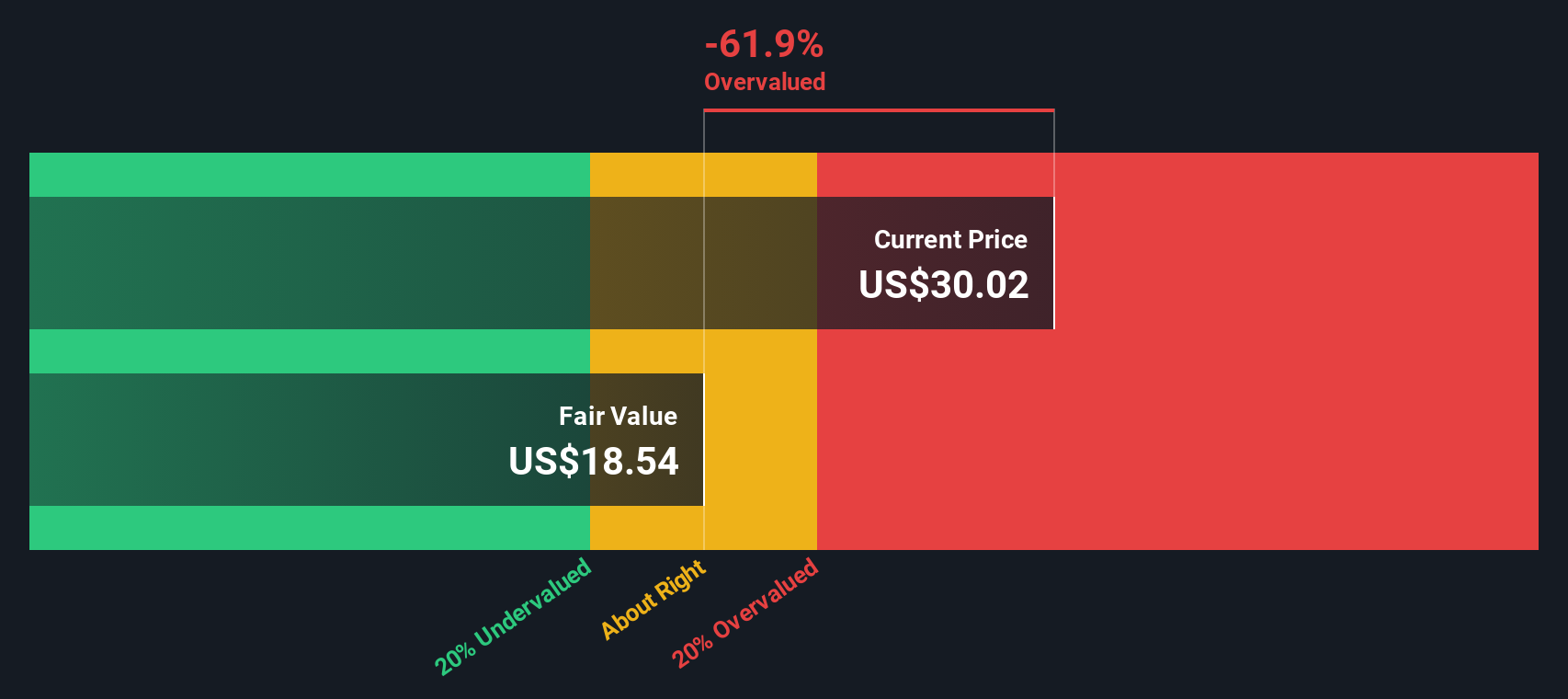

While the analyst price target suggests Appian could be undervalued relative to future earnings, our DCF model paints a different picture. By projecting cash flows, the SWS DCF model estimates fair value at just $18.47, which is well below the current share price. Does this hint at downside risk the market is overlooking?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Appian for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Appian Narrative

If you see the story differently or want to dive deeper into the numbers yourself, it's straightforward to build your own narrative in just minutes, so why not Do it your way

A great starting point for your Appian research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always a step ahead. Use the Simply Wall Street Screener to uncover fresh opportunities with big potential before the crowd catches on.

- Uncover high-yield potential by targeting these 19 dividend stocks with yields > 3% with payouts over 3% that stand out for their consistent returns and stability.

- Accelerate your portfolio’s tech edge by securing your spot in the race for innovation with these 24 AI penny stocks, which are at the forefront of artificial intelligence breakthroughs.

- Tap into exciting market growth with these 3569 penny stocks with strong financials, combining attractive financials and compelling turnaround stories that are ready for tomorrow’s headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:APPN

Appian

Operates as a software company in the United States, Australia, Canada, France, Germany, India, Italy, Japan, Mexico, the Netherlands, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and internationally.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives