- United States

- /

- Software

- /

- NasdaqGS:ADSK

Autodesk (NasdaqGS:ADSK) Secures US$1.5 Billion Unsecured Revolving Loan Facility

Reviewed by Simply Wall St

Autodesk (NasdaqGS:ADSK) announced a new Credit Agreement providing a $1.5 billion unsecured revolving loan facility with Citibank, replacing a previous agreement. This strategic financial move potentially reflects improved leverage management and flexibility for expanding corporate activities. Over the past month, Autodesk's share price increased by 21%, possibly influenced by this significant financial development and its integrations with eMOD Safety and Clearstory, which enhance operational efficiency. While broader market trends saw a minor dip and fluctuations due to tariff discussions, Autodesk's proactive financial structuring likely supported its distinct upward trajectory.

Buy, Hold or Sell Autodesk? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

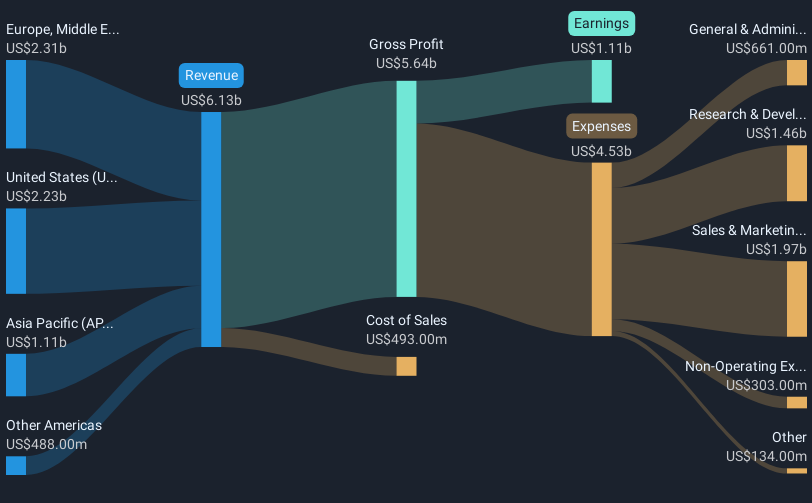

The recent announcement of Autodesk’s new Credit Agreement with Citibank suggests increased financial flexibility, which could positively impact its revenue and earnings forecasts. By replacing the previous agreement with a $1.5 billion unsecured revolving loan facility, Autodesk potentially strengthens its leverage management and positions itself for further corporate expansion. Over the past five years, the company's total shareholder return, including dividends, was 62.83%, reflecting significant value creation for investors. During the past year, Autodesk outperformed the US Market, which saw an 8.2% return, showcasing its resilience and robust performance relative to broader market trends.

The recent share price movement, with a 21% increase over the past month, aligns with the enthusiasm around the credit agreement and other integrations, suggesting positive market sentiment and confidence in Autodesk's future prospects. With the price target set at US$320.15, the current share price of US$278.64 indicates a potential 13% increase. These factors underline strong investor expectations for continued revenue and earnings growth, supported by strategic investments in cloud and AI initiatives aimed at expanding Autodesk’s customer ecosystem. The forward-looking initiatives could drive consistent revenue streams, supporting future growth and potentially justifying the pricing target based on analysts’ consensus.

Unlock comprehensive insights into our analysis of Autodesk stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADSK

Autodesk

Provides 3D design, engineering, and entertainment technology solutions worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives