- United States

- /

- Biotech

- /

- NasdaqGS:NBIX

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

Amidst a backdrop of geopolitical tensions and fluctuating oil prices, U.S. markets have shown mixed performance, with key indices like the Dow Jones Industrial Average experiencing slight gains while the S&P 500 and Nasdaq Composite faced minor declines. In this environment of economic uncertainty and inflation concerns, high-growth tech stocks in the U.S. market stand out as potential opportunities for investors seeking innovation-driven growth, provided they carefully assess each company's fundamentals and market positioning.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.63% | 66.57% | ★★★★★★ |

| Ardelyx | 21.03% | 60.42% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.36% | 60.93% | ★★★★★★ |

| Blueprint Medicines | 21.12% | 60.77% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.63% | 60.61% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 22.99% | 103.97% | ★★★★★★ |

Click here to see the full list of 227 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

SoundHound AI (SOUN)

Simply Wall St Growth Rating: ★★★★★☆

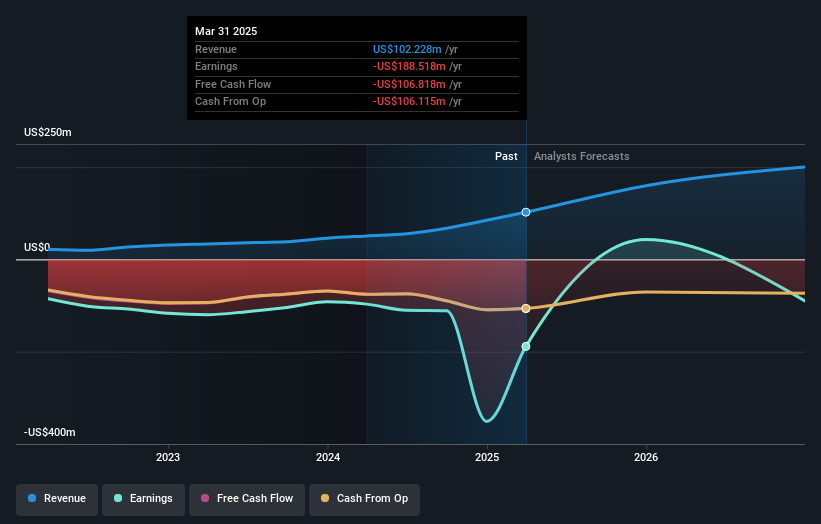

Overview: SoundHound AI, Inc. specializes in creating independent voice AI solutions for businesses in sectors such as automotive, TV, IoT, and customer service across various countries globally, with a market cap of $3.78 billion.

Operations: SoundHound AI, Inc. generates revenue primarily from its Internet Software & Services segment, amounting to $102.23 million. The company focuses on delivering voice AI solutions for industries like automotive and IoT across multiple international markets, including the United States and Japan.

SoundHound AI's strategic expansion into healthcare with its AI agent Alli, alongside a robust partnership with Allina Health, underscores its innovative approach in leveraging conversational AI to enhance patient engagement. This move not only streamlines operations for Allina Health by reducing average call times significantly but also positions SoundHound at the forefront of applying AI solutions in practical, high-impact environments. Additionally, the company's recent financial performance reveals a striking turnaround with Q1 sales jumping to $29.13 million from $11.59 million year-over-year and transforming a net loss into a substantial net income of $129.93 million. This financial rebound is indicative of SoundHound's potential to harness AI technology not just for growth but as a transformative element within various industry sectors.

- Delve into the full analysis health report here for a deeper understanding of SoundHound AI.

Examine SoundHound AI's past performance report to understand how it has performed in the past.

Alkami Technology (ALKT)

Simply Wall St Growth Rating: ★★★★★★

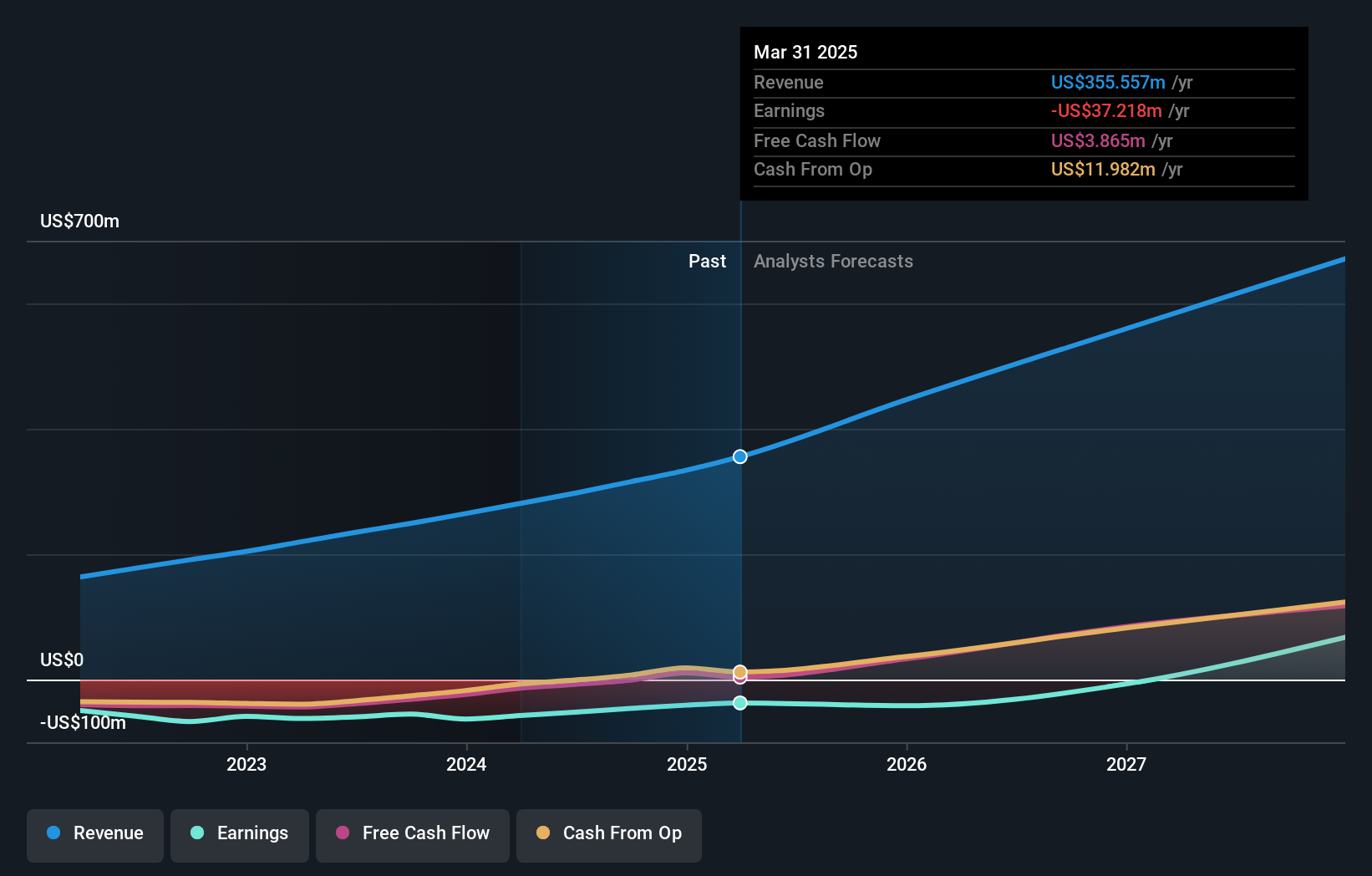

Overview: Alkami Technology, Inc. offers cloud-based digital banking solutions in the United States, with a market capitalization of approximately $2.92 billion.

Operations: Alkami Technology generates revenue primarily from its Internet Software & Services segment, totaling $355.56 million. The company focuses on providing cloud-based digital banking solutions across the U.S., leveraging its expertise in software services to drive growth and innovation within the financial technology sector.

Alkami Technology, Inc. is navigating a transformative path in the tech landscape with its recent product innovations and strategic partnerships aimed at enhancing digital banking experiences. The company's Out-of-the-Box Campaigns, launched to simplify financial marketing processes, are set to bolster client engagement through data-driven strategies. Despite a challenging fiscal environment marked by a net loss of $7.82 million in Q1 2025, Alkami's sales surged to $97.84 million from $76.13 million year-over-year, showcasing robust revenue growth of 20.5%. This growth trajectory is complemented by an anticipated profit surge, with earnings expected to grow by 76.67% annually over the next three years, underpinned by strategic initiatives like the partnership with NuMark Credit Union that leverages Alkami’s platform for superior online and mobile banking solutions.

- Navigate through the intricacies of Alkami Technology with our comprehensive health report here.

Gain insights into Alkami Technology's past trends and performance with our Past report.

Neurocrine Biosciences (NBIX)

Simply Wall St Growth Rating: ★★★★☆☆

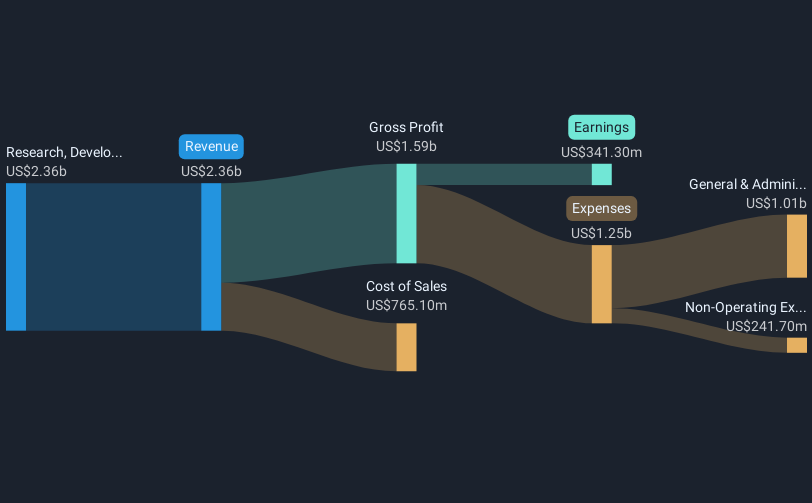

Overview: Neurocrine Biosciences, Inc. is engaged in the discovery, development, and marketing of pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders on a global scale with a market cap of approximately $12.60 billion.

Operations: Neurocrine Biosciences focuses on the research, development, and commercialization of pharmaceuticals, generating revenue of $2.41 billion from these activities.

Neurocrine Biosciences has been actively presenting new findings and expanding its influence in the healthcare sector, particularly with its innovative treatments for neurological conditions. At recent conferences, significant patient-reported improvements were highlighted from their Phase 4 studies of INGREZZA® for tardive dyskinesia, emphasizing enhanced quality of life and functional status among older adults. The appointment of Lewis Choi as CIO underscores a strategic push towards integrating more advanced AI technologies to drive future innovations. With a robust pipeline and strong R&D focus, evidenced by their latest presentations at key medical conferences, Neurocrine is poised to address critical unmet medical needs effectively.

- Get an in-depth perspective on Neurocrine Biosciences' performance by reading our health report here.

Evaluate Neurocrine Biosciences' historical performance by accessing our past performance report.

Make It Happen

- Explore the 227 names from our US High Growth Tech and AI Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Neurocrine Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIX

Neurocrine Biosciences

Neurocrine Biosciences, Inc. discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion