- United States

- /

- Software

- /

- NasdaqGS:ADSK

Does Autodesk’s Current Price Reflect Growth After Solid 2024 Performance?

If you have Autodesk stock sitting in your portfolio right now, you might be asking yourself, "Is this the moment to stick with this solid performer, grab more shares, or start searching for opportunity elsewhere?" That's not an easy call, but let's take a moment to break down what the market is telling us and why so many investors are paying close attention.

Over the last week, Autodesk’s stock barely budged, up only 0.2%. The last month was similarly quiet, with a 0.5% gain. Looking beyond the day-to-day, you’ll spot much livelier moves. Since the start of the year, shares have put in a 9.4% climb, and over the last twelve months, Autodesk has rewarded shareholders with a 19.5% return. The longer-term numbers are even more striking, with an increase of 55.9% in the past three years and a hefty 37.0% over five years. Investors have clearly noticed Autodesk’s resilience and potential, reacting to broader trends in digital design, project automation, and efficiency-boosting technologies that drive innovation in industries Autodesk serves.

Now, with a last closing price of $320.91, the big question is value. According to our objective valuation checklist, Autodesk scores a 1 out of 6 for being undervalued, suggesting there is room for debate on whether the current price offers a true bargain. Next, we will dig into what that score means and explore how different valuation approaches stack up against each other, before unveiling a lesser-known, even more insightful way to look at Autodesk’s worth.

Autodesk scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Autodesk Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future free cash flows and discounting them back to today’s value. This approach helps investors assess whether a stock is trading above or below what its long-term fundamentals suggest it is worth.

For Autodesk, the model begins with its latest trailing twelve-month free cash flow, which stands at $1.85 billion. Analysts expect this figure to steadily grow, reaching nearly $3.0 billion by 2028. Because Wall Street usually only forecasts up to five years, cash flows beyond that point are extrapolated based on industry trends and Autodesk's historic performance. The 10-year projection, which incorporates both analyst estimates and continued forecasted growth, shows Autodesk potentially generating close to $4.7 billion by 2035.

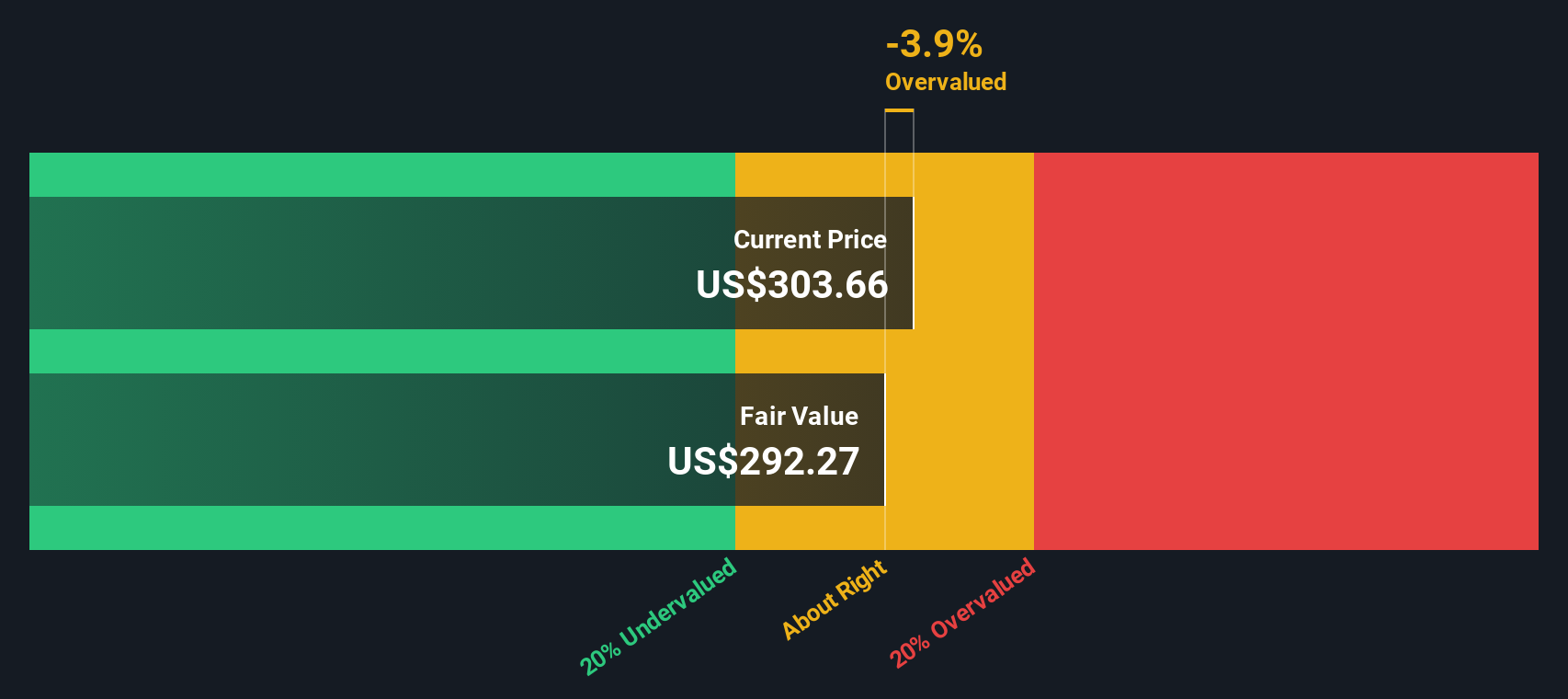

After discounting these future cash flows back to present value, the DCF model arrives at an estimated fair value for Autodesk stock of $288.79 per share. Compared to the current share price of $320.91, this suggests the stock is about 11.1% above its fair value. This means it is currently overvalued according to the DCF approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Autodesk may be overvalued by 11.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Autodesk Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies, since it relates a company’s share price to its earnings and helps investors assess how much they are paying for a dollar of profit. It is most useful for businesses with stable or growing earnings, such as Autodesk, and gives a straightforward comparison against peers and industry standards.

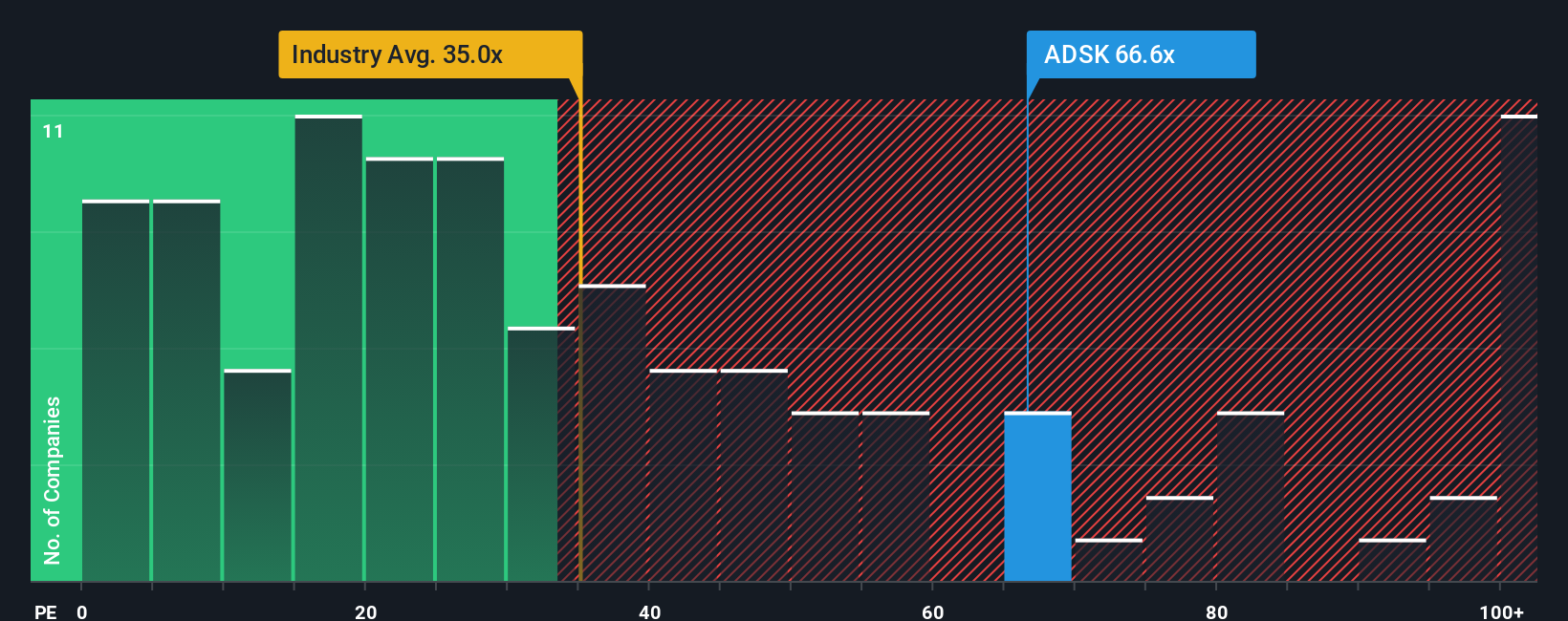

What counts as a “fair” PE ratio depends on a company’s growth outlook and the risks it faces. High growth and strong profitability usually justify a higher PE, while higher risk or slowing growth can pull the benchmark lower. Autodesk’s current PE ratio is 65.5x, sitting well above the Software industry average of 35.6x and even above the peer group average of 77.4x. This signals that the market is pricing in strong future growth.

