- United States

- /

- Software

- /

- NasdaqGS:APP

AppLovin (NasdaqGS:APP) Welcomes Maynard Webb to Board as Edward Oberwager Steps Down

Reviewed by Simply Wall St

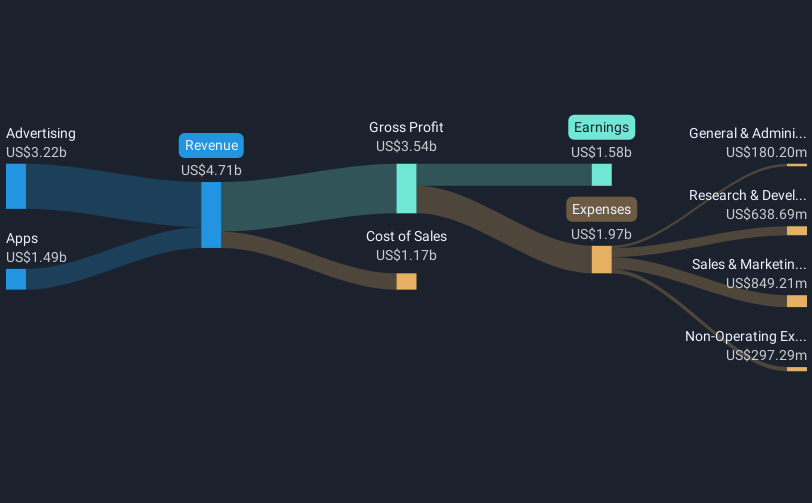

AppLovin (NasdaqGS:APP) experienced a 15% price increase over the last month, amidst significant executive changes and merger discussions. The appointment of Maynard Webb to the board likely bolstered investor confidence in the company's governance. Meanwhile, the announcement of a potential bid for TikTok's non-Chinese assets positioned AppLovin as a contender in the global advertising space. Despite these positive movements, the broader market faced downturns, with the Nasdaq dropping 6% due to factors like tariff uncertainties. The company's advancements offered a counterbalance to the wider market challenges, showcasing resilience amid broader sell-offs in the tech sector.

We've discovered 3 risks for AppLovin that you should be aware of before investing here.

The recent developments at AppLovin, including executive changes and potential mergers, could significantly impact its strategy and operational focus. The introduction of Maynard Webb to the board may enhance investor confidence, suggesting improved governance could facilitate bolder strategic moves. The potential bid for TikTok's assets aligns with AppLovin's goal of expanding its global advertising reach, which may increase revenue and earnings forecasts as the company taps into a broader market.

Over the past three years, AppLovin's total shareholder return, including share price appreciation and dividends, was a very large 429.18%. This long-term performance highlights the company's ability to deliver substantial returns, contrasting with its 344.3% earnings growth over the past year, which also exceeded the US Software industry's 25.4% growth. In the context of a volatile market, AppLovin outperformed its industry with a 1-year return that surpassed the software industry's slight loss.

As analysts have assigned a consensus price target of US$476.03, the current share price of US$235.28 indicates a significant potential increase. If AppLovin successfully integrates its advertising platform with TikTok's non-Chinese assets, this could bolster revenue forecasts and improve earnings. However, the expected price movement also depends on AppLovin maintaining its high earnings growth rate amidst competitive pressures and operational execution.

Learn about AppLovin's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives