- United States

- /

- Software

- /

- NasdaqCM:ABTC

American Bitcoin (ABTC): Reassessing Valuation After a 9% Rebound and Steep Recent Share Price Slide

Reviewed by Simply Wall St

After a punishing slide over the past 3 months, American Bitcoin (ABTC) just logged a sharp 9% daily bounce, giving investors a reason to revisit how this Bitcoin infrastructure play is actually positioned.

See our latest analysis for American Bitcoin.

That rebound comes after a steep reset, with the 30 day and year to date share price returns both down more than 50%, signaling that bearish momentum may be easing as investors reassess the story at a 2.39 dollar share price.

If this kind of volatility has your radar up, it could be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership as potential new ideas.

With shares now trading over 60 percent below recent highs, yet still carrying a premium to traditional miners, the real question is whether this reset reveals an undervalued Bitcoin infrastructure platform or if the market already reflects its future growth potential.

Price-to-Earnings of 13.3x: Is it justified?

On a simple valuation screen, American Bitcoin trades at a 13.3 times price to earnings multiple, which looks modest next to peers despite the recent share price slide.

The price to earnings ratio compares the current share price to the company’s earnings per share, giving a snapshot of how much investors are willing to pay for each dollar of profit. For a Bitcoin infrastructure platform still early in scaling its model, a relatively low multiple can suggest the market is cautious about how durable those earnings will be through the crypto cycle.

Against that backdrop, ABTC’s 13.3 times price to earnings stands out as sharply discounted versus the broader US Software industry at 32 times and a peer group closer to 98 times. That kind of gap implies investors are baking in far less optimistic expectations for future profitability and growth than the sector average, even though the business has posted rapid revenue expansion alongside weaker recent earnings.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 13.3x (UNDERVALUED)

However, lingering uncertainty around crypto regulation and the inherent cyclicality of Bitcoin prices could quickly undermine sentiment toward American Bitcoin’s earnings power.

Find out about the key risks to this American Bitcoin narrative.

Another View: What Does DCF Say?

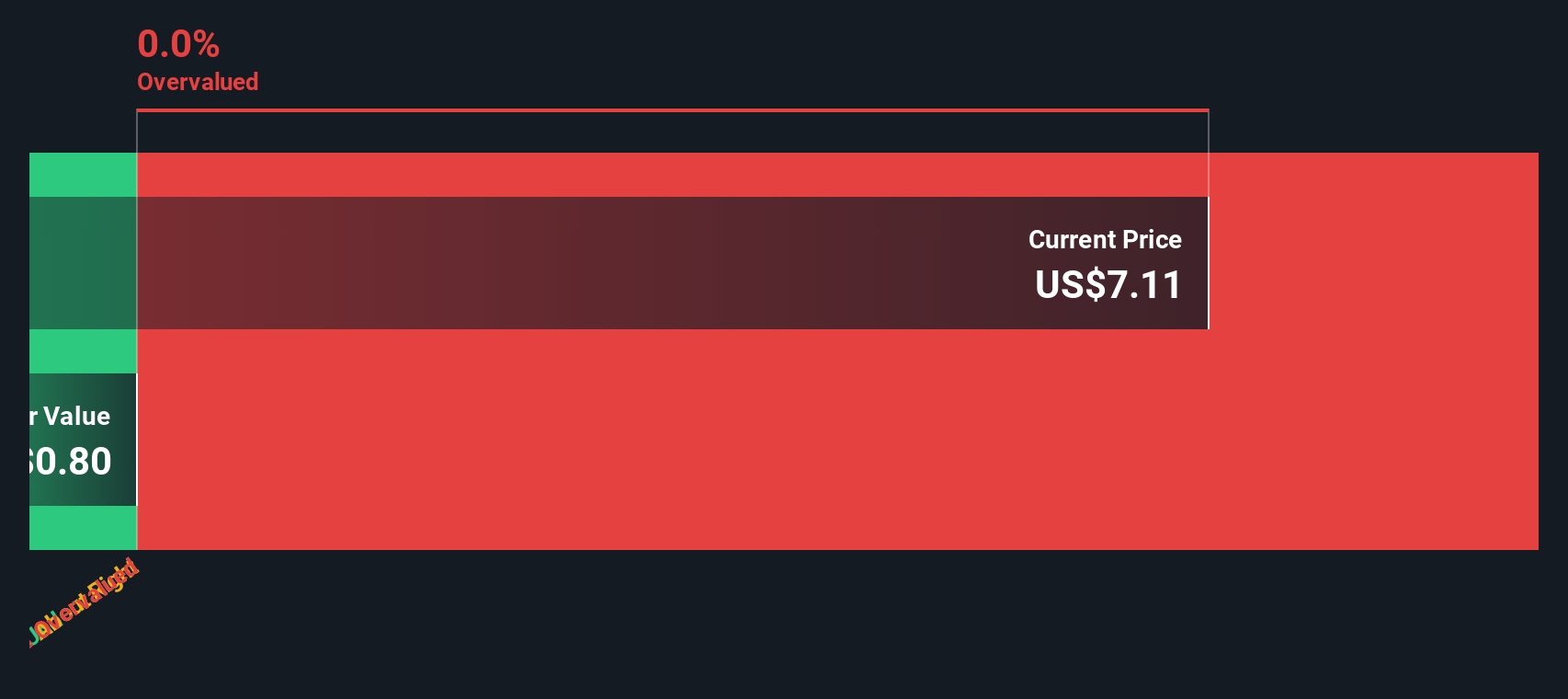

While the earnings multiple points to value, our DCF model also suggests ABTC is trading at a discount, with the current 2.39 dollar price sitting around 20 percent below an estimated fair value of roughly 3 dollars. Is the market underestimating its long term cash generation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Bitcoin for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Bitcoin Narrative

If you see the numbers differently or want to dig into the assumptions yourself, you can build a customized view in just minutes, Do it your way.

A great starting point for your American Bitcoin research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at one opportunity. Use the Simply Wall St screener to surface stocks that match your strategy and help avoid missing tomorrow’s strongest movers.

- Capture upside potential early with these 3571 penny stocks with strong financials that already show robust fundamentals instead of fragile speculation.

- Position yourself for the next wave of innovation through these 25 AI penny stocks that combine real revenue traction with powerful AI tailwinds.

- Seek better risk reward setups by targeting these 920 undervalued stocks based on cash flows trading below what their future cash flows may justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ABTC

American Bitcoin

A Bitcoin accumulation platform company, focuses on building Bitcoin infrastructure platform.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026