- United States

- /

- Semiconductors

- /

- NYSE:WOLF

Wolfspeed (WOLF) Is Up 6.7% After $699 Million IRS Refund Eases Post‑Bankruptcy Strain

Reviewed by Sasha Jovanovic

- In early December 2025, Wolfspeed, Inc. reported receiving a US$698.6 million cash tax refund from the IRS under the Advanced Manufacturing Investment Credit, boosting liquidity as it ramps its 200mm silicon carbide manufacturing footprint and earmarks funds to retire about US$175 million of debt.

- This refund is particularly important because Wolfspeed only recently emerged from Chapter 11 bankruptcy and continues to contend with ongoing cash burn and financial pressure while expanding into AI data centers, electric vehicles, aerospace, industrial, and energy markets.

- We’ll now examine how this large tax refund, and its role in funding Wolfspeed’s 200mm silicon carbide expansion, shapes the company’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Wolfspeed's Investment Narrative?

To own Wolfspeed today, you have to believe its silicon carbide roadmap, 200mm transition and exposure to EVs, AI data centers, industrial and energy markets can eventually turn years of large losses into a sustainable business. The new US$698.6 million AMIC tax refund is a real swing factor in that story: it lifts liquidity to about US$1.5 billion, buys more time to ramp the 200mm fabs and trims roughly US$175 million of debt, easing one of the most immediate balance sheet concerns flagged before this announcement. That said, it does not remove the core risks around continued cash burn, execution on new capacity, and an inexperienced leadership and board that only recently steered the company out of Chapter 11. Short term, the key catalysts remain factory ramp milestones, design wins and any signs that losses are narrowing.

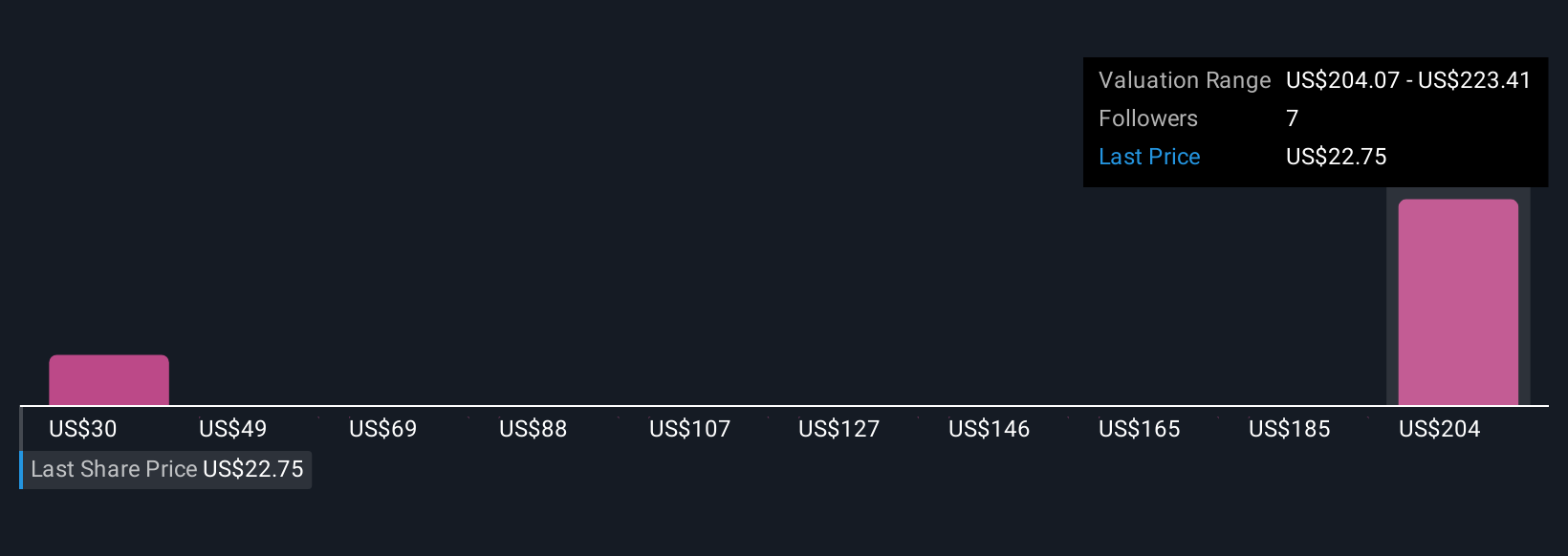

However, investors also need to think hard about what happens if the cash burn continues longer than expected. The valuation report we've compiled suggests that Wolfspeed's current price could be inflated.Exploring Other Perspectives

Explore 2 other fair value estimates on Wolfspeed - why the stock might be worth over 10x more than the current price!

Build Your Own Wolfspeed Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wolfspeed research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Wolfspeed research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wolfspeed's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wolfspeed might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WOLF

Wolfspeed

A semiconductor company, focuses on silicon carbide and gallium nitride (GaN) technologies in Europe, Hong Kong, China, rest of Asia Pacific, the United States, and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026