- United States

- /

- Machinery

- /

- NasdaqCM:SCWO

374Water And 2 Other Promising US Penny Stocks To Watch

Reviewed by Simply Wall St

As the U.S. stock market experiences a pullback from record highs, with major indices like the Dow Jones and S&P 500 seeing declines, investors are closely watching economic indicators and corporate earnings reports for signs of future trends. In such a fluctuating environment, penny stocks—often representing smaller or newer companies—can present intriguing opportunities for those willing to look beyond established names. Despite being considered somewhat outdated as a term, these stocks continue to attract attention due to their potential for growth and value.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7987 | $5.8M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $2.95 | $485.02M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.65 | $2.1B | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.42 | $147.91M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.595 | $52.63M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.76 | $114.05M | ★★★★★★ |

| MIND C.T.I (NasdaqGM:MNDO) | $1.88 | $39.56M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.07 | $96.23M | ★★★★★☆ |

Click here to see the full list of 749 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

374Water (NasdaqCM:SCWO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 374Water Inc. operates in the United States, offering technology that converts wet wastes into recoverable resources, with a market cap of $229.62 million.

Operations: The company's revenue segment is entirely derived from the United States, totaling $0.24 million.

Market Cap: $229.62M

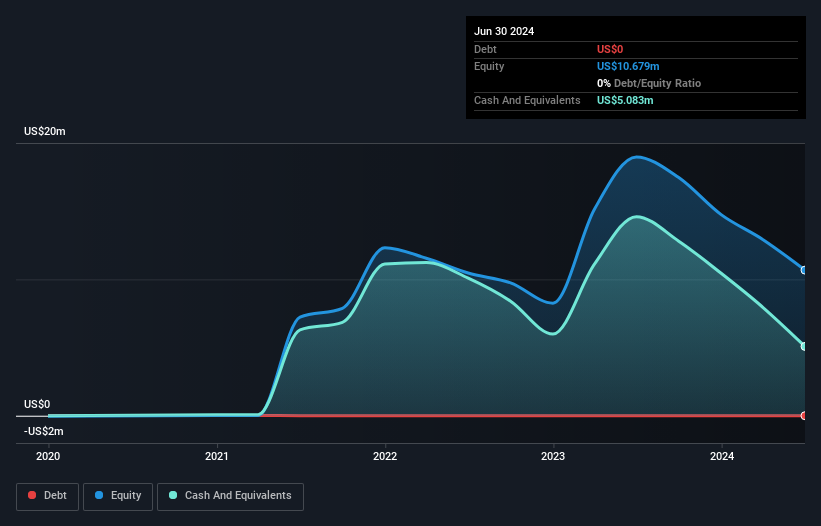

374Water Inc., with a market cap of US$229.62 million, operates in the waste-to-resource technology sector but remains pre-revenue, generating only US$0.24 million annually. The company is debt-free and has short-term assets of US$8.8 million exceeding liabilities, yet it faces a cash runway of less than a year due to negative free cash flow trends. Recent activities include filing for a US$30.73 million shelf registration and appointing Peter Mandel as General Counsel to aid in scaling operations and commercialization efforts amid ongoing losses and revenue decline from previous years.

- Unlock comprehensive insights into our analysis of 374Water stock in this financial health report.

- Gain insights into 374Water's outlook and expected performance with our report on the company's earnings estimates.

Atai Life Sciences (NasdaqGM:ATAI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Atai Life Sciences N.V. is a clinical-stage biopharmaceutical company focused on developing and investing in therapeutics for mental health disorders such as depression, anxiety, and addiction, with a market cap of approximately $214.78 million.

Operations: Atai Life Sciences generates revenue primarily from its business of identifying and advancing innovations in mental health, amounting to $0.38 million.

Market Cap: $214.78M

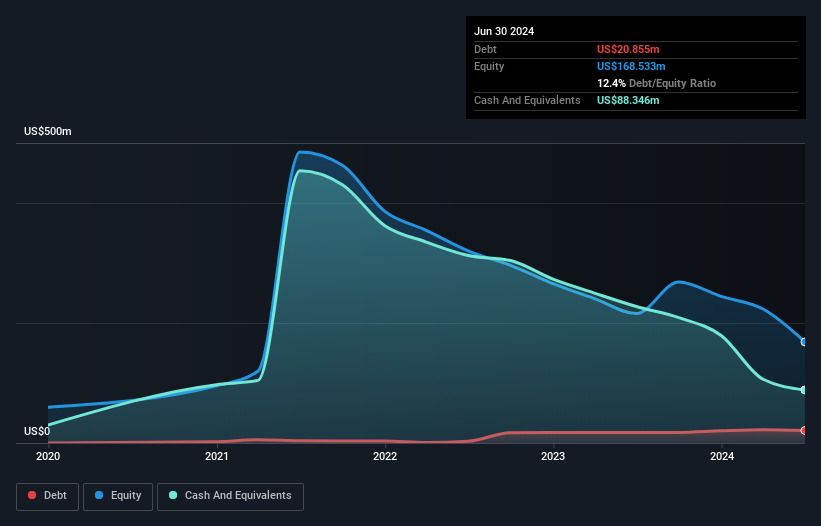

Atai Life Sciences, with a market cap of US$214.78 million, is pre-revenue, generating only US$0.38 million annually. Despite being unprofitable, the company has managed to reduce losses by 14.1% per year over five years and maintains more cash than total debt. Recent positive Phase 1b trial results for its VLS-01 formulation indicate progress in its pipeline targeting mental health disorders. However, with less than a year of cash runway if free cash flow continues to decline at historical rates and no forecasted profitability in the near term, financial sustainability remains a concern amidst ongoing clinical developments and conference presentations.

- Click to explore a detailed breakdown of our findings in Atai Life Sciences' financial health report.

- Examine Atai Life Sciences' earnings growth report to understand how analysts expect it to perform.

Eventbrite (NYSE:EB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Eventbrite, Inc. operates a two-sided marketplace offering self-service ticketing and marketing tools for event creators globally, with a market cap of approximately $286.38 million.

Operations: The company generates revenue primarily through its Internet Software & Services segment, which accounted for $340.11 million.

Market Cap: $286.38M

Eventbrite, Inc., with a market cap of US$286.38 million, has shown signs of financial improvement despite being currently unprofitable. The company reported a net income of US$1.06 million for Q2 2024, marking progress from the previous year's loss. Its short-term assets exceed both short and long-term liabilities, providing some financial stability. Eventbrite's recent management changes and strategic appointments aim to enhance growth and operational efficiency. Additionally, the company has repurchased shares worth US$39.29 million under its buyback program while issuing convertible senior notes to strengthen its financial position further.

- Jump into the full analysis health report here for a deeper understanding of Eventbrite.

- Understand Eventbrite's earnings outlook by examining our growth report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 749 US Penny Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 374Water might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SCWO

374Water

Provides a technology that transforms wet wastes into recoverable resources in the United States.

Flawless balance sheet medium-low.