- United States

- /

- Software

- /

- NasdaqGS:ALLT

Allot (NASDAQ:ALLT) Shareholders Have Enjoyed An Impressive 199% Share Price Gain

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on a lighter note, a good company can see its share price rise well over 100%. For instance, the price of Allot Ltd. (NASDAQ:ALLT) stock is up an impressive 199% over the last five years. It's also good to see the share price up 34% over the last quarter. But this could be related to the strong market, which is up 16% in the last three months.

View our latest analysis for Allot

Allot isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

For the last half decade, Allot can boast revenue growth at a rate of 5.0% per year. Put simply, that growth rate fails to impress. In comparison, the share price rise of 24% per year over the last half a decade is pretty impressive. Shareholders should be pretty happy with that, although interested investors might want to examine the financial data more closely to see if the gains are really justified. It may be that the market is pretty optimistic about Allot.

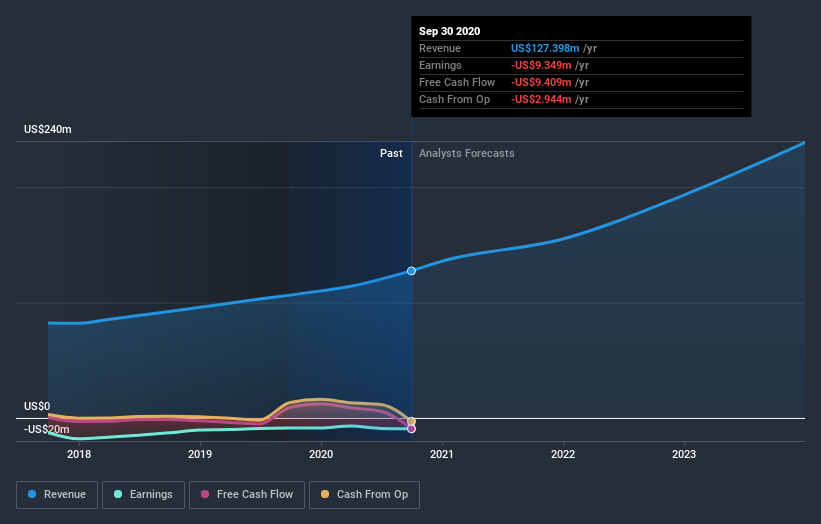

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for Allot in this interactive graph of future profit estimates.

A Different Perspective

Allot shareholders gained a total return of 11% during the year. But that was short of the market average. On the bright side, the longer term returns (running at about 24% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. It's always interesting to track share price performance over the longer term. But to understand Allot better, we need to consider many other factors. Take risks, for example - Allot has 2 warning signs we think you should be aware of.

But note: Allot may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Allot, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:ALLT

Allot

Engages in developing, selling, and marketing security solutions and network intelligence solutions for mobile, fixed, and cloud service providers, as well as enterprises worldwide.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives