- United States

- /

- Software

- /

- NasdaqGS:ALKT

A Closer Look at Alkami Technology’s Valuation Following New Credit Union Deals and Industry Recognition

Reviewed by Kshitija Bhandaru

Alkami Technology (ALKT) is in the spotlight after announcing new partnerships with Hanscom Federal Credit Union and Red Rocks Credit Union, both adopting its digital banking solutions. Recent industry recognitions support the company's momentum in digital banking innovation.

See our latest analysis for Alkami Technology.

These new credit union partnerships and recent industry accolades have sparked more conversation around Alkami’s long-term growth. However, the 1-year total shareholder return is just below flat at -0.2%. While investor sentiment has perked up on signs of strong product demand, momentum in the share price has not yet followed, suggesting there is still some skepticism or a wait-and-see approach in the market for now.

If you’re tracking shifts in digital banking, it’s worth exploring other standout tech and AI-driven platforms. See the full lineup with our See the full list for free..

With these recent wins and industry accolades, is Alkami’s share price lagging behind its growth potential? Or are investors right to wonder if the company’s future success is already factored in at current valuations?

Most Popular Narrative: 37% Undervalued

With Alkami Technology last closing at $24.12 and the most widely followed narrative assigning a fair value of $38.44, the gap is striking. This narrative is based on expectations of rapid expansion, setting a bold justification for a much higher price than what the market currently reflects.

Growing expectations for advanced, fraud-resistant, omnichannel digital banking experiences are prompting more financial institutions to adopt Alkami's API-driven, cloud-native architecture. This can support secure growth and higher operating leverage. Over time, this trend should improve gross and operating margin profiles.

Ever wondered what kind of growth story produces such a premium? Hint: It is about a leap in both earnings and recurring revenue, all tied to assumptions that would put Alkami in elite company. See which forecasts are steering this narrative into bullish territory.

Result: Fair Value of $38.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, factors such as increasing competition from larger fintechs and possible regulatory shifts could quickly challenge even the most optimistic outlook for Alkami.

Find out about the key risks to this Alkami Technology narrative.

Another View: Are Multiples Telling a Different Story?

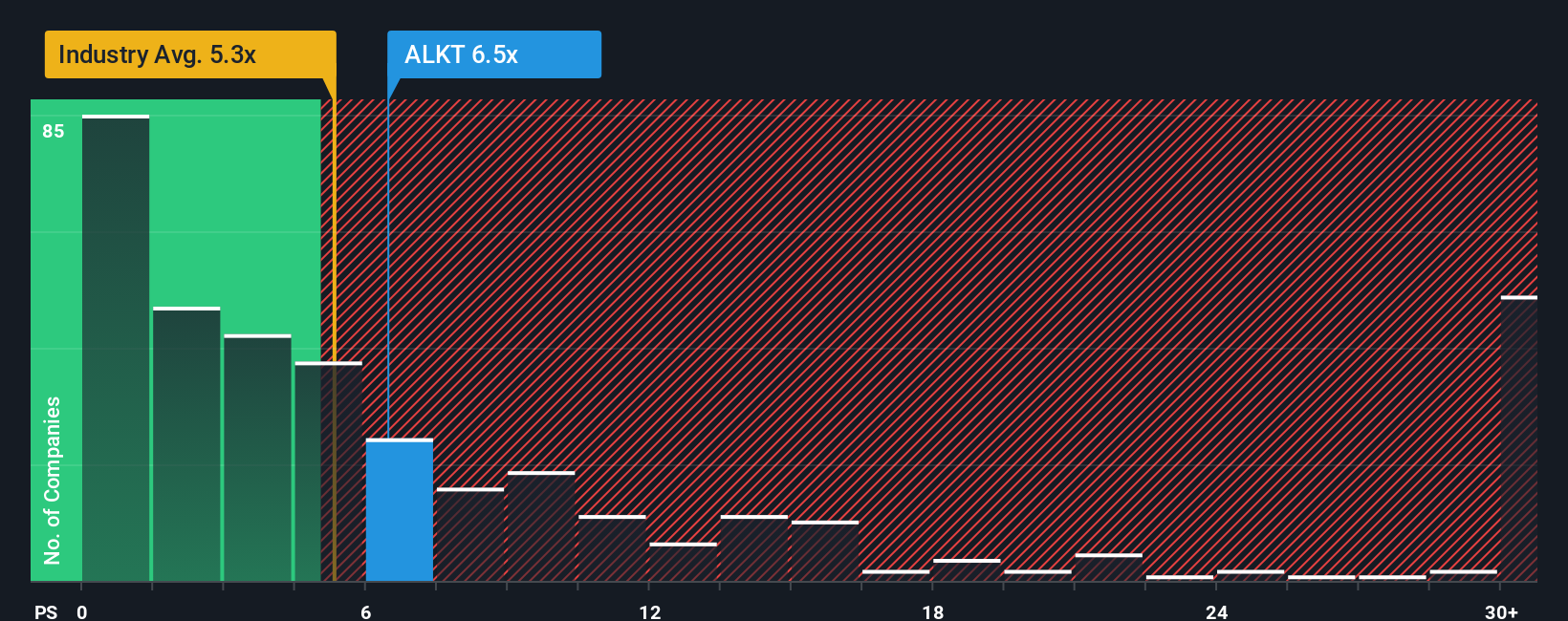

While the analyst consensus and future growth assumptions suggest Alkami’s shares are undervalued, the current price-to-sales ratio (6.5x) actually sits higher than the US Software industry average (5.3x) and the fair ratio of 5.6x. This could hint at downside risk if excitement fades or growth slows. Is the market pricing in more than what is realistic, or is this just the cost of high expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alkami Technology Narrative

If you want to investigate the numbers firsthand or shape your own perspective on Alkami Technology, crafting your own narrative takes just a few minutes. Do it your way.

A great starting point for your Alkami Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your research stop here. Uncover investment gems and stay ahead of the curve using Simply Wall Street’s tailored screeners for fresh insights and smarter portfolio moves.

- Target value by checking out these 909 undervalued stocks based on cash flows with strong cash flows and hidden upside other investors may have missed.

- Capitalize on the AI boom and sharpen your edge by reviewing these 24 AI penny stocks set to benefit from artificial intelligence breakthroughs.

- Lock in reliable payouts by reviewing these 19 dividend stocks with yields > 3% offering attractive yields and robust financials for steady, long-term income.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALKT

Alkami Technology

Provides cloud-based digital banking solutions in the United States.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives