- United States

- /

- Semiconductors

- /

- NYSE:WOLF

Investors Give Wolfspeed, Inc. (NYSE:WOLF) Shares A 30% Hiding

Wolfspeed, Inc. (NYSE:WOLF) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 59% loss during that time.

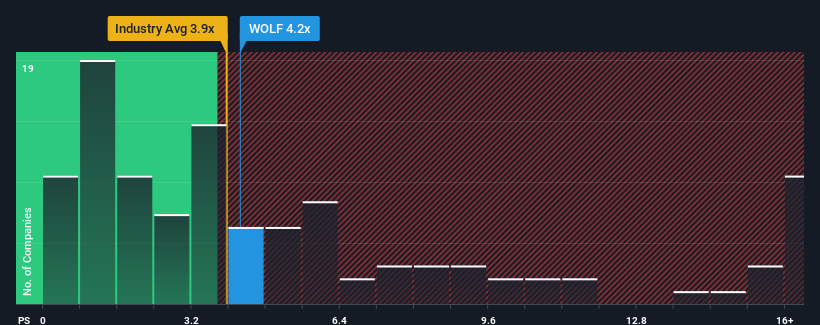

Even after such a large drop in price, it's still not a stretch to say that Wolfspeed's price-to-sales (or "P/S") ratio of 4.2x right now seems quite "middle-of-the-road" compared to the Semiconductor industry in the United States, where the median P/S ratio is around 3.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Wolfspeed

How Has Wolfspeed Performed Recently?

There hasn't been much to differentiate Wolfspeed's and the industry's revenue growth lately. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on Wolfspeed will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Wolfspeed?

The only time you'd be comfortable seeing a P/S like Wolfspeed's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. The strong recent performance means it was also able to grow revenue by 103% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 31% per annum as estimated by the analysts watching the company. With the industry only predicted to deliver 24% per year, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Wolfspeed is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Wolfspeed's P/S?

Wolfspeed's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Wolfspeed's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you take the next step, you should know about the 2 warning signs for Wolfspeed that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Wolfspeed, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wolfspeed might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WOLF

Wolfspeed

Operates as a bandgap semiconductor company focuses on silicon carbide and gallium nitride (GaN) technologies in Europe, Hong Kong, China, rest of Asia-Pacific, the United States, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives