- United States

- /

- Software

- /

- NasdaqGS:API

Improved Revenues Required Before Agora, Inc. (NASDAQ:API) Stock's 35% Jump Looks Justified

The Agora, Inc. (NASDAQ:API) share price has done very well over the last month, posting an excellent gain of 35%. The last month tops off a massive increase of 124% in the last year.

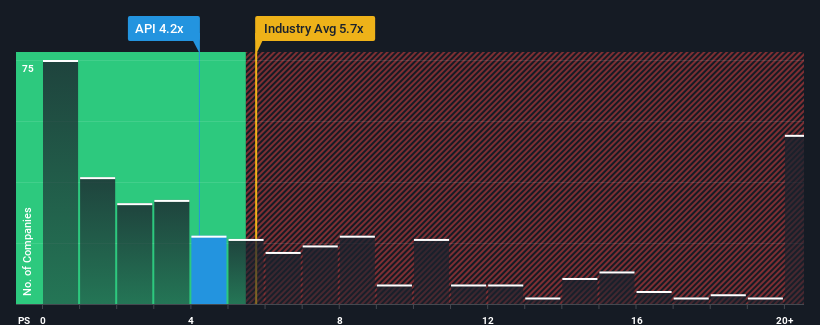

Even after such a large jump in price, Agora may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 4.2x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 5.7x and even P/S higher than 12x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Agora

How Agora Has Been Performing

While the industry has experienced revenue growth lately, Agora's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Agora's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Agora's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.4%. As a result, revenue from three years ago have also fallen 16% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 10% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 20% per annum, which is noticeably more attractive.

In light of this, it's understandable that Agora's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Agora's P/S

Despite Agora's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Agora's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Agora (1 can't be ignored!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:API

Agora

Through its subsidiaries, engages in the operation of a real-time engagement platform-as-a-service in the United States, the People’s Republic of China, and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Inotiv NAMs Test Center

Credo Technology Group (CRDO): High-Speed Growth Meets Margin Compression in 2026.

MongoDB Inc. (MDB): The Data Platform Pivot – Navigating the FY2027 Outlook in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks