- United States

- /

- Software

- /

- NasdaqGS:ADBE

Adobe Inc. (NASDAQ:ADBE) has some Competition, but the Fundamentals Indicate that there is No Need for Concern

After analyzing Adobe Inc. (NASDAQ:ADBE), it seems that the company has some qualities that are not immediately apparent to investors, and can be used when deciding how to approach the stock. In this article for Adobe, we will go over some key fundamentals that are sometimes overlooked in regular analysis.

Competition

First, we start with a qualitative factor for the company - the competition. As technologies become more available and cheaper for consumers and businesses, companies must adapt to the changing landscape. In the last few years, Adobe has seen a new generation of competitors rising up. These new players may seek to find a niche that is not covered by Adobe, or may seek to compete directly with the platform in some specialized fields.

Apps that seek to compete with Adobe include: Figma, Canva, CorelDraw etc. The first 2 are startups that seek to make consumer and business design faster and cheaper, while CorelDraw is an old competitor to Adobe which targets enterprise level clients.

While Adobe is still the industry standard, we should monitor new developments in the landscape.

See our latest analysis for Adobe

Growth

Next, we will consider three key fundamentals, Growth, Returns, and Cash Flows.

The company seems to be successfully maintaining growth in earnings by 30% in the last 5 years.

While annual revenue growth is forecasted to keep pushing up by 12.6%. This is below the historical 19% p.a. growth over the last five years. Compared with the 495 other companies in this industry with analyst coverage, which are forecast to grow their revenue at 14% per year, it looks like Adobe is growing at about the same rate as the wider industry.

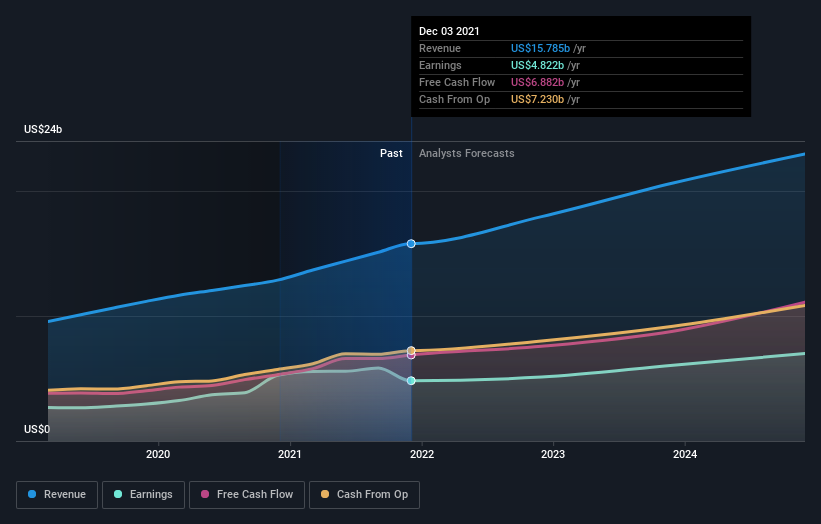

In the chart below, you will notice that we have paired the past income with future analyst expectations. This gives you a better picture of why the stock is so popular.

Return on Capital Employed

At this point, we should evaluate the possible reason behind the reliable growth. One way to do that is by looking at the fundamental returns on capital. It seems that Adobe is producing a 28.6% return on the capital it employs in the company. This signals that management is making good decisions regarding efficiency and the company is using these decisions to leverage growth.

This is also closely reflected in the 30% profit margin for Adobe.

Free Cash Flows

Now, there is one more key factor we can consider when looking for a quality firm - Positive Free Cash Flows.

While some investors are focus on profit, it is the free cash flows that matter the most for a stock. This is because cash flows are what investors can expect to gain as a return on their investment - In the past, dividends were the gold standard, and now some companies are more focused on price appreciation via buybacks.

That is why, it is great to see a company with high free cash flows like Adobe!

In-fact, the company's cash flows are almost always higher than profits. In 2021, they made $6.88b free cash flows vs. $4.8b in profit.

This has a lot to do with the subscription system employed in Adobe, as it makes clients pay in-advance for the use of their services. The 2 most impactful items in the cash flow statement that account for this are deferred revenue and stock based compensation (Annual report p. 59). This means that the company is very efficient at gathering cash for services upfront!

Recap

- Adobe is a strong cash flow generating company that optimizes yearly subscription services for large enterprise clients.

- The company generates more cash flows than profit, mostly as part of the deferred revenue from their subscriptions.

- Adobe has a high 28.6% return on the capital it employs, which means that management is making smart decisions when investing in the company.

- New competitors are slowly approaching the industry, while they are relatively small, they should not be underestimated because the costs of developing new technologies become cheaper as time passes.

Keep in mind that we did not analyze what this means for the current price for Adobe's stock. You can look at the full report if you want to get a better picture in this regard.

If you want to explore 20+ strong companies in the software industry, visit our pre-configured screener HERE!

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:ADBE

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)