- United States

- /

- IT

- /

- NasdaqGS:APLD

Applied Digital (APLD): Assessing Valuation After ETF Launch and Shift to AI Data Centers

Applied Digital (APLD) is making headlines after a flurry of developments that could change how investors view the stock. The spotlight comes from Tradr ETFs rolling out high-profile leveraged funds tracking Applied Digital, giving sophisticated traders new ways to play the company’s moves. At the same time, Applied Digital is doubling down on its pivot away from cryptocurrency mining and is aiming instead for a front-row seat in the rapidly growing market for AI infrastructure and specialized data centers. These events are catching investor attention and signaling a shift that could redefine APLD’s risk and growth profile.

There has already been significant price action as these stories unfold. Applied Digital’s shares surged over 280% in the last year, with momentum accelerating this month as the ETF news and strategy pivot take center stage. Annual revenue is climbing, but mixed signals remain; recent funding rounds and debt issuance show the company is still grappling with negative free cash flow and dilution concerns. Nevertheless, it is clear that the market is reacting to both the potential in AI infrastructure and the risks that come with repositioning a business model.

With the stock up dramatically and new ETF products drawing even more eyes to Applied Digital, a key question remains: is the market accurately pricing in the prospects of this AI pivot, or is there still real value left for investors who get in now?

Most Popular Narrative: 6.6% Undervalued

The prevailing narrative currently views Applied Digital as undervalued, pointing to ambitious expansion within the AI data center sector and robust long-term contracts that support future growth expectations.

"The company has recently secured long-term (15-year) leasing agreements with CoreWeave, a major AI hyperscaler, for its purpose-built AI/HPC data center campus, Polaris Forge 1. This represents a total of $7 billion in contracted revenue and a multi-year, recurring, and predictable revenue stream that directly supports future revenue growth and cash flow stability."

Curious about what powers such a bullish valuation? The headline figure is only the beginning. Discover which future milestones and bold financial projections are included in this calculation. Interested in the quantitative factors that make this price target stand out? The full narrative reveals the numbers that the market is monitoring closely and the assumptions analysts are focusing on.

Result: Fair Value of $20.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing reliance on crypto clients and heavy debt burdens remain key risks that could challenge the bullish outlook for Applied Digital.

Find out about the key risks to this Applied Digital narrative.Another View: Are Shares Still a Bargain?

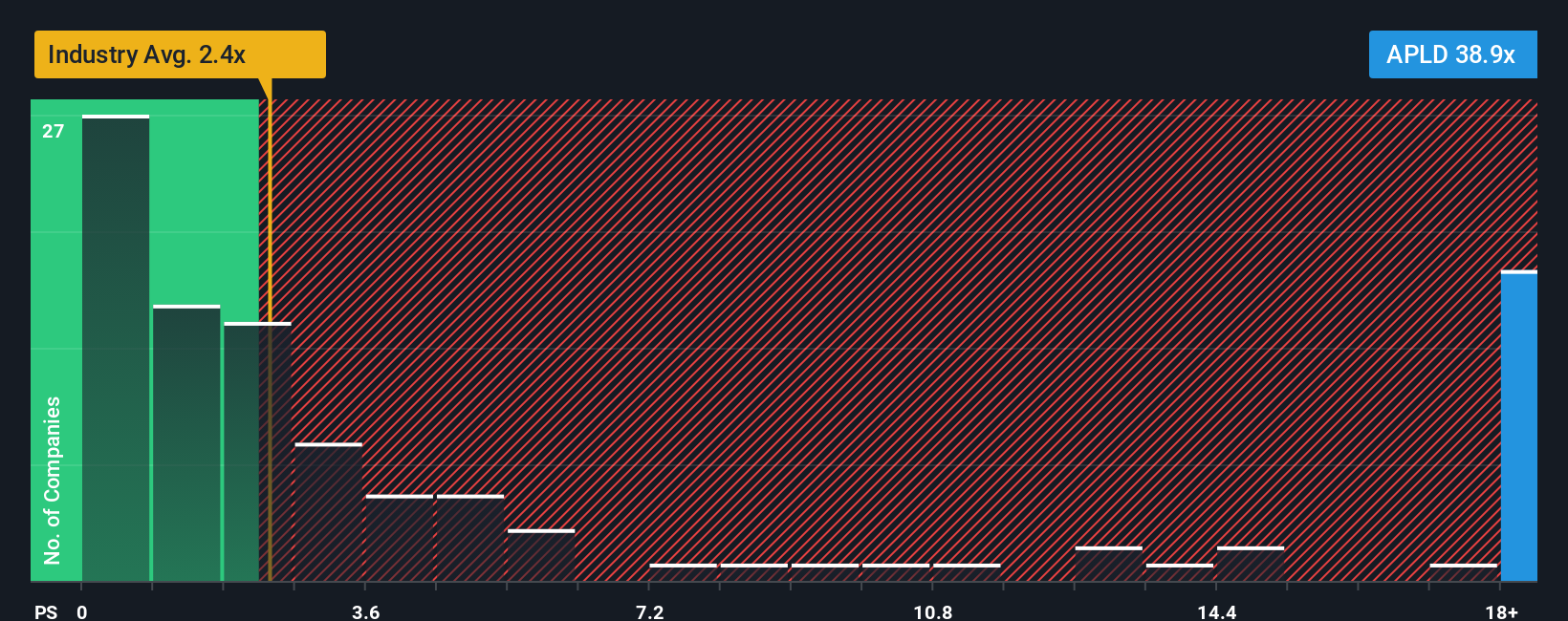

While analyst forecasts suggest there is value if future growth targets are met, examining the stock’s price-to-sales ratio compared to the broader industry presents a less optimistic perspective. Could the high valuation indicate that investors are overly optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Digital Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you can generate your own unique view in just minutes. Do it your way.

A great starting point for your Applied Digital research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Ready to power up your portfolio? Don’t let game-changing opportunities pass you by. Our hand-picked tools will help you uncover stocks that others are missing.

- Accelerate your search for high-potential, undiscovered companies by tapping into penny stocks with strong financials. These companies are leading the financial transformation.

- Spot the next wave in artificial intelligence by targeting AI penny stocks. These stocks are positioned at the forefront of tomorrow’s breakthroughs.

- Secure steady returns with confidence by checking out dividend stocks with yields > 3%. This tool highlights stocks for reliable income and strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APLD

Applied Digital

Designs, develops, and operates digital infrastructure solutions to high-performance computing (HPC) and artificial intelligence industries in North America.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Salesforce's Market Dominance and AI Pivot Will Drive Earnings Re-acceleration

IREN's Trump Card: How Federal Policy Could Unlock Massive Value in AI Infrastructure

ESPN’s NFL Power Play: How Disney’s Sports Engine Could Drive the Next Leg of Stock Growth

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion