- United States

- /

- Software

- /

- NasdaqGS:ALKT

Will Integrating MANTL and HubSpot Reshape Alkami Technology’s (ALKT) Competitive Edge in Digital Banking?

Reviewed by Simply Wall St

- In July 2025, Alkami Technology reported its second-quarter earnings, revealing US$112.06 million in sales and a net loss of US$13.59 million, alongside updated guidance projecting third-quarter GAAP revenue of US$112.5 million to US$114 million.

- The company's progress included leveraging early benefits from the MANTL acquisition and introducing a key integration with HubSpot, both aimed at expanding cross-sell opportunities and enhancing personalized offerings for financial institutions.

- We'll explore how Alkami's accelerating sales growth and deeper integration of MANTL solutions may revise the company's investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Alkami Technology Investment Narrative Recap

To be a shareholder in Alkami Technology, one must believe in the company’s ability to integrate acquisitions like MANTL to capitalize on cross-sell opportunities within the digital banking sector. The company’s second-quarter results and updated guidance reinforce that accelerating sales growth remains a short-term catalyst, while successful MANTL integration continues to be the central risk; this news does not materially change that balance.

The recent announcement of Alkami’s integration with HubSpot is particularly relevant, as it supports the company’s cross-sell strategy by enabling financial institutions to execute more personalized, data-driven campaigns. This product update may strengthen Alkami’s value proposition as it deepens client engagement, a factor closely linked to the key catalyst of revenue growth through expanded platform capabilities.

But in contrast, investors should be aware that a smooth integration of MANTL remains crucial, as any major delays or execution challenges could…

Read the full narrative on Alkami Technology (it's free!)

Alkami Technology's narrative projects $709.5 million in revenue and $19.9 million in earnings by 2028. This requires 25.9% yearly revenue growth and a $57.1 million increase in earnings from the current level of -$37.2 million.

Uncover how Alkami Technology's forecasts yield a $38.80 fair value, a 74% upside to its current price.

Exploring Other Perspectives

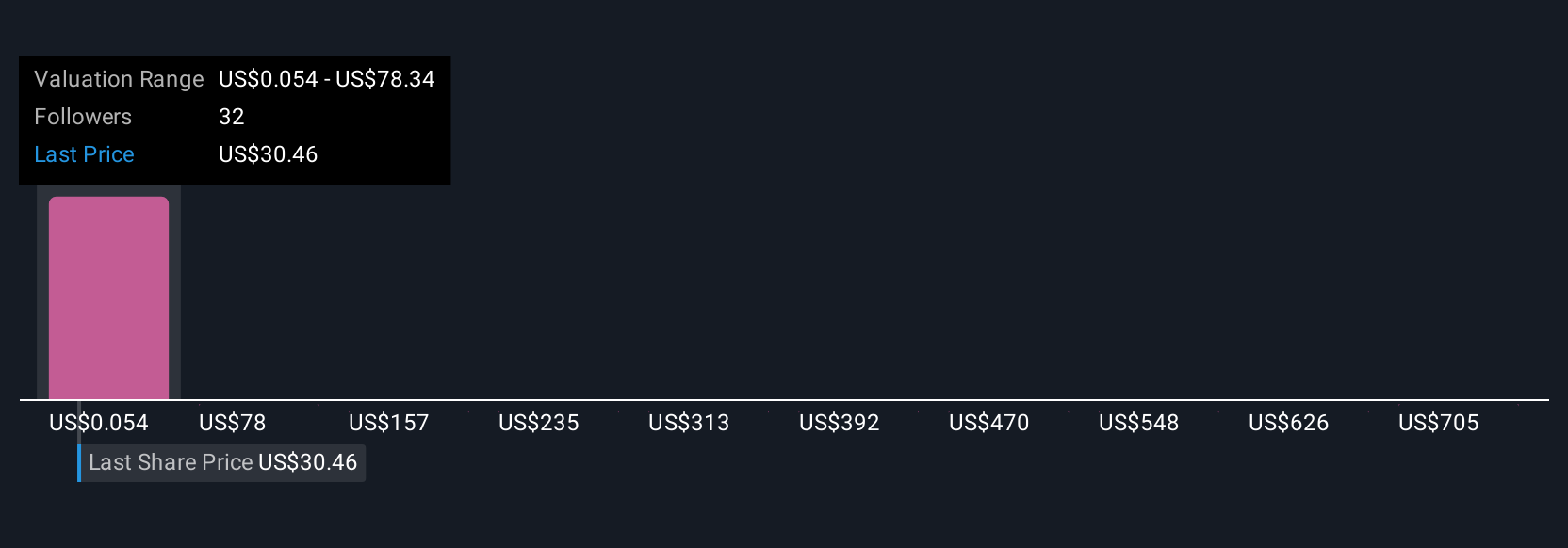

Eight members of the Simply Wall St Community estimate Alkami’s fair value ranging from US$0.05 to US$122.14 per share. That diversity of opinion makes it worth considering how execution risks in cross-selling and integration could shape future outcomes.

Explore 8 other fair value estimates on Alkami Technology - why the stock might be worth over 5x more than the current price!

Build Your Own Alkami Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alkami Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alkami Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alkami Technology's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALKT

Alkami Technology

Provides cloud-based digital banking solutions in the United States.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026