- United States

- /

- Software

- /

- NasdaqGS:ADBE

Adobe (ADBE) Valuation in Focus Following Strong Earnings and New AI-Powered Product Launches

Reviewed by Simply Wall St

If you have been watching Adobe (ADBE) lately and wondering whether it is the right time to make a move, you are not alone. The latest quarterly earnings just rolled in, and Adobe again managed to outpace Wall Street expectations, boosted by impressive revenue growth and yet another guidance increase for the full year. What really has people talking though is the company's major leap forward in AI, with fresh product launches aimed squarely at marketing automation and customer experience. This is a space where competition has been heating up.

This wave of announcements follows a year marked by strong AI integration across Adobe's lineup, including enhancements in Creative Cloud and business analytics. Still, the stock is down over 31% from a year ago, and year-to-date performance hasn't sparked much confidence either. The recent improvements in cash flow and the launch of new AI-powered tools have yet to reverse the broader trend of fading momentum, even as management projects more growth ahead.

With all these updates on the table, it is fair to ask whether the current share price reflects a buying opportunity, or if the market is already a step ahead and factoring in Adobe's next phase of growth.

Most Popular Narrative: 11.2% Overvalued

According to the prevailing narrative by Goran_Damchevski, Adobe’s stock is currently considered to be overvalued by 11.2% when compared to a fair value calculation based on long-term growth and margin expectations. The narrative suggests that while the company remains profitable and continues to return capital to shareholders, achieving significant future growth could prove challenging.

"The blocked Figma merger and AI capability deceleration leaves Adobe with few growth avenues aside from its marketing cloud aimed at enterprise customers. Adobe is targeting revenues around $23.5B in 2025, implying a 9.3% growth over 2024. The dampening growth rate may be part of the reason why investors reacted negatively after the Q3 earnings report."

Curious about what’s really driving this valuation? The key ingredients are big numbers, stubborn profit margins, and a future earnings multiple that may surprise even the most loyal Adobe bulls. There is bold thinking behind the assumed pace of growth and profitability for this iconic software stock. Think you know what happens when growth slows and the world’s most popular creative platform faces new challengers? Read on to discover the crucial projections that shape this provocative valuation.

Result: Fair Value of $317 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if Adobe successfully acquires Figma or an economic downturn weakens its competitors, the bearish narrative could quickly unravel as market dynamics shift.

Find out about the key risks to this Adobe narrative.Another View: Value Metrics Tell a Different Story

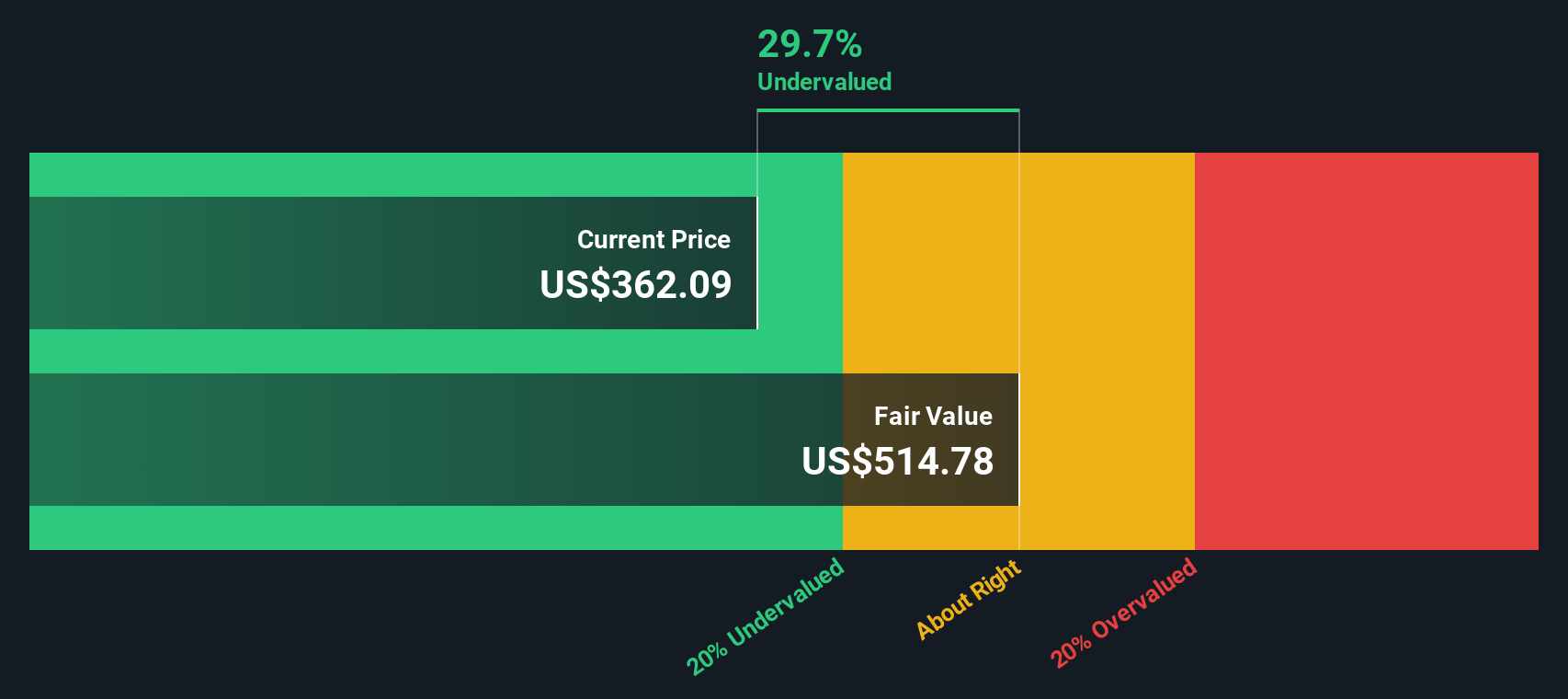

While the user-generated valuation sees Adobe as overvalued based on growth assumptions, a look at our DCF model suggests the stock is actually undervalued. Can traditional cash flow analysis reveal opportunity where narrative models see risk?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Adobe to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Adobe Narrative

If you see things differently or want to dive deeper on your own terms, you can put together your own Adobe narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Adobe.

Looking for More Smart Investment Ideas?

Why stop at Adobe? The market is packed with unique opportunities, and now is your chance to get ahead by targeting stocks with real potential. Don’t let the next big winner slip through your fingers. Use these powerful tools to find your edge today.

- Unlock growth with AI leaders shaping the future of technology in AI penny stocks.

- Capture undervalued gems that the crowd is missing by browsing undervalued stocks based on cash flows.

- Grab steady cash flow from reliable picks highlighted in dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADBE

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives