- United States

- /

- Software

- /

- NasdaqGS:ADSK

Is Now the Right Moment for Autodesk After Its Recent 6% Price Dip?

Reviewed by Bailey Pemberton

If you're eyeing Autodesk and wondering whether it's the right time to make a move, you're in good company. Many investors are pausing to weigh the risk and reward behind this design software giant, especially after watching the stock cool off recently. Over the last week, Autodesk's shares slipped by 3.4%, and the 30-day trend shows a 5.9% dip. That might sound concerning on the surface; however, taking a step back reveals a longer-term narrative that is much more upbeat. Year to date, the stock is up 2.2%, and over the past three years, Autodesk has delivered a remarkable 51.6% gain. Even after factoring in recent fluctuations, that consistent upward momentum suggests some real staying power.

Some of these ups and downs can be traced back to broader market sentiment, especially as technology and software companies have moved in and out of favor depending on economic outlooks and investor appetite for growth. What is interesting about Autodesk specifically is the way its valuation has started to draw more attention. Using common valuation checks, Autodesk gets a score of 2 out of 6; this means it is considered undervalued by two different measures, but not across the board.

So, what do those valuation checks actually mean, and how should you interpret that score? Let's break down the different methods analysts use to decide if Autodesk is really a bargain, or whether the numbers are hiding something deeper. Stay tuned, because by the end, a more holistic approach to valuation will help clarify where this stock really stands.

Autodesk scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Autodesk Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular tool analysts use to estimate the current worth of a company by projecting its future free cash flows and discounting them back to today's dollars. Essentially, it tries to answer what Autodesk is truly worth if you account for all the cash it is expected to generate in years to come.

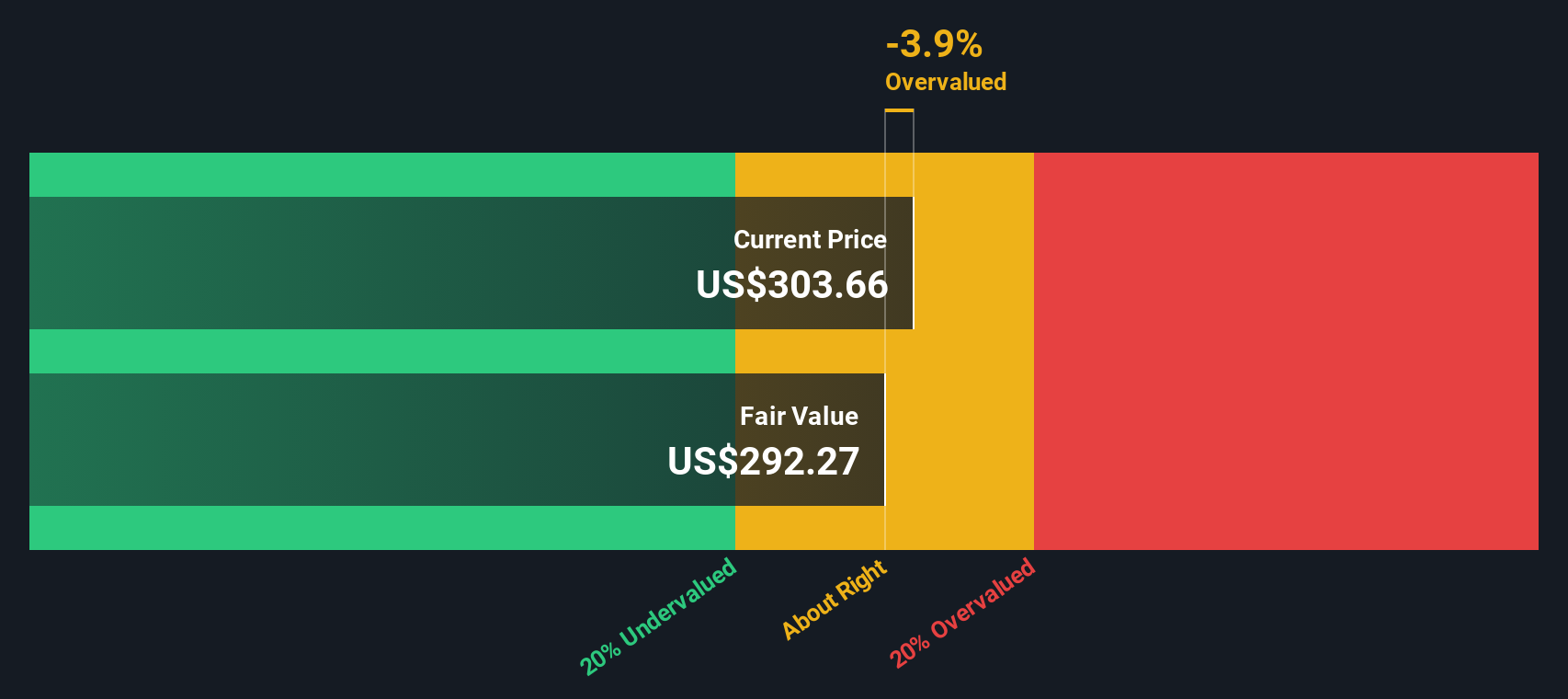

Currently, Autodesk is generating Free Cash Flow (FCF) of $1.85 billion. Based on both analyst estimates and extended projections, this cash flow is expected to grow steadily, reaching roughly $4.76 billion by 2035. The forecasted growth includes both short-term analyst predictions and longer-term extrapolations, providing a comprehensive look ahead. By discounting these future cash flows, the DCF model arrives at an estimated intrinsic value of $292.57 per share.

Comparing this calculation to the present share price, Autodesk appears to be trading at a 2.5% premium. This indicates that the stock is very slightly overvalued using this model. However, since the difference is marginal, the intrinsic value and current price are essentially in line with each other.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Autodesk's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Autodesk Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a popular way to value profitable companies like Autodesk, as it captures how much investors are willing to pay for one dollar of the company's earnings. For companies with strong bottom lines, the PE ratio gives a straightforward benchmark of market expectations for future performance.

However, a “normal” or “fair” PE ratio is not a static number. Higher growth prospects often justify a higher PE, while greater risks or sluggish profits can warrant a discount. Essentially, the PE reflects both how fast a company is expected to grow and how certain that growth appears to be.

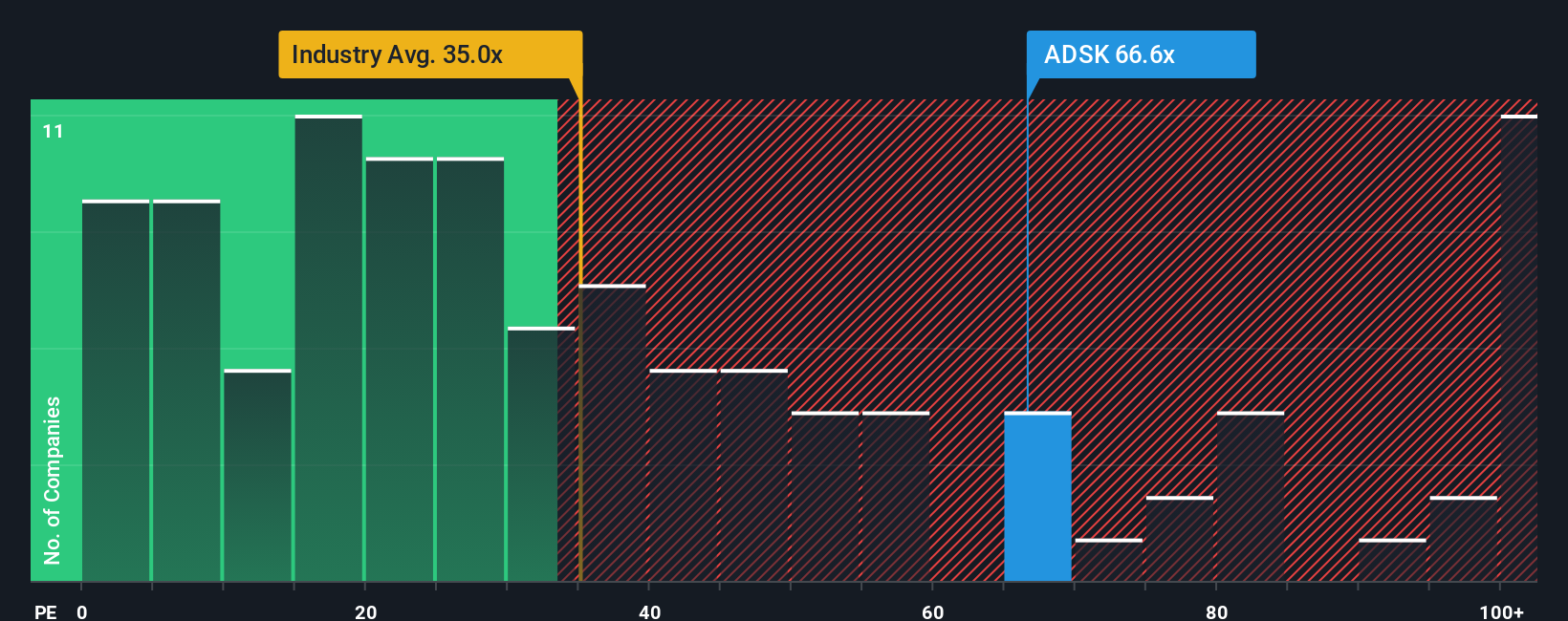

Currently, Autodesk trades at a PE of 61.2x, which is notably higher than the industry average of 35x and even above its peer average of 74.1x. While this might seem expensive at first glance, context matters. This is where Simply Wall St’s "Fair Ratio" comes in. For Autodesk, the Fair Ratio is calculated at 42.5x, taking into account growth outlook, profitability, risks, industry dynamics and even company size.

The Fair Ratio is a step above simple peer or industry comparisons because it adjusts for important variables such as how fast Autodesk is projected to grow its earnings, its risk profile, and profit margins, providing a tailored view of what the company should be worth in today’s market.

Comparing Autodesk’s actual PE (61.2x) to its Fair Ratio (42.5x), the shares are trading at a premium to their intrinsic value based on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Autodesk Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple way for investors to connect a company’s story with their financial forecasts, and then directly link these expectations to a fair value estimate. Instead of just crunching numbers or relying on analyst targets, you can create your own view of how Autodesk’s future will play out by bringing together your assumptions about revenue growth, earnings, and profit margins, and translating all of that into what you think the stock should be worth.

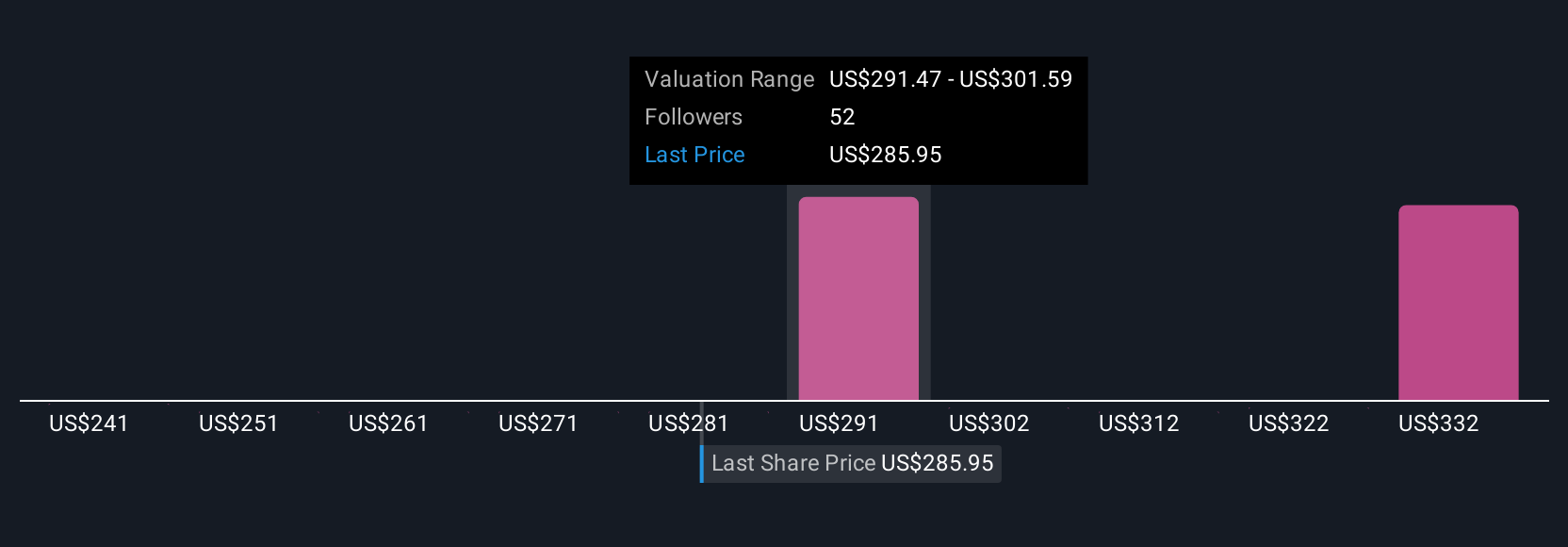

Narratives make this process intuitive and accessible for everyone, not just financial professionals. On Simply Wall St’s Community page, millions of investors can build, share, and update Narratives as new earnings or news arrive, so their investment decisions always reflect the latest information. Narratives help you decide when to buy or sell by continuously comparing your view of fair value to the current price. For example, some investors expect Autodesk to capture new markets and achieve a share price near $430, while others are more cautious, anticipating risks that could see fair value around $271. Your Narrative empowers you to act on your beliefs, not just react to consensus.

Do you think there's more to the story for Autodesk? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADSK

Autodesk

Provides 3D design, engineering, and entertainment technology solutions worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives