Shantanu Narayen has been the CEO of Adobe Inc. (NASDAQ:ADBE) since 2007. This analysis aims first to contrast CEO compensation with other large companies. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for Adobe

How Does Shantanu Narayen's Compensation Compare With Similar Sized Companies?

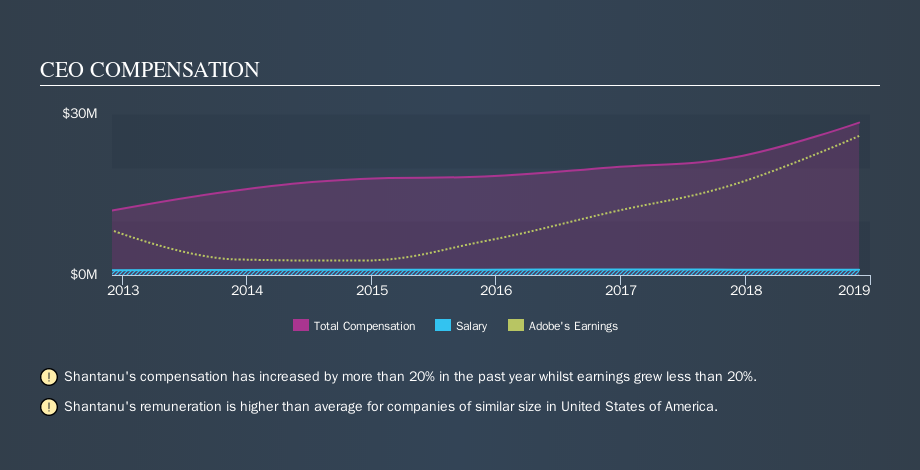

At the time of writing, our data says that Adobe Inc. has a market cap of US$131b, and reported total annual CEO compensation of US$28m for the year to November 2018. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at US$1.0m. We further remind readers that the CEO may face performance requirements to receive the non-salary part of the total compensation. We looked at a group of companies with market capitalizations over US$8.0b and the median CEO total compensation was US$11m. There aren't very many mega-cap companies, so we had to take a wide range to get a meaningful comparison figure.

As you can see, Shantanu Narayen is paid more than the median CEO pay at large companies, in the same market. However, this does not necessarily mean Adobe Inc. is paying too much. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous.

The graphic below shows how CEO compensation at Adobe has changed from year to year.

Is Adobe Inc. Growing?

Adobe Inc. has increased its earnings per share (EPS) by an average of 34% a year, over the last three years (using a line of best fit). It achieved revenue growth of 24% over the last year.

This shows that the company has improved itself over the last few years. Good news for shareholders. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. It could be important to check this free visual depiction of what analysts expect for the future.

Has Adobe Inc. Been A Good Investment?

I think that the total shareholder return of 152%, over three years, would leave most Adobe Inc. shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

We examined the amount Adobe Inc. pays its CEO, and compared it to the amount paid by other large companies. We found that it pays well over the median amount paid in the benchmark group.

Importantly, though, the company has impressed with its earnings per share growth, over three years. On top of that, in the same period, returns to shareholders have been great. So, considering this good performance, the CEO compensation may be quite appropriate. Whatever your view on compensation, you might want to check if insiders are buying or selling Adobe shares (free trial).

Important note: Adobe may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:ADBE

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Broadcom - A Fundamental and Historical Valuation

Hims & Hers Health aims for three dimensional revenue expansion

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026