- United States

- /

- Software

- /

- NasdaqGS:APP

Reassessing AppLovin (APP) After Sharp Pullback And Rich Earnings Multiple

- If you are wondering whether AppLovin is still worth the price on your screen, you are not alone. This article will focus squarely on what the current share price might imply about value.

- The stock recently closed at US$535.44, with a 7 day return of a 5.9% decline, a 30 day return of a 25.0% decline and a year to date return of a 13.4% decline, set against a 1 year return of 56.1% and a very large 3 year return.

- Recent headlines around AppLovin have kept investor attention on factors such as its role in mobile app monetisation and broader interest in software and advertising technology stocks. These themes help frame why the share price has been so active over both shorter and longer time frames.

- Right now AppLovin scores 1 out of 6 on our valuation checks. You can see the full breakdown in our valuation score. Next we will look at how different valuation methods line up on the stock, before finishing with a perspective that can help you think about value in a more complete way.

AppLovin scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AppLovin Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes estimates of the cash a company could generate in the future and discounts those amounts back into today’s dollars. The idea is simple: what matters is the present value of all the cash shareholders might receive over time.

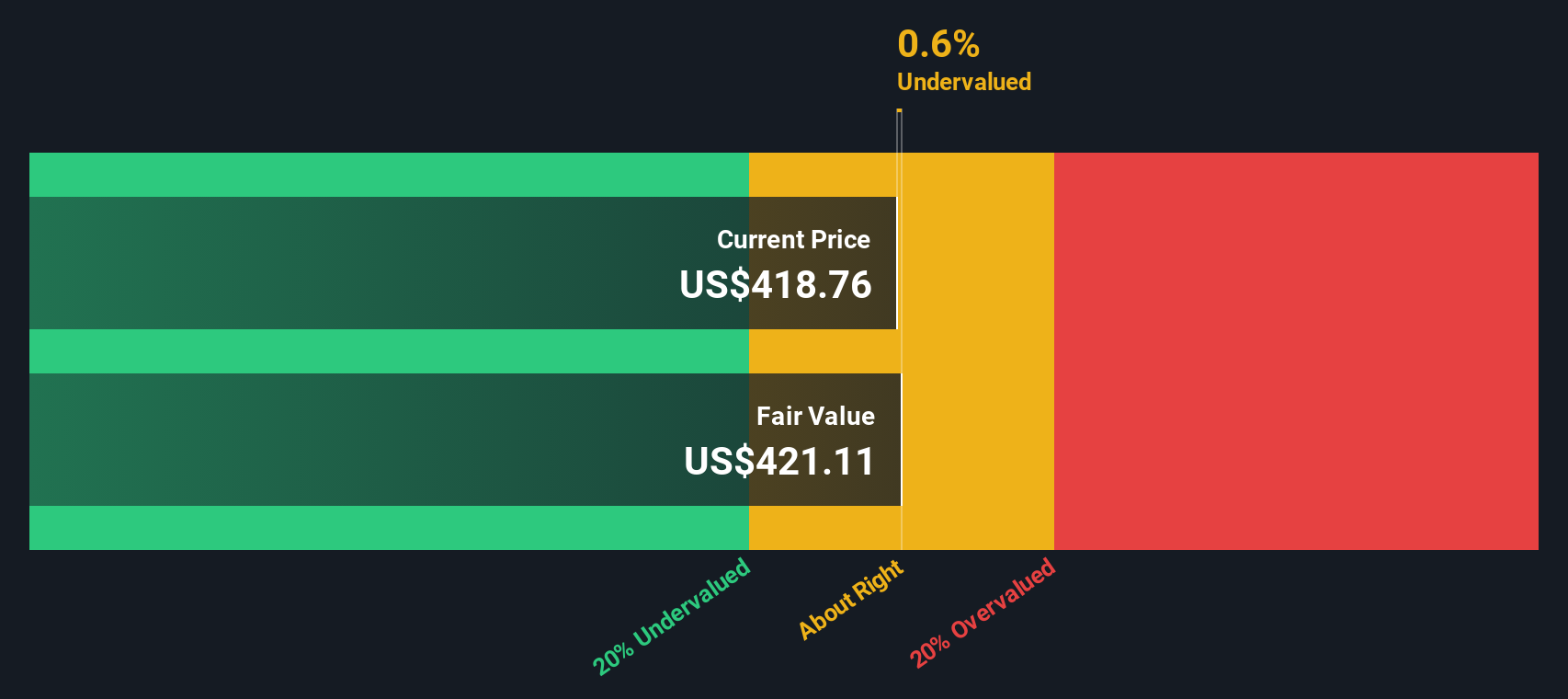

For AppLovin, the model used here is a 2 Stage Free Cash Flow to Equity approach, based on cash flow projections that are then extrapolated further out. The latest twelve month Free Cash Flow is about $3.40b. Analyst inputs and extrapolations point to Free Cash Flow of $4.83b in 2026 and $8.82b by 2030, with further estimates running out to 2035, all converted back to today’s value using a discount rate.

Putting all those discounted cash flows together gives an estimated intrinsic value of about $465.10 per share. Compared with the recent share price of $535.44, the DCF output suggests the stock is around 15.1% overvalued on these assumptions.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AppLovin may be overvalued by 15.1%. Discover 886 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: AppLovin Price vs Earnings

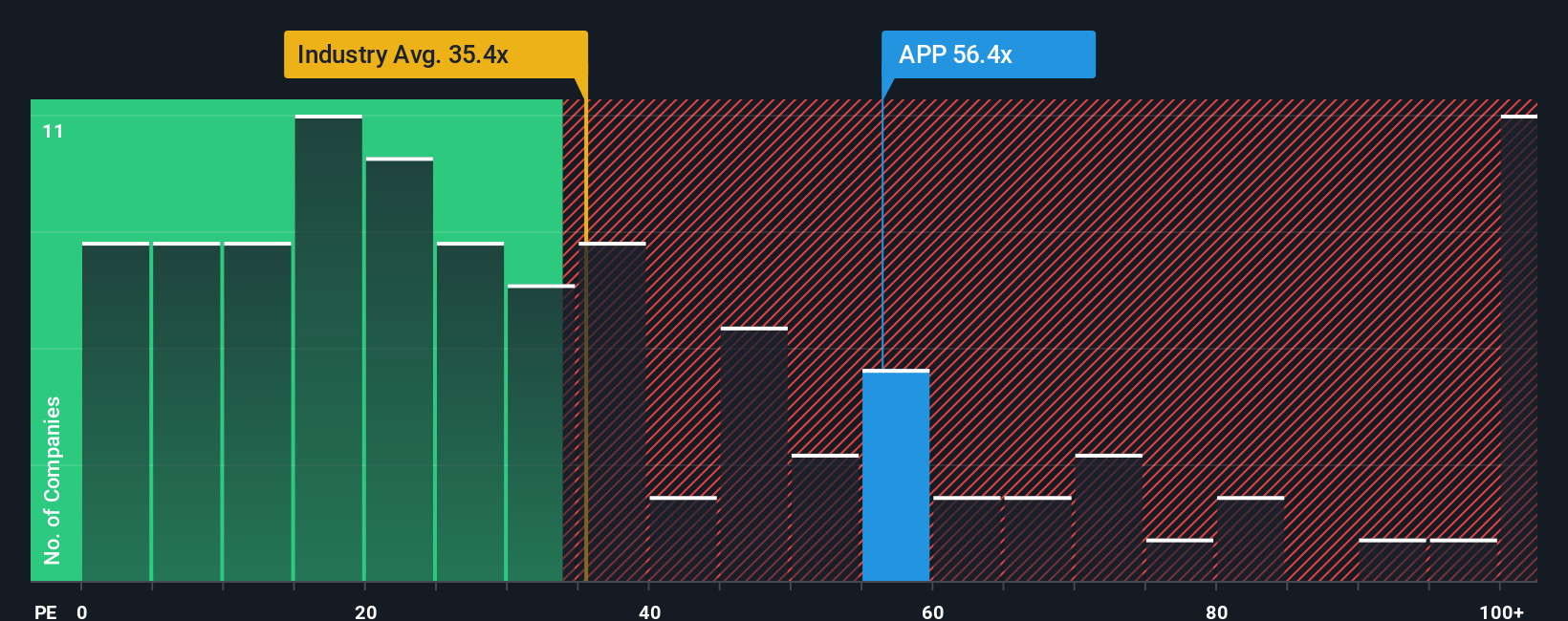

For a profitable company like AppLovin, the P/E ratio is a useful way to think about value because it links what you pay directly to the earnings the business is generating today. Investors usually accept a higher P/E when they expect stronger growth or see lower risk, and look for a lower P/E when they see slower growth or higher risk.

AppLovin is currently trading on a P/E of 62.05x, compared with the broader Software industry average of 30.76x and a peer group average of 39.32x. On these simple comparisons alone, the shares are priced well above both the sector and peers.

Simply Wall St’s Fair Ratio for AppLovin is 53.94x. This is a proprietary estimate of what the P/E could reasonably be, given factors such as the company’s earnings growth profile, its industry, profit margins, market value and identified risks. Because it blends these company specific inputs, the Fair Ratio can give you a more tailored reference point than a broad industry or peer average.

Against this Fair Ratio of 53.94x, the current P/E of 62.05x sits meaningfully higher, which suggests the shares look expensive on this metric.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1425 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AppLovin Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company linked directly to your assumptions about its future revenue, earnings, margins and fair value.

On Simply Wall St, Narratives live in the Community page and let you connect AppLovin’s business story, such as its position in mobile app monetisation and software, to a clear financial forecast and a single Fair Value number you can compare with today’s share price.

Because Narratives are updated automatically when new information like earnings releases or news headlines arrive, your view of AppLovin’s Fair Value can adjust without you rebuilding a full model each time.

Narratives can also help you decide what to do. For example, some AppLovin Narratives on Simply Wall St might point to a relatively high Fair Value, while others point to a relatively low Fair Value, reflecting different views on future growth, profitability and risk.

Do you think there's more to the story for AppLovin? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Hims & Hers Health - Valuation

TAV Havalimanlari Holding will soar with €2.5 billion investments fueling future growth

Lexaria Bioscience's Breakthrough with DehydraTECH to Revolutionize Drug Delivery

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.

NVDA+AEVA Agreement is a game changer for the AEVA stock even though it is just a partnership and does not have a roll out until 2028 (which means receivables as early as 2027, I would imagine) This agreement effectively moves the goal posts of profitability for AEVA much closer since this is in addition to the recent Forterra agreement, as well as the (just announced) European carmaker agreement (which is believed to be Mercedes-Benz). Underneath all of this, AEVA has a pre-existing agreement with Daimler truck. So business seems to be booming, especially with really big name brands…which tends to bring in more brand nanes (and more agreements/contracts/announcements, etc). This often creates more coverage from analysts (often with upside stock upgrades) that I believe will be occurring over the next 3 to 6 months (as professional traders/analysts often research for 2 to 3 months before initiating coverage of a new issue). Anyway, just my opinion , so please do your own due diligence. Disclaimer: I DO trade in this stock from time to time and I may have a position currently