- United States

- /

- Software

- /

- NasdaqGS:ADBE

If You Had Bought Adobe (NASDAQ:ADBE) Stock Five Years Ago, You Could Pocket A 283% Gain Today

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. One great example is Adobe Inc. (NASDAQ:ADBE) which saw its share price drive 283% higher over five years. Also pleasing for shareholders was the 12% gain in the last three months. But this could be related to the strong market, which is up 10% in the last three months.

View our latest analysis for Adobe

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

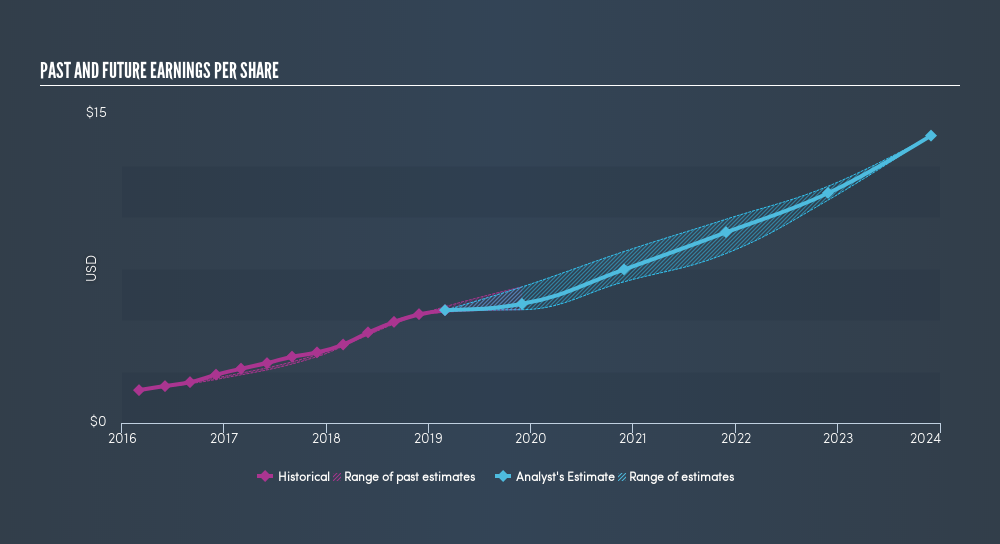

During five years of share price growth, Adobe achieved compound earnings per share (EPS) growth of 59% per year. This EPS growth is higher than the 31% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Adobe has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this freeinteractive graphic.

A Different Perspective

It's nice to see that Adobe shareholders have received a total shareholder return of 14% over the last year. Having said that, the five-year TSR of 31% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. If you would like to research Adobe in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:ADBE

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives