- United States

- /

- Software

- /

- NasdaqGS:ACIW

How Investors May Respond To ACI Worldwide (ACIW) Spotlighting AI Fraud Solutions Ahead of Holiday Shopping Surge

Reviewed by Sasha Jovanovic

- In the past week, ACI Worldwide presented at both Citi's 14th Annual FinTech Conference in New York and Stephens Annual Investment Conference in Nashville, sharing insights on payment technology trends.

- A unique highlight from these events was ACI Worldwide’s warning that retailers could see a 25% increase in 'friendly fraud' between Thanksgiving and Cyber Monday, and the promotion of its AI-powered solutions to help merchants manage this growing risk.

- To understand how these developments impact ACI Worldwide's investment case, we’ll focus on their emphasis on AI-driven fraud prevention during critical shopping periods.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ACI Worldwide Investment Narrative Recap

For ACI Worldwide, the core investment thesis hinges on long-term adoption of its AI-powered, scalable payment platforms and the company's ability to capture growing transaction volumes in digital payments. The recent warning about a potential 25% surge in friendly fraud during peak shopping days highlights ACI's timely response with advanced fraud prevention solutions, but does not materially shift the near-term revenue catalysts or overall competitive risks facing the business today. Investors appear most focused on whether ACI's innovation can outpace intensifying competition and margin pressures in the short term.

Among ACI's recent updates, the strategic partnership with BitPay to enhance digital asset solutions stands out as especially relevant. As the payments ecosystem rapidly evolves with alternative payment types and digital currencies, this expansion of the Payments Orchestration Platform could directly support the company's aim to broaden its addressable market, a key catalyst identified for future growth.

In contrast, while ACI is working to address fraud risks for merchants, rising competition in digital payments remains a risk investors should be aware of...

Read the full narrative on ACI Worldwide (it's free!)

ACI Worldwide's narrative projects $2.0 billion in revenue and $277.3 million in earnings by 2028. This requires 5.1% annual revenue growth and a $26.2 million increase in earnings from the current $251.1 million.

Uncover how ACI Worldwide's forecasts yield a $64.60 fair value, a 38% upside to its current price.

Exploring Other Perspectives

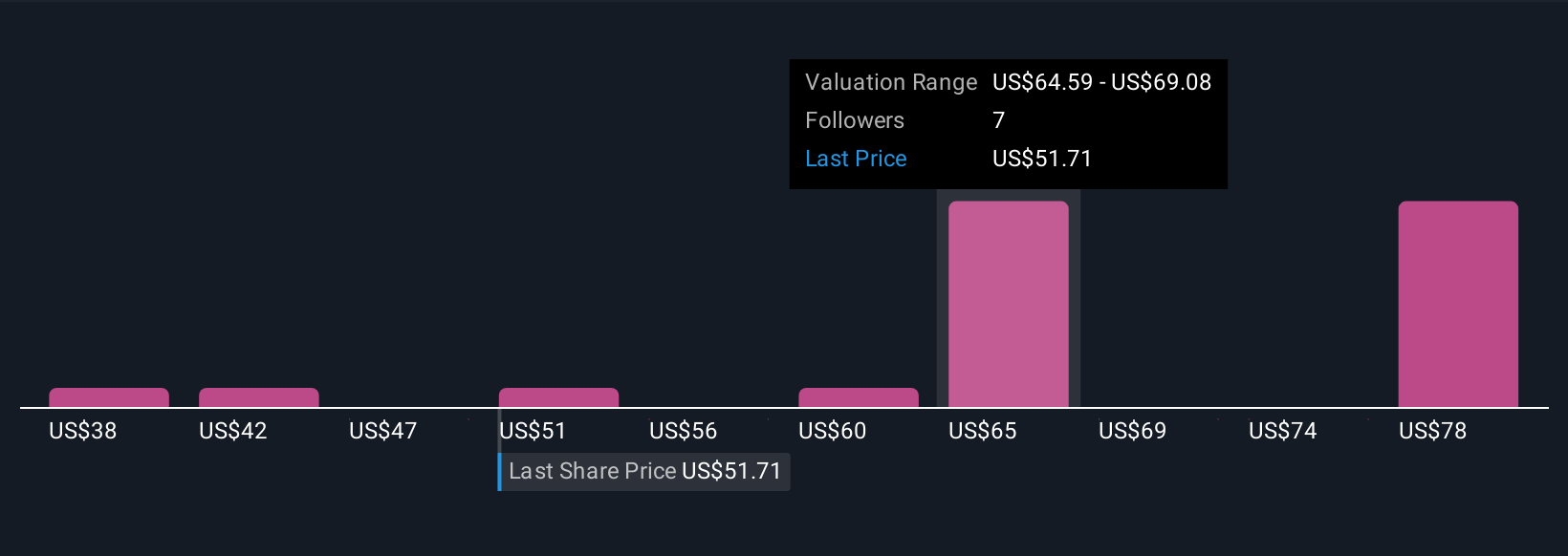

Eight fair value estimates from the Simply Wall St Community span a wide range between US$37.66 and US$77 per share. While some see significant upside, recall from earlier that competitive disruption and margin pressures are a real risk for performance, highlighting the importance of exploring several viewpoints whenever considering ACI Worldwide.

Explore 8 other fair value estimates on ACI Worldwide - why the stock might be worth as much as 64% more than the current price!

Build Your Own ACI Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ACI Worldwide research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ACI Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ACI Worldwide's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACIW

ACI Worldwide

Develops, markets, installs, and supports software products and services for facilitating electronic payments in the United States and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success