- United States

- /

- Insurance

- /

- NYSE:ASIC

3 Stocks That Could Be Trading At An Estimated 49.9% Discount To Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a downturn with major indices like the Dow Jones Industrial Average dropping significantly, investors are increasingly concerned about AI-related stock valuations and broader economic uncertainties. In such volatile conditions, identifying undervalued stocks that may be trading at a significant discount to their intrinsic value can offer potential opportunities for those looking to navigate these challenging times effectively.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Warrior Met Coal (HCC) | $78.01 | $155.74 | 49.9% |

| TowneBank (TOWN) | $32.02 | $62.85 | 49.1% |

| Northwest Bancshares (NWBI) | $11.37 | $22.10 | 48.6% |

| Horizon Bancorp (HBNC) | $15.65 | $30.82 | 49.2% |

| Hasbro (HAS) | $77.04 | $150.06 | 48.7% |

| GeneDx Holdings (WGS) | $129.55 | $253.46 | 48.9% |

| Eagle Bancorp (EGBN) | $15.80 | $31.12 | 49.2% |

| BeOne Medicines (ONC) | $376.63 | $747.00 | 49.6% |

| BCB Bancorp (BCBP) | $7.45 | $14.77 | 49.5% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $18.68 | $37.29 | 49.9% |

Let's explore several standout options from the results in the screener.

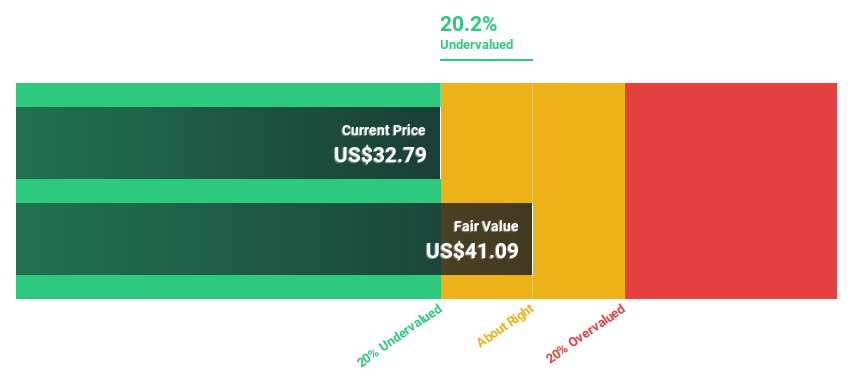

Alkami Technology (ALKT)

Overview: Alkami Technology, Inc. offers cloud-based digital banking solutions in the United States and has a market capitalization of approximately $2.15 billion.

Operations: The company's revenue is primarily generated from its Internet Software & Services segment, totaling $412.50 million.

Estimated Discount To Fair Value: 33.7%

Alkami Technology appears undervalued based on cash flow analysis, trading at US$20.4, below its estimated fair value of US$30.76. Despite recent net losses, revenue growth is strong with a forecasted annual increase of 20.9%, outpacing the market's 10.3%. The company is expected to become profitable within three years and has recently expanded its digital platform offerings with strategic partnerships, enhancing client engagement and operational efficiency for institutions like Jeanne D'Arc Credit Union and Belco Community Credit Union.

- Our expertly prepared growth report on Alkami Technology implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Alkami Technology.

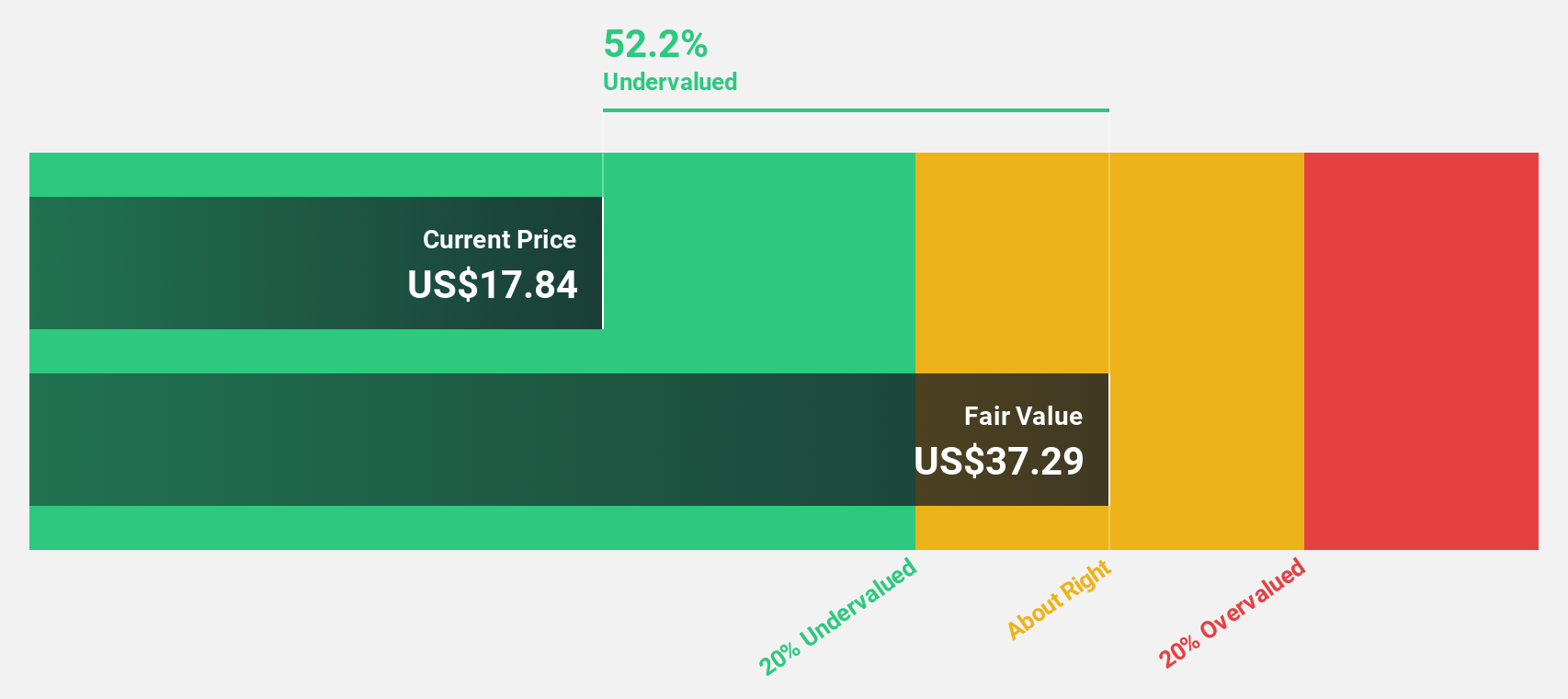

Ategrity Specialty Insurance Company Holdings (ASIC)

Overview: Ategrity Specialty Insurance Company Holdings, with a market cap of $926.73 million, offers excess and surplus lines insurance and reinsurance products to small and medium-sized businesses in the United States through its subsidiaries.

Operations: The company generates revenue of $405.66 million from its insurance business segment.

Estimated Discount To Fair Value: 49.9%

Ategrity Specialty Insurance Company Holdings is trading at US$18.68, well below its estimated fair value of US$37.29, suggesting it may be undervalued based on cash flows. The company reported strong earnings growth with net income rising to US$22.66 million in Q3 2025 from US$12.86 million a year ago and revenue increasing to US$116.1 million from US$88.75 million, driven by innovative underwriting solutions like Ategrity Select for religious organizations which enhance efficiency and reduce costs in the underwriting process.

- The growth report we've compiled suggests that Ategrity Specialty Insurance Company Holdings' future prospects could be on the up.

- Navigate through the intricacies of Ategrity Specialty Insurance Company Holdings with our comprehensive financial health report here.

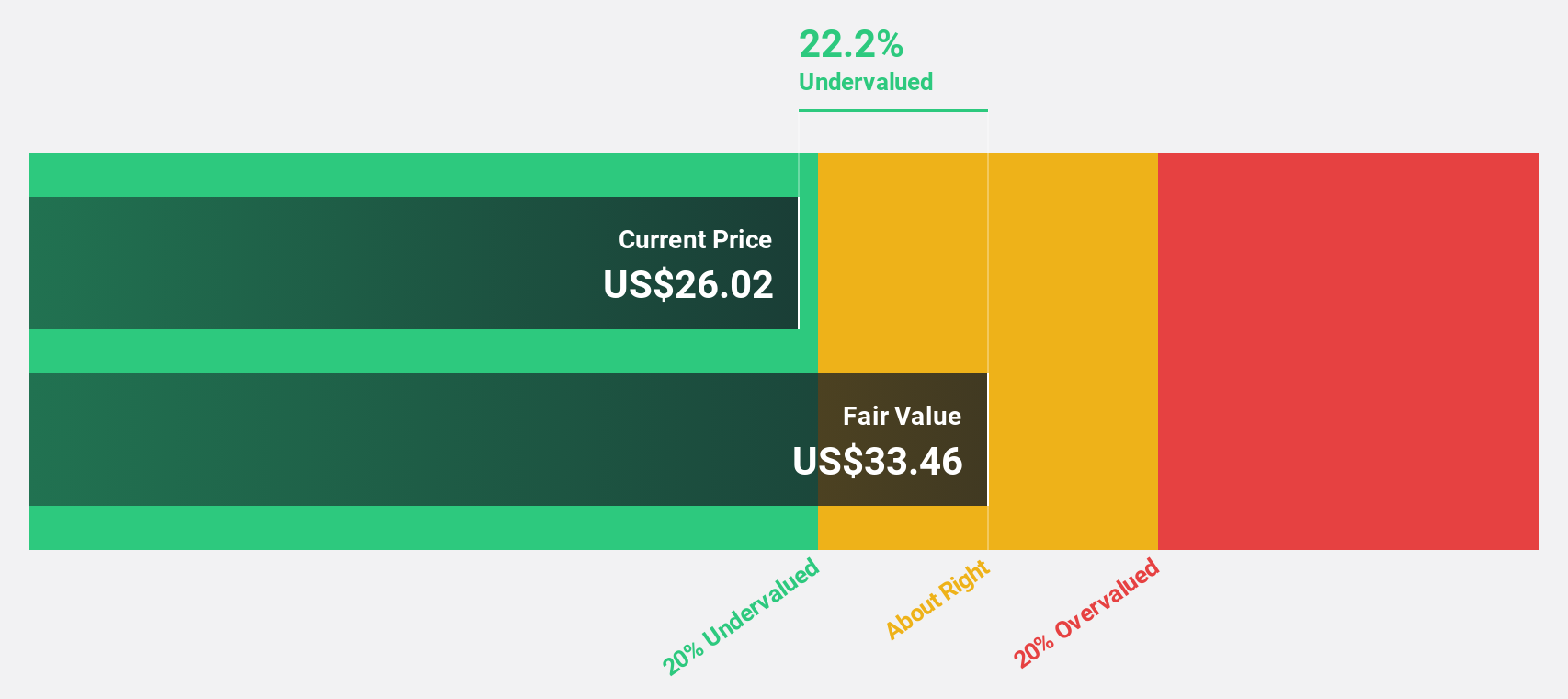

BBB Foods (TBBB)

Overview: BBB Foods Inc. operates a chain of grocery retail stores in Mexico and has a market cap of $3.23 billion.

Operations: The company's revenue primarily comes from the sale, acquisition, and distribution of various products and consumer goods, amounting to MX$67.08 billion.

Estimated Discount To Fair Value: 13.1%

BBB Foods is trading at US$28.4, slightly undervalued compared to its estimated fair value of US$32.67. The company is expected to become profitable within three years, with revenue growth projected at 21.7% annually, outpacing the broader US market's growth rate of 10.4%. Despite this positive outlook, the forecasted return on equity remains modest at 15.1%, which may temper enthusiasm for its valuation based on cash flows alone.

- According our earnings growth report, there's an indication that BBB Foods might be ready to expand.

- Get an in-depth perspective on BBB Foods' balance sheet by reading our health report here.

Taking Advantage

- Gain an insight into the universe of 202 Undervalued US Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASIC

Ategrity Specialty Insurance Company Holdings

Through its subsidiaries, provides excess and surplus lines insurance and reinsurance products to small and medium-sized businesses in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives