Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for Agora (NASDAQ:API) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Agora

How Long Is Agora's Cash Runway?

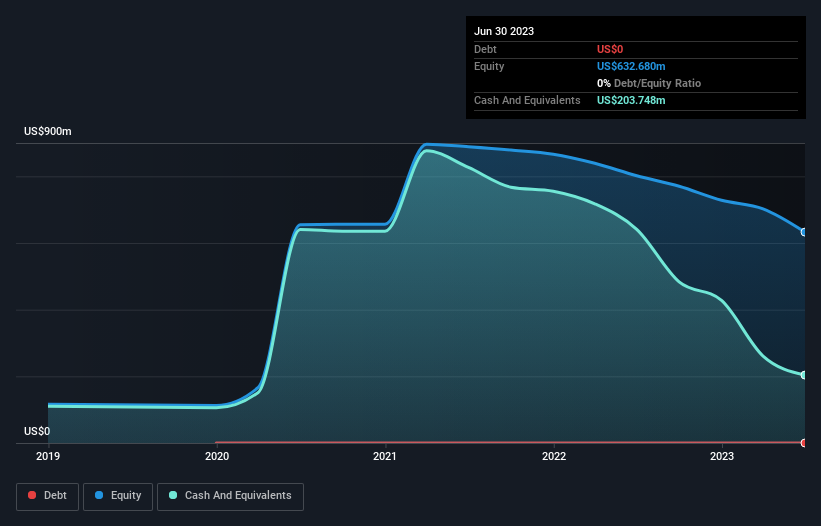

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In June 2023, Agora had US$204m in cash, and was debt-free. Looking at the last year, the company burnt through US$175m. That means it had a cash runway of around 14 months as of June 2023. Importantly, analysts think that Agora will reach cashflow breakeven in around 16 months. So there's a very good chance it won't need more cash, when you consider the burn rate will be reducing in that period. You can see how its cash balance has changed over time in the image below.

How Well Is Agora Growing?

Agora boosted investment sharply in the last year, with cash burn ramping by 98%. While that's concerning on it's own, the fact that operating revenue was actually down 7.5% over the same period makes us positively tremulous. Considering both these metrics, we're a little concerned about how the company is developing. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Agora To Raise More Cash For Growth?

Agora revenue is declining and its cash burn is increasing, so many may be considering its need to raise more cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of US$314m, Agora's US$175m in cash burn equates to about 56% of its market value. From this perspective, it seems that the company spent a huge amount relative to its market value, and we'd be very wary of a painful capital raising.

So, Should We Worry About Agora's Cash Burn?

On this analysis of Agora's cash burn, we think its cash runway was reassuring, while its cash burn relative to its market cap has us a bit worried. It's clearly very positive to see that analysts are forecasting the company will break even fairly soon. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. Taking an in-depth view of risks, we've identified 1 warning sign for Agora that you should be aware of before investing.

Of course Agora may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:API

Agora

Through its subsidiaries, engages in the operation of a real-time engagement platform-as-a-service in the United States, the People’s Republic of China, and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026