Simply Wall St’s Fair Ratio for Autodesk is 42.5x. Unlike standard benchmarks, the Fair Ratio factors in more than just the industry snapshot or peer group. It incorporates insights about Autodesk’s projected earnings growth, profit margins, size, and risk profile, resulting in a fairer, company-specific benchmark. With Autodesk’s current PE of 65.5x significantly above its Fair Ratio, the stock appears to be overvalued using this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Autodesk Narrative

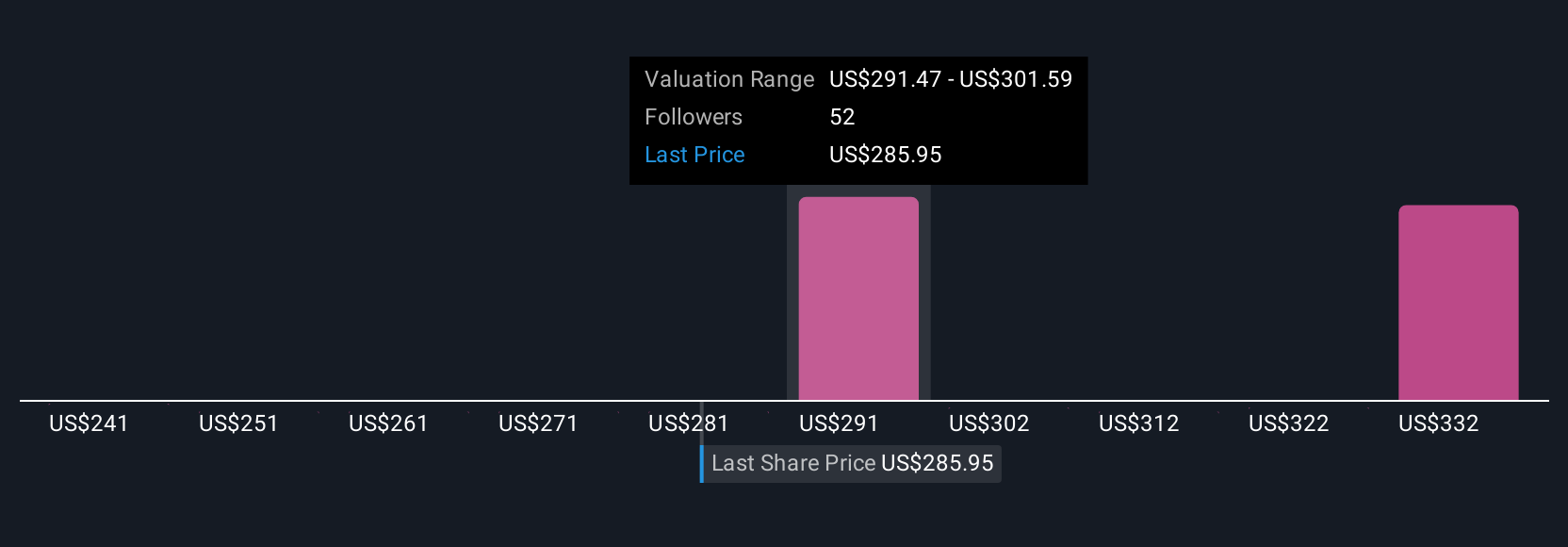

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives make investing more approachable by letting you tell the story behind a company, from your personal outlook on its future growth, margins, and revenues to the fair value you believe reflects its true worth. Rather than just focusing on static numbers or analyst opinions, a Narrative links your view of the business (the story) to a financial forecast and finally to a fair value, making your investment thesis clear and actionable.

Simply Wall St’s platform, used by millions of investors, lets you easily create or follow Narratives right on the Community page. This way, you can see at a glance how fair values compare to today’s price and act decisively when it makes sense. Because Narratives update automatically as the news or new earnings arrive, your thesis stays current and relevant. For example, some investors may believe Autodesk’s aggressive cloud adoption and margin expansion justify the highest analyst target of $430, while others focusing on risks around open-source competition or regulatory pressures set a more cautious value near $270. Narratives empower you to weigh up these viewpoints, compare them to your own, and ultimately make smarter investment decisions.

Do you think there's more to the story for Autodesk? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADSK

Autodesk

Provides 3D design, engineering, and entertainment technology solutions worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Novo Nordisk - A Fundamental and Historical Valuation

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion