- United States

- /

- Software

- /

- NasdaqCM:AEYE

3 US Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market experiences a pullback from recent record highs, with Treasury yields on the rise and investors bracing for a wave of earnings reports, attention turns to growth companies that demonstrate resilience through high insider ownership. In this environment, stocks with significant insider stakes can be appealing as they often indicate strong alignment between management and shareholder interests, potentially enhancing long-term value creation.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.6% | 26% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.4% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 33.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 37.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Let's explore several standout options from the results in the screener.

AudioEye (NasdaqCM:AEYE)

Simply Wall St Growth Rating: ★★★★☆☆

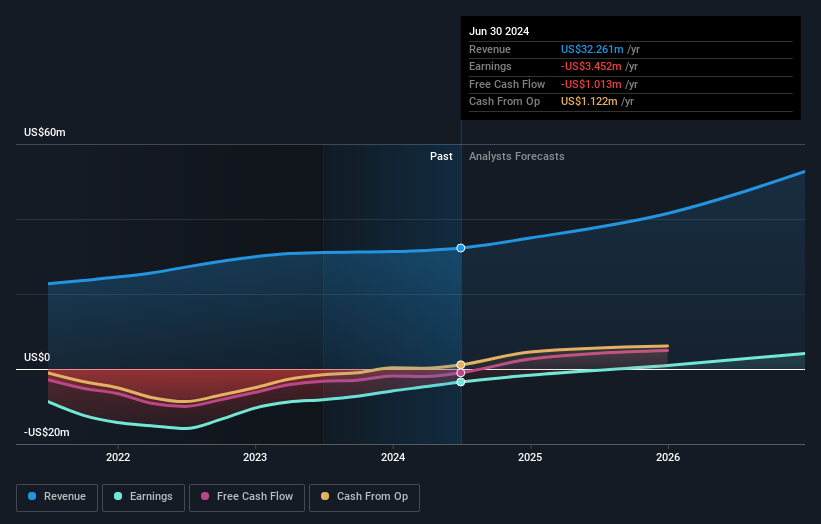

Overview: AudioEye, Inc. offers patented software and services that enable accessible internet content publication and distribution across various devices and locations in the United States, with a market cap of $305.53 million.

Operations: The company generates revenue from its developer of patented voice infrastructure technology segment, amounting to $32.26 million.

Insider Ownership: 20.9%

Earnings Growth Forecast: 115.9% p.a.

AudioEye, Inc. is positioned for growth with a forecasted annual earnings increase of 115.93% and revenue growth expected to surpass the US market average at 18.1% per year. Despite recent share price volatility, AudioEye trades significantly below its estimated fair value, presenting potential opportunities for investors focused on high insider ownership companies. Recent strategic moves include an expanded partnership with CivicPlus and revised financial guidance reflecting increased revenue expectations between US$35.15 million and US$35.25 million for 2024.

- Navigate through the intricacies of AudioEye with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that AudioEye is priced higher than what may be justified by its financials.

Arq (NasdaqGM:ARQ)

Simply Wall St Growth Rating: ★★★★☆☆

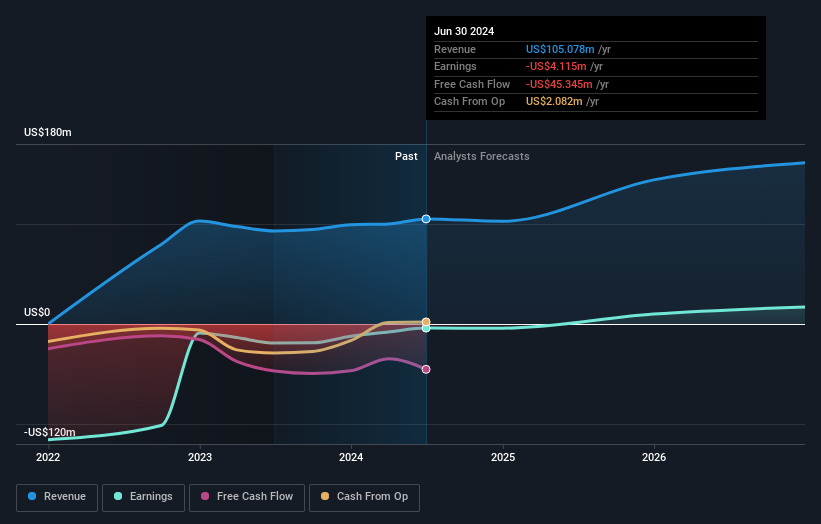

Overview: Arq, Inc. produces activated carbon products in North America and has a market cap of $250.59 million.

Operations: The company's revenue is primarily generated from its Specialty Chemicals segment, amounting to $105.08 million.

Insider Ownership: 18%

Earnings Growth Forecast: 78.5% p.a.

Arq, Inc. demonstrates potential as a growth-focused company with significant insider ownership. Recent developments include its addition to the S&P Global BMI Index and a successful follow-on equity offering raising US$25.04 million. Despite past shareholder dilution, insiders have been actively purchasing shares recently, indicating confidence in future prospects. The company has reduced its net loss significantly year-over-year and is forecasted to achieve profitability within three years, with revenue growth expected to outpace the broader US market at 19.8% annually.

- Delve into the full analysis future growth report here for a deeper understanding of Arq.

- Our valuation report here indicates Arq may be overvalued.

Guild Holdings (NYSE:GHLD)

Simply Wall St Growth Rating: ★★★★☆☆

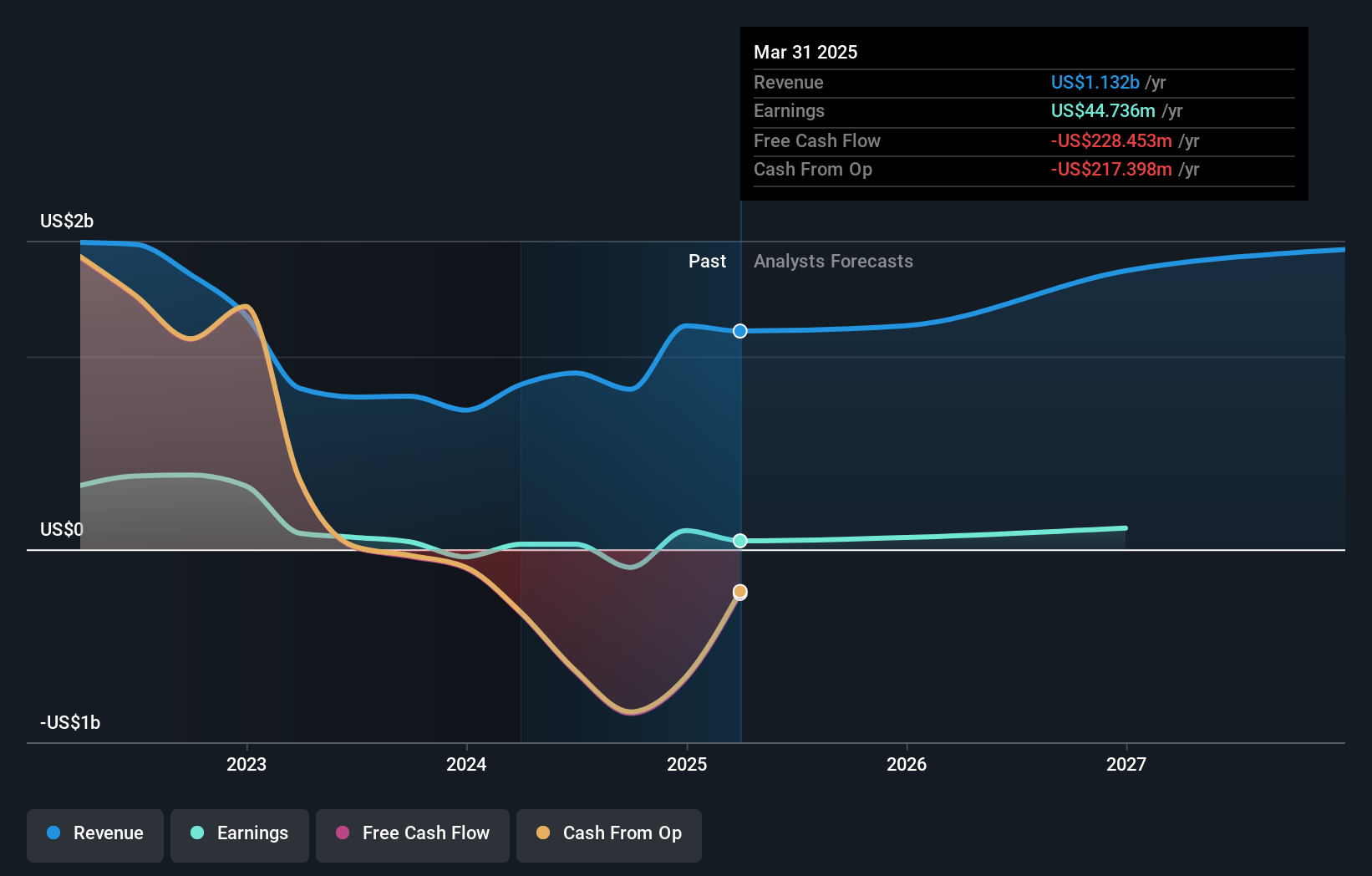

Overview: Guild Holdings Company originates, sells, and services residential mortgage loans in the United States with a market cap of approximately $947.80 million.

Operations: Guild Holdings generates revenue primarily through its origination segment, accounting for $623.64 million, and its servicing segment, contributing $173.23 million in the United States residential mortgage market.

Insider Ownership: 11.5%

Earnings Growth Forecast: 29.9% p.a.

Guild Holdings shows promise with its high insider ownership and forecasted earnings growth of 29.9% annually, surpassing the US market's average. Despite a lower profit margin of 3% compared to last year, recent earnings reports indicate revenue growth to US$285.69 million in Q2 2024 from US$236.81 million a year ago, alongside net income improvement. The introduction of GuildGPT enhances operational efficiency, while share buybacks reflect management's commitment to shareholder value despite interest coverage concerns.

- Click to explore a detailed breakdown of our findings in Guild Holdings' earnings growth report.

- Our valuation report unveils the possibility Guild Holdings' shares may be trading at a premium.

Seize The Opportunity

- Explore the 183 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AEYE

AudioEye

Provides patented, internet content publication, distribution software, and related services to Internet and other media to people regardless of their device, location, or disabilities in the United States.

Reasonable growth potential with adequate balance sheet.