- United States

- /

- Software

- /

- NasdaqGM:AISP

Airship AI Holdings (NasdaqGM:AISP) Sees 41% Price Surge Despite US$57M Net Loss

Reviewed by Simply Wall St

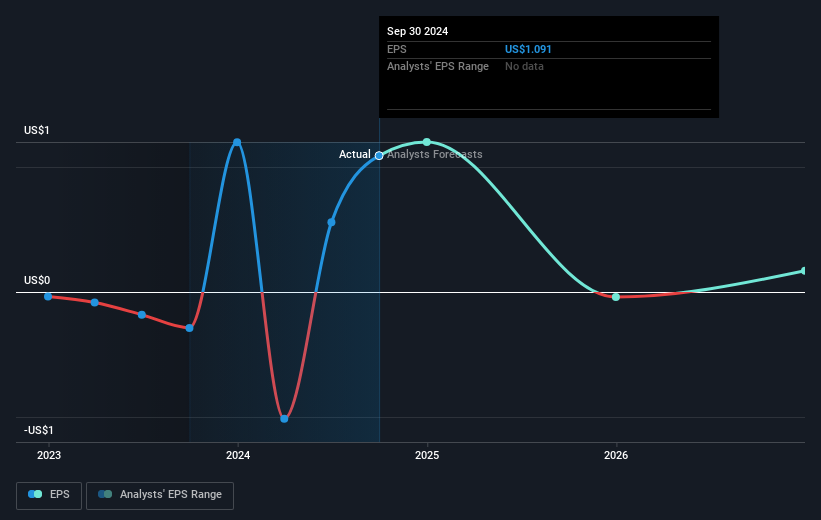

Airship AI Holdings (NasdaqGM:AISP) recently saw a remarkable 41% increase in its stock price over the last quarter, amidst challenging financial results and broader market volatility. Despite reporting a substantial net loss of USD 57 million for 2024, the company experienced notable revenue growth from USD 12.3 million to USD 23.1 million. Contributing positively to investor sentiment, the contract secured with a Fortune 100 client underscored ongoing demand for its technological solutions. While market indexes like the Dow Jones and Nasdaq showed volatility, with the latter dropping 4% in February, Airship AI's share rise stands in contrast, hinting that the new client acquisition might have bolstered investor confidence. Despite the broader market's 1.3% decline over seven days amid economic concerns, the performance underscores a unique investor response, likely fueled by optimism surrounding the latest client engagement and revenue achievements.

Dig deeper into the specifics of Airship AI Holdings here with our thorough analysis report.

Over the past year, Airship AI Holdings achieved a total shareholder return of 156.97%, significantly outperforming the US Software industry’s 4.4% increase. Key drivers of this strong performance include strategic contract acquisitions. Notably, in January 2025, the company secured a maintenance contract with a Fortune 100 customer for its Acropolis platform, highlighting continued demand for its technology solutions. In addition, a Department of Defense contract in August 2024 further bolstered confidence, expanding the platform's government sector presence.

The company's consistent revenue growth plays a crucial role, as demonstrated by its full-year earnings report indicating revenue of US$23.05 million, up from US$12.3 million the previous year. Future optimism was fueled by guidance reports in April and November 2024, forecasting triple-digit revenue growth and positive cash flow, supported by a strong pipeline worth approximately US$130 million. Despite encountering financial losses, these factors provided substantial longer-term support to the company's stock performance.

- Discover whether Airship AI Holdings is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Gain insight into the risks facing Airship AI Holdings and how they might influence its performance—click here to read more.

- Is Airship AI Holdings part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AISP

Airship AI Holdings

Provides artificial intelligence (AI)-driven data management surveillance platforms in the United States.

High growth potential low.

Market Insights

Community Narratives