- United States

- /

- Semiconductors

- /

- NYSE:WOLF

Wolfspeed (NYSE:WOLF) Sees 1% Price Move Despite Major Net Loss Announcement

Reviewed by Simply Wall St

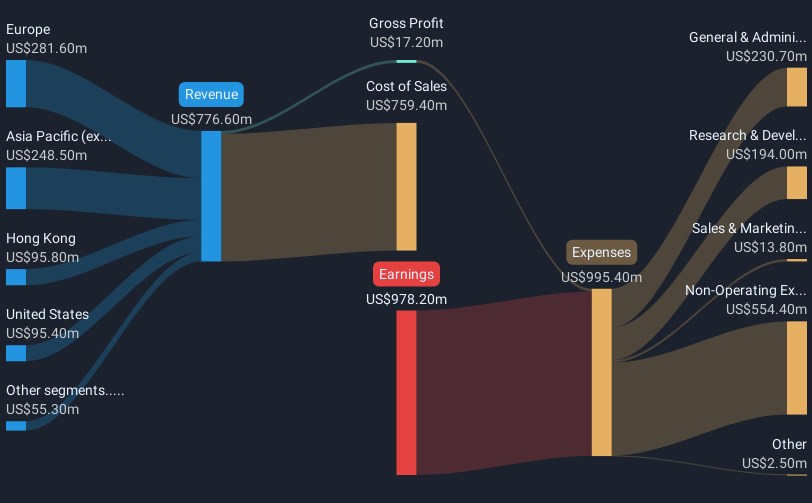

Wolfspeed (NYSE:WOLF) has seen a price move of 1.49% over the past month, amid its announcement of a significant net loss for the second quarter and downward revenue trends for the period ending December 2024. The company’s guidance for the third quarter, which anticipates further losses, may be weighing on sentiment despite a slight gain in share value. However, macroeconomic factors likely played a role as well, with the broader tech sector experiencing volatility, particularly chip stocks amid market concerns around tariffs and global economic conditions. The mixed performance of major indices, including a recent dip in the Nasdaq and downticks in other chip stocks such as Nvidia, may reflect investor wariness, potentially affecting Wolfspeed's shares despite the recent market-wide recovery. The overall market environment was challenging, with shares of other semiconductor companies declining significantly, yet Wolfspeed's shares managed to inch upwards.

Unlock comprehensive insights into our analysis of Wolfspeed stock here.

Over the last year, Wolfspeed's total shareholder return amounted to a significant decline of 75.97%, contrasting sharply with the US Semiconductor industry's gain of 28.2% and the broader US Market's increase of 16.7%. During this period, the company's volatility and performance challenges were underscored by several key developments. Noteworthy was the announcement of continued substantial net losses, as exemplified by the Q2 fiscal 2025 report showing a net loss of US$372.2 million, a marked increase from the previous year. Additionally, changes at the executive level, including the departure of CEO Gregg Lowe and the appointment of Thomas Werner as Executive Chairman in November 2024, may have influenced market sentiment.

Adding to market turbulence were legal challenges, including a class action lawsuit filed in November 2024 alleging securities law violations linked to performance issues at the Mohawk Valley facility. Meanwhile, financial strategies such as a follow-on equity offering completed in January 2025, raising US$200 million, reflected efforts to bolster liquidity in a challenging environment. These factors collectively painted a complex landscape for Wolfspeed over the past year.

- Analyze Wolfspeed's fair value against its market price in our detailed valuation report—access it here.

- Understand the uncertainties surrounding Wolfspeed's market positioning with our detailed risk analysis report.

- Shareholder in Wolfspeed? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wolfspeed might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WOLF

Wolfspeed

Operates as a bandgap semiconductor company focuses on silicon carbide and gallium nitride (GaN) technologies in Europe, Hong Kong, China, rest of Asia-Pacific, the United States, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives