- United States

- /

- IT

- /

- NasdaqGS:AKAM

Can Sustained Customer Loyalty Help Akamai (AKAM) Maintain Its Edge in Cloud Security?

Reviewed by Sasha Jovanovic

- Recently, Akamai Technologies was named a Customers' Choice for the sixth consecutive year in Gartner Peer Insights' 2025 report for Cloud Web Application and API Protection, highlighting strong customer satisfaction and trust in its cloud security products.

- This recognition comes amid robust analyst sentiment, positive earnings guidance, and steady growth in Akamai's security offerings, signaling industry confidence in the company's ability to address evolving cyber threats.

- We'll explore how this continued industry recognition for Akamai's cloud security reshapes the company's investment narrative and growth outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Akamai Technologies Investment Narrative Recap

To be a shareholder in Akamai Technologies, you need to believe that the company’s investments in security and cloud infrastructure will drive sustainable earnings growth, even as its legacy CDN segment faces long-term decline. Recent news, including industry recognition for its cloud security products and new solutions targeting bot abuse, may add credibility to these growth initiatives but does not materially change the core catalyst: successful scaling of newer security and cloud businesses. The most important near-term risk remains Akamai’s dependency on a few large contracts for compute revenue, which could impact reported results if client adoption is delayed. Akamai’s expanded partnership with Apiiro is especially relevant here, bringing together leading-edge security platforms to address growing enterprise concerns around application risk and governance. This collaboration enhances Akamai’s ability to provide comprehensive API and application security, supporting the company’s efforts to accelerate customer adoption of its next-generation offerings, a key factor for offsetting CDN headwinds and driving shareholder value. However, as Akamai leans further into compute and cloud, investors should be mindful of the customer concentration risk in compute revenue...

Read the full narrative on Akamai Technologies (it's free!)

Akamai Technologies' outlook anticipates $4.9 billion in revenue and $765.1 million in earnings by 2028. This implies a 6.1% annual revenue growth and a $340.5 million increase in earnings from the current level of $424.6 million.

Uncover how Akamai Technologies' forecasts yield a $95.20 fair value, a 30% upside to its current price.

Exploring Other Perspectives

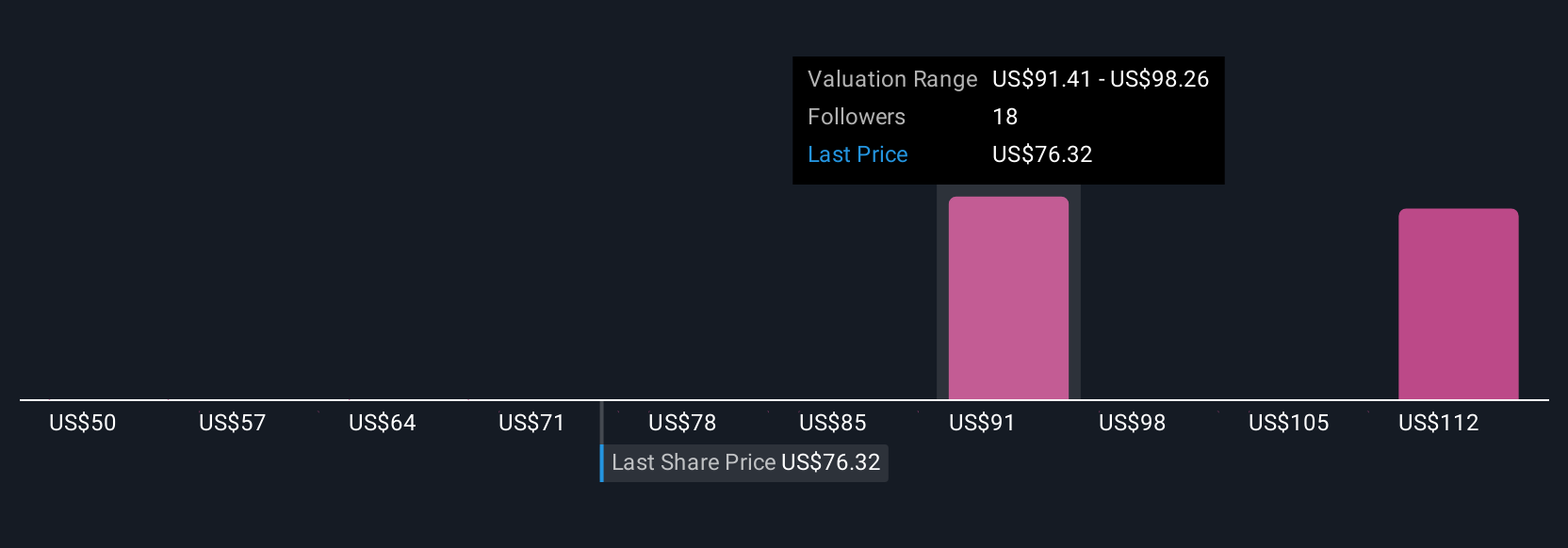

Five members of the Simply Wall St Community estimate Akamai’s fair value to range from US$66 to US$131.64 per share. While growth in cloud and security is a compelling catalyst, the company’s reliance on major contracts for compute revenue could result in uneven performance. These contrasting views are worth considering as you compare the spectrum of individual analysis available.

Explore 5 other fair value estimates on Akamai Technologies - why the stock might be worth 10% less than the current price!

Build Your Own Akamai Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Akamai Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Akamai Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Akamai Technologies' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AKAM

Akamai Technologies

Engages in the provision of security, delivery, and cloud computing solutions in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives