- United States

- /

- Pharma

- /

- NasdaqGS:AVIR

Discovering Opportunities: Penny Stocks To Consider In October 2025

Reviewed by Simply Wall St

As the major U.S. stock indices recently reached new highs, only to retreat slightly, investors are keenly observing market dynamics and seeking opportunities that align with current economic conditions. Among these opportunities are penny stocks, a term that may seem outdated but continues to hold significance for those looking beyond well-known names. These stocks often represent smaller or newer companies and can offer a blend of affordability and growth potential when supported by robust financials. In this article, we will explore three penny stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.95 | $420.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.92 | $698.01M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.14 | $196.67M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.98 | $56.61M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.89 | $23.5M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.48 | $601.5M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.955 | $6.97M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.82 | $86.55M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.43 | $10.18M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 365 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

KORU Medical Systems (KRMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: KORU Medical Systems, Inc. develops, manufactures, and commercializes subcutaneous infusion solutions for the drug delivery market both in the United States and internationally, with a market cap of $181.70 million.

Operations: The company generates revenue of $36.85 million from its Surgical & Medical Equipment segment.

Market Cap: $181.7M

KORU Medical Systems, with a market cap of US$181.70 million, has shown revenue growth in its Surgical & Medical Equipment segment, reporting US$19.83 million for the first half of 2025. Despite being unprofitable and experiencing increased losses over five years, it remains debt-free with strong short-term asset coverage over liabilities. Recent developments include an agreement with ForCast Orthopedics to use KORU's FreedomEDGE® infusion system in a new treatment platform for joint infections, alongside inclusion in the S&P Global BMI Index. The company raised its 2025 revenue guidance to US$39.5-40.5 million amidst stable weekly volatility and experienced management and board teams.

- Navigate through the intricacies of KORU Medical Systems with our comprehensive balance sheet health report here.

- Understand KORU Medical Systems' earnings outlook by examining our growth report.

Agora (API)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Agora, Inc. operates a real-time engagement platform-as-a-service across the United States, China, and globally, with a market cap of approximately $350.20 million.

Operations: The company generates $133.55 million in revenue from its Internet Telephone segment.

Market Cap: $350.2M

Agora, Inc., with a market cap of US$350.20 million, is navigating the penny stock landscape by leveraging its real-time engagement platform. Recent advancements include expanded support for OpenAI's Realtime API, enhancing Agora’s Conversational AI Engine capabilities. Despite being unprofitable, Agora has shown improved financials with a net income of US$1.46 million in Q2 2025 compared to a loss previously and maintains more cash than debt. The company completed significant share buybacks and filed for a US$135.32 million shelf registration, indicating strategic financial maneuvers amidst leadership changes and ongoing product innovation efforts.

- Click here to discover the nuances of Agora with our detailed analytical financial health report.

- Gain insights into Agora's outlook and expected performance with our report on the company's earnings estimates.

Atea Pharmaceuticals (AVIR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atea Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company focused on discovering, developing, and commercializing oral antiviral therapeutics for serious viral infections, with a market cap of $235.69 million.

Operations: Atea Pharmaceuticals, Inc. does not have reported revenue segments as it is currently a clinical-stage company focusing on the development of oral antiviral therapeutics.

Market Cap: $235.69M

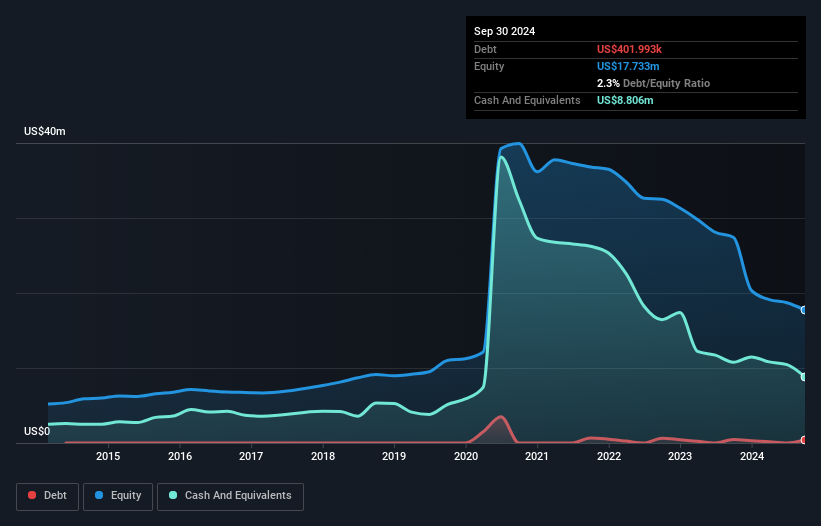

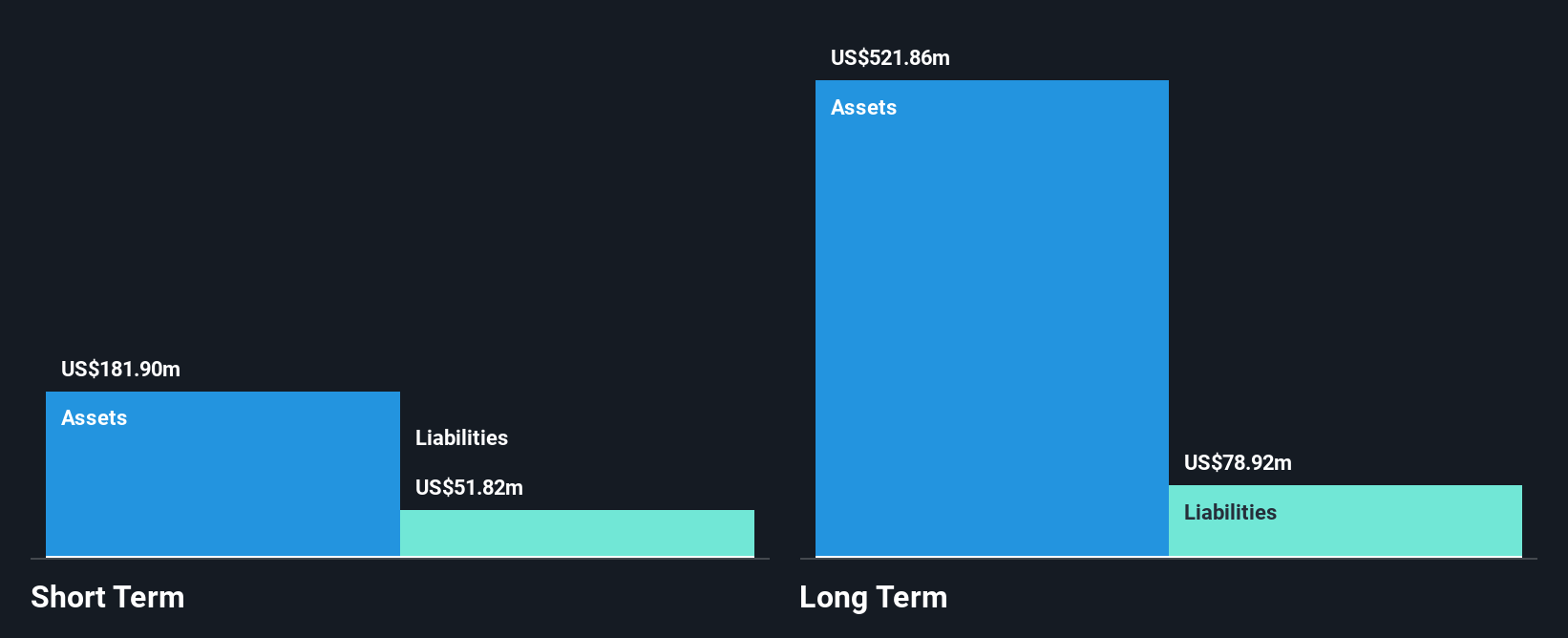

Atea Pharmaceuticals, Inc., with a market cap of US$235.69 million, remains pre-revenue as it focuses on developing oral antiviral therapeutics. The company recently reported a reduced net loss of US$37.16 million for Q2 2025 compared to the previous year and completed a share buyback program worth US$13.9 million, reflecting strategic capital management. Despite being unprofitable and not expected to achieve profitability in the near term, Atea has no debt and maintains sufficient cash runway for over three years based on current free cash flow levels, supported by its experienced management team and board of directors.

- Dive into the specifics of Atea Pharmaceuticals here with our thorough balance sheet health report.

- Gain insights into Atea Pharmaceuticals' future direction by reviewing our growth report.

Next Steps

- Click here to access our complete index of 365 US Penny Stocks.

- Want To Explore Some Alternatives? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVIR

Atea Pharmaceuticals

A clinical-stage biopharmaceutical company, discovers, develops, and commercializes oral antiviral therapeutics for patients with serious viral infections.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion