- United States

- /

- IT

- /

- NasdaqGS:AKAM

Will Akamai Technologies' (AKAM) Busy Quarter Reveal a Shift in Its Long-Term Growth Priorities?

Reviewed by Simply Wall St

- Akamai Technologies recently announced a new partnership with Aptum, enabling Aptum to offer day 0-2 cloud migration and transformation services for joint Akamai Cloud customers and expanding integrated solutions for technology services distributors and their sub-agents.

- This collaboration, alongside Akamai’s latest quarterly earnings, new financial guidance, a US$598.08 million shelf registration, and completion of a major share buyback tranche, reflects significant activity aimed at strengthening its market position and ongoing capital allocation.

- Next, we’ll explore how Aptum’s partnership to accelerate cloud migration initiatives may impact Akamai’s investment outlook and growth priorities.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Akamai Technologies Investment Narrative Recap

To be a shareholder in Akamai Technologies, you generally need to believe that the company’s ongoing pivot toward cloud infrastructure, security solutions, and edge computing can offset the stagnation and potential decline in its core CDN segment. The latest partnership with Aptum strengthens Akamai’s cloud migration and transformation offerings but is unlikely to materially move the needle for its biggest near-term catalyst, scaling cloud revenue, or resolve the risk of client concentration and earnings volatility just yet.

Of the recent developments, the new financial guidance stands out, with management reiterating an expected full-year revenue of US$4,135 million to US$4,205 million. This aligns with long-term growth catalysts but does not change the inherent risk associated with relying on a handful of large contracts to drive compute and cloud revenue, making delivery on projections dependent on client migration timelines.

By contrast, one issue investors should be keenly aware of is the customer concentration in cloud revenue, since a change in just one large client relationship could...

Read the full narrative on Akamai Technologies (it's free!)

Akamai Technologies' narrative projects $4.9 billion in revenue and $759.9 million in earnings by 2028. This requires 6.1% yearly revenue growth and a $335.3 million increase in earnings from $424.6 million today.

Uncover how Akamai Technologies' forecasts yield a $95.41 fair value, a 25% upside to its current price.

Exploring Other Perspectives

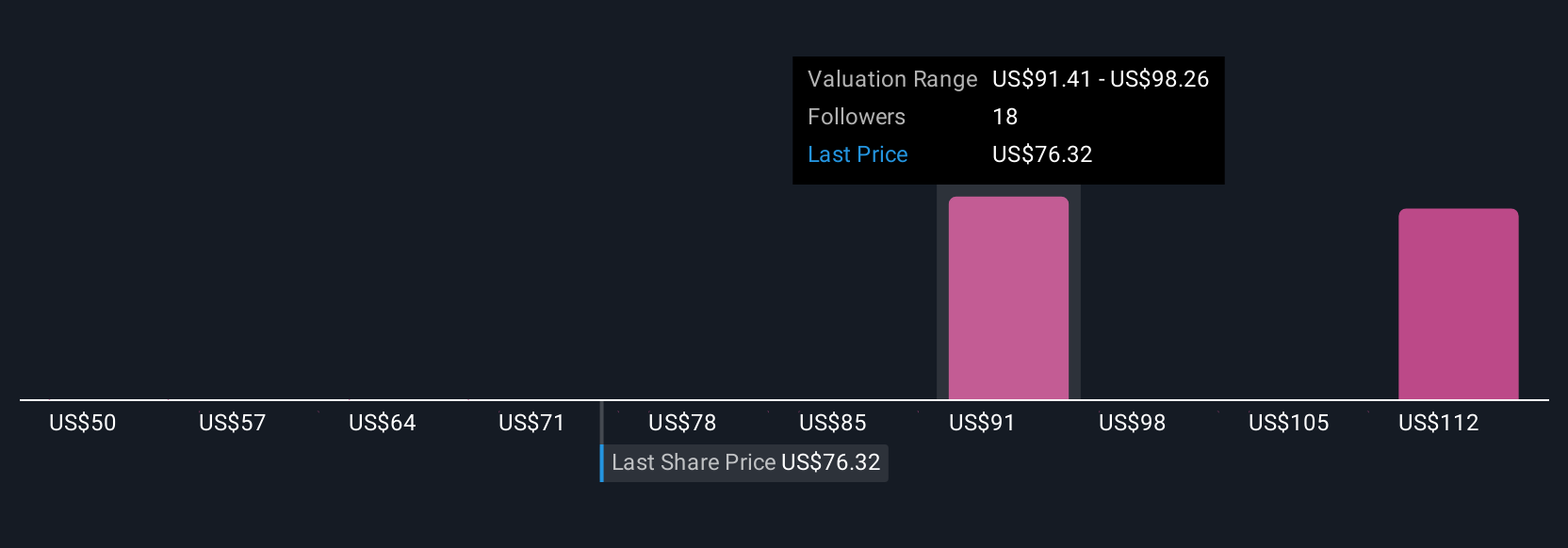

Five individual community members from Simply Wall St have estimated Akamai’s fair value from US$50.32 to US$117.36. With opinions varying widely, investors should note that heavy dependence on a few cloud contracts can increase earnings volatility and prompt sharply different forecasts among market participants.

Explore 5 other fair value estimates on Akamai Technologies - why the stock might be worth as much as 53% more than the current price!

Build Your Own Akamai Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Akamai Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Akamai Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Akamai Technologies' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AKAM

Akamai Technologies

Engages in the provision of security, delivery, and cloud computing solutions in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives