David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Altair Engineering Inc. (NASDAQ:ALTR) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Altair Engineering

What Is Altair Engineering's Net Debt?

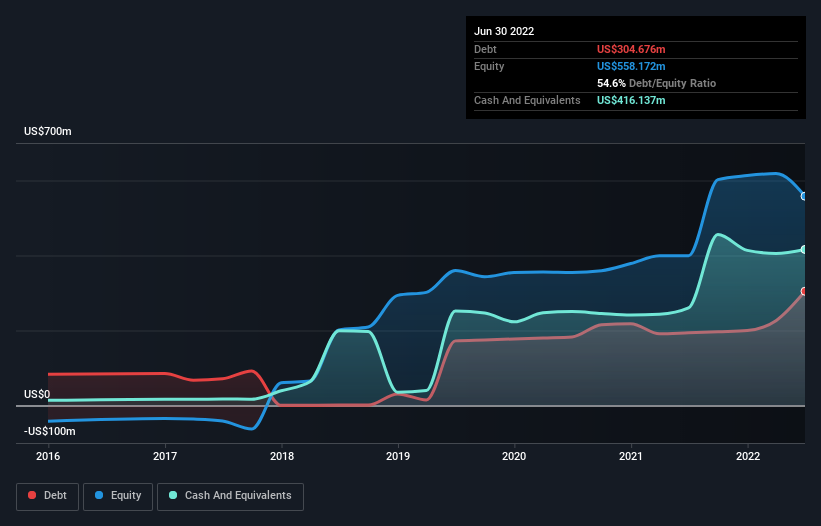

The image below, which you can click on for greater detail, shows that at June 2022 Altair Engineering had debt of US$304.7m, up from US$193.9m in one year. However, it does have US$416.1m in cash offsetting this, leading to net cash of US$111.5m.

A Look At Altair Engineering's Liabilities

We can see from the most recent balance sheet that Altair Engineering had liabilities of US$187.1m falling due within a year, and liabilities of US$383.3m due beyond that. On the other hand, it had cash of US$416.1m and US$114.9m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$39.3m.

Having regard to Altair Engineering's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the US$4.63b company is struggling for cash, we still think it's worth monitoring its balance sheet. Despite its noteworthy liabilities, Altair Engineering boasts net cash, so it's fair to say it does not have a heavy debt load!

We note that Altair Engineering grew its EBIT by 21% in the last year, and that should make it easier to pay down debt, going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Altair Engineering's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Altair Engineering may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Altair Engineering actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing Up

We could understand if investors are concerned about Altair Engineering's liabilities, but we can be reassured by the fact it has has net cash of US$111.5m. The cherry on top was that in converted 227% of that EBIT to free cash flow, bringing in US$19m. So is Altair Engineering's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Altair Engineering is showing 3 warning signs in our investment analysis , you should know about...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ALTR

Altair Engineering

Provides software and cloud solutions in the areas of simulation, high-performance computing, data analytics, and artificial intelligence in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